Greentown Service dividend – Greentown Service Group Co Ltd Declares 0.1 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1 2023, the Greentown Service ($SEHK:02869) Group Co Ltd declared a 0.1 cash dividend for the upcoming year. The company has a consistent track record of paying dividends, with an annual dividend per share of 0.14 CNY for the past three years, resulting in a 2.23% dividend yield between 2020 and 2023. This makes GREENTOWN SERVICE an attractive option for dividend investors looking for a consistent income source. The ex-dividend date for the upcoming dividend is June 20 2023. This means that investors must purchase the stock prior to that date to receive the dividend.

After the ex-dividend date, the amount of the dividend is deducted from the share price of the company’s shares. Investors should take this into account when planning their investment strategy in GREENTOWN SERVICE. Overall, GREENTOWN SERVICE looks to be a great option for those looking to invest in a dividend stock. With a consistent track record of paying dividends and a 2.23% yield, it presents a viable opportunity for investors to gain a steady source of income.

Price History

This announcement caused the company’s stock price to open at HK$4.2 and close at HK$4.0, resulting in a 4.5% drop from the prior closing price of HK$4.2. The dividend announcement was met with mixed sentiment in the market, as GREENTOWN SERVICE‘s discounted price presented a buying opportunity for some investors while others chose to sell their stocks. The decision to issue the dividend was likely made to reward shareholders for their loyalty to the company, even during times of uncertainty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Greentown Service. More…

| Total Revenues | Net Income | Net Margin |

| 14.86k | 547.5 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Greentown Service. More…

| Operations | Investing | Financing |

| 695.28 | -140.77 | -720.42 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Greentown Service. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.85k | 8.98k | 2.2 |

Key Ratios Snapshot

Some of the financial key ratios for Greentown Service are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.1% | 19.0% | 6.4% |

