Home Depot dividend yield – The Home Depot Inc Announces 2.09 Cash Dividend

March 21, 2023

Dividends Yield

On March 2 2023, The Home Depot ($BER:HDI) Inc announced a 2.09 cash dividend. Over the last three years, HOME DEPOT has distributed an annual dividend of 7.6 USD per share, with a yield of 2.4%. This average dividend yield of 2.4% might make HOME DEPOT a good option for dividend investors. With the announcement of the new dividend, the ex-dividend date is March 8 2023, which means investors must own the stock before that date to receive the dividend.

The company also has a strong balance sheet and a history of delivering consistent returns to its investors. With a yield of 2.4%, HOME DEPOT may be a great option for those looking for consistent income from their investments. The new ex-dividend date of March 8 2023 provides investors with an opportunity to get in on the action before the dividend is paid out.

Share Price

This is great news for investors, as it reflects the company’s continued commitment to rewarding shareholders. Following the announcement, HOME DEPOT stock opened at €272.8 and closed at €272.6, down by 2.4% from last closing price of €279.4. It is likely that this decrease is attributable to the dividend announcement and the market’s reaction to the news. Although the stock closed lower than its opening price, it is possible that this decrease will be reversed once the market has had time to digest the news and its potential implications for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Home Depot. More…

| Total Revenues | Net Income | Net Margin |

| 157.4k | 17.11k | 10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Home Depot. More…

| Operations | Investing | Financing |

| 14.62k | -3.14k | -10.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Home Depot. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 76.44k | 74.88k | 1.27 |

Key Ratios Snapshot

Some of the financial key ratios for Home Depot are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.6% | 14.9% | 15.3% |

| FCF Margin | ROE | ROA |

| 7.3% | 1160.2% | 19.7% |

Analysis

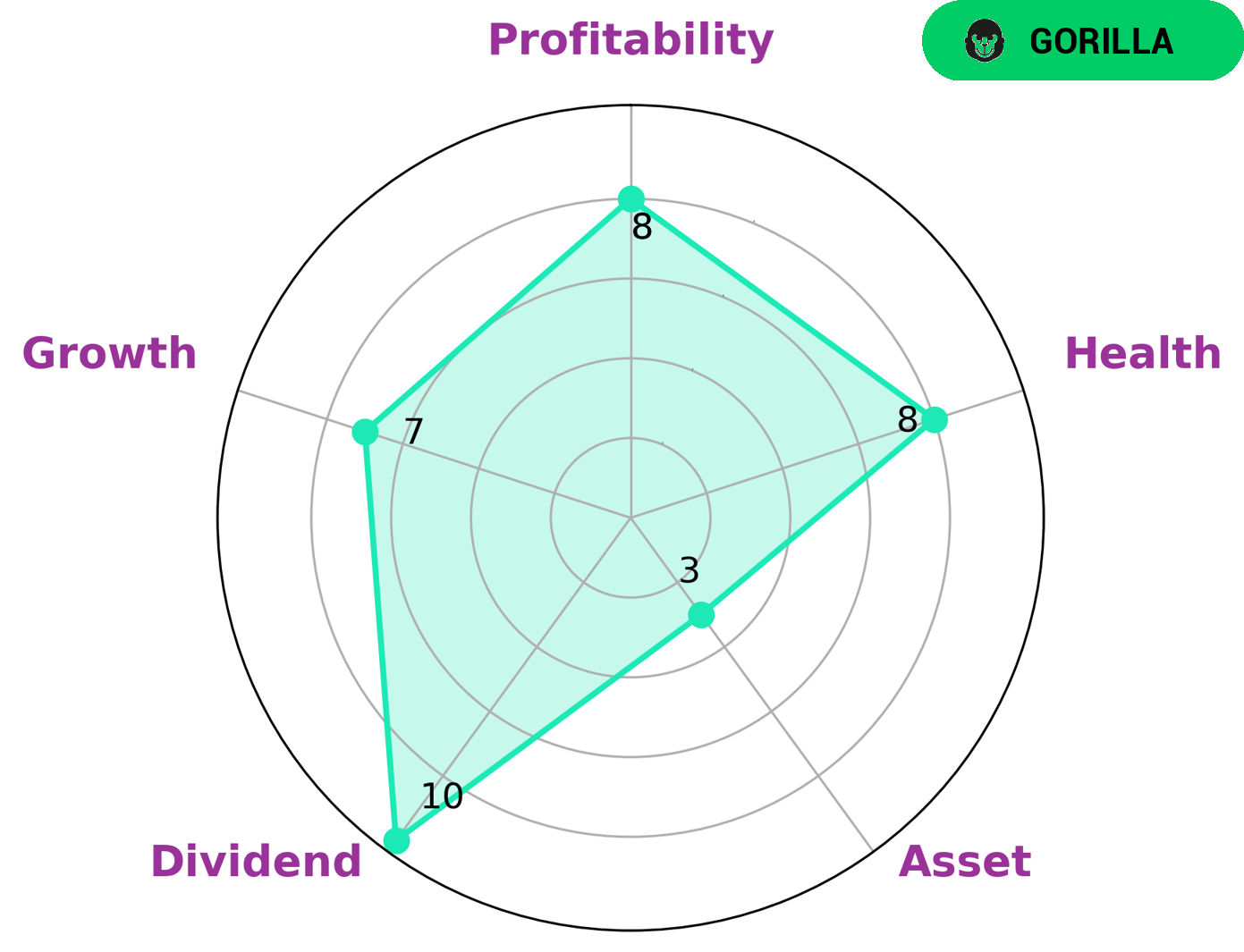

GoodWhale has conducted an analysis of HOME DEPOT‘s financials, and determined that the company is strong in dividend, growth, profitability, and weak in asset. On the Star Chart, HOME DEPOT scored 8/10 in terms of health, indicating that the company is well-equipped to sustain future operations during uncertain times. We have classified HOME DEPOT as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth as a result of its competitive advantage. We believe investors interested in such a company include value investors, growth investors, and dividend investors. Value investors may look favorably upon HOME DEPOT for its low asset requirements and high dividend payouts. Growth investors will be attracted to the company’s strong profitability and growth potential. Finally, dividend investors may appreciate the company’s commitment to consistently paying dividends to shareholders. More…

Summary

Investing in Home Depot could be a good choice for dividend investors, as the company has provided an average dividend yield of 2.4% over the last three years. This is a solid return compared to other stocks, and has been consistent, making it a reliable investment. Home Depot also has an established history of providing excellent customer service, making it a secure choice for long-term investment. With a strong balance sheet, experienced management team, and conservative approach to operations, Home Depot is likely to remain a safe choice for dividend investors.

Recent Posts