| FCF Margin | ROE | ROA |

| 4.7% | 8.5% | 3.5% |

Analysis

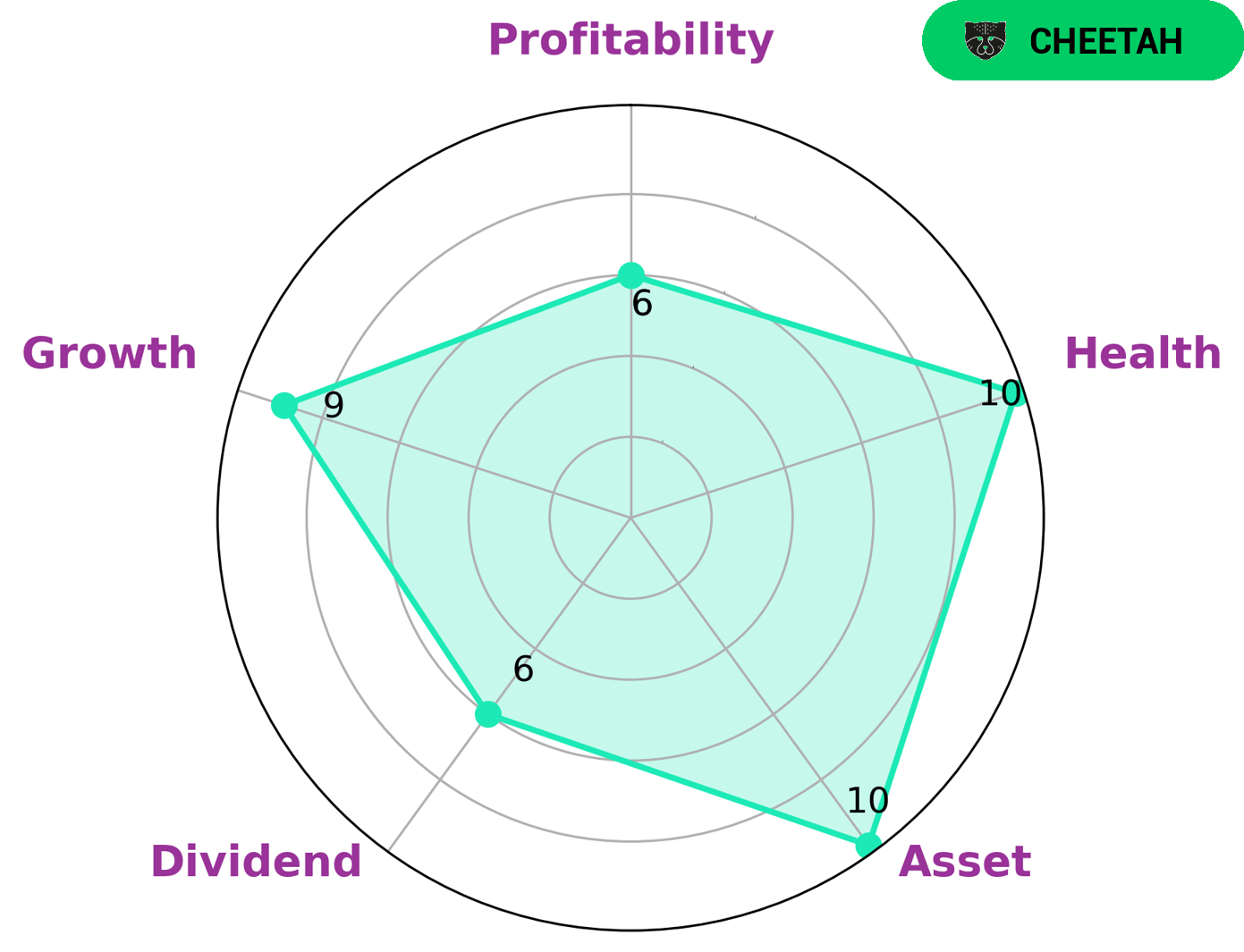

As GoodWhale, we recently conducted an analysis of GREENTOWN SERVICE‘s financials and based on our Star Chart, we concluded that it is classified as a ‘cheetah’ – a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who would be most suited to this type of company are those that are looking for high-risk, high-reward investments. We also found that GREENTOWN SERVICE has a high health score of 10/10. This shows that the company is in a sound financial position and is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, GREENTOWN SERVICE is strong in asset, growth, and medium in dividend, profitability; demonstrating that the company has a solid base to build upon and make strategic investments. More…

Peers

The company offers a range of services, including property management, facility management, and real estate development. Greentown Service Group Co Ltd’s competitors include Poly Property Services Co Ltd, Fullsun International Holdings Group Co Ltd, and Zhuguang Holdings Group Co Ltd.

– Poly Property Services Co Ltd ($SEHK:06049)

Poly Property Services Co Ltd is a property services company in China. The company provides a range of services including property management, security, cleaning, and landscaping. It also offers value-added services such as event planning and space rental. The company has a market cap of 19.98B as of 2022 and a return on equity of 12.04%.

– Fullsun International Holdings Group Co Ltd ($SEHK:00627)

Sun International Holdings Group Co Ltd is a holding company that focuses on the development, operation, and management of its subsidiaries. The company operates through four segments: Real Estate Development, Property Management, Investment, and Others. The Real Estate Development segment develops and sells residential and commercial properties. The Property Management segment provides property management services. The Investment segment invests in and develops real estate projects. The Others segment includes the company’s hotel business. Sun International Holdings Group Co Ltd was founded in 1963 and is headquartered in Hong Kong.

– Zhuguang Holdings Group Co Ltd ($SEHK:01176)

Zhuguang Holdings Group Co Ltd is a Chinese state-owned enterprise that engages in the design, manufacture, and sale of power equipment. The company has a market capitalization of $6.07 billion as of 2022 and a return on equity of 7.12%. Zhuguang Holdings Group Co Ltd is headquartered in Beijing, China.

Summary

GREENTOWN SERVICE is an attractive dividend stock, with a consistent annual dividend per share of 0.14 CNY for the past three years. This results in a dividend yield of 2.23% from 2020 to 2023, making it an ideal option for investors seeking a steady income stream from their investments. Additionally, with its strong financials and healthy balance sheet, GREENTOWN SERVICE is well-positioned to maintain its dividend payments going forward. Investors should research the company and consider its risk profile before making an investment decision.

Recent Posts