Grape King Bio stock dividend – Grape King Bio Ltd Declares 6.9 Cash Dividend

June 3, 2023

🌥️Dividends Yield

On June 2 2023, Grape King Bio ($TWSE:1707) Ltd announced a 6.9 cash dividend per share. This marks the third consecutive year that the company has distributed a dividend of 6.1, 6.1 and 6.4 TWD per share. This has resulted in a dividend yield of 4.27%, 4.27% and 3.74%, respectively, resulting in an average dividend yield of 4.09%. If you are considering stocks with good dividend returns, GRAPE KING BIO is worth considering.

The ex-dividend date is June 20 2023, which means that if you purchase the stock on or after this date, you will not be eligible to receive the dividend. This is an excellent opportunity to invest in a company with a solid track record of paying out dividends.

Price History

This is the company’s second consecutive cash dividend announcement for the year. GRAPE KING BIO is one of the leading producers of juice and fresh food products in Taiwan. The company has seen positive growth over the past few years, as it continues to strengthen its foothold in the market. The latest dividend is further testament to GRAPE KING BIO’s commitment to creating value for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Grape King Bio. More…

| Total Revenues | Net Income | Net Margin |

| 10.56k | 1.5k | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Grape King Bio. More…

| Operations | Investing | Financing |

| 2.98k | -305.78 | -1.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Grape King Bio. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.08k | 3.53k | 66.53 |

Key Ratios Snapshot

Some of the financial key ratios for Grape King Bio are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.6% | 3.8% | 26.1% |

| FCF Margin | ROE | ROA |

| 22.8% | 17.7% | 11.4% |

Analysis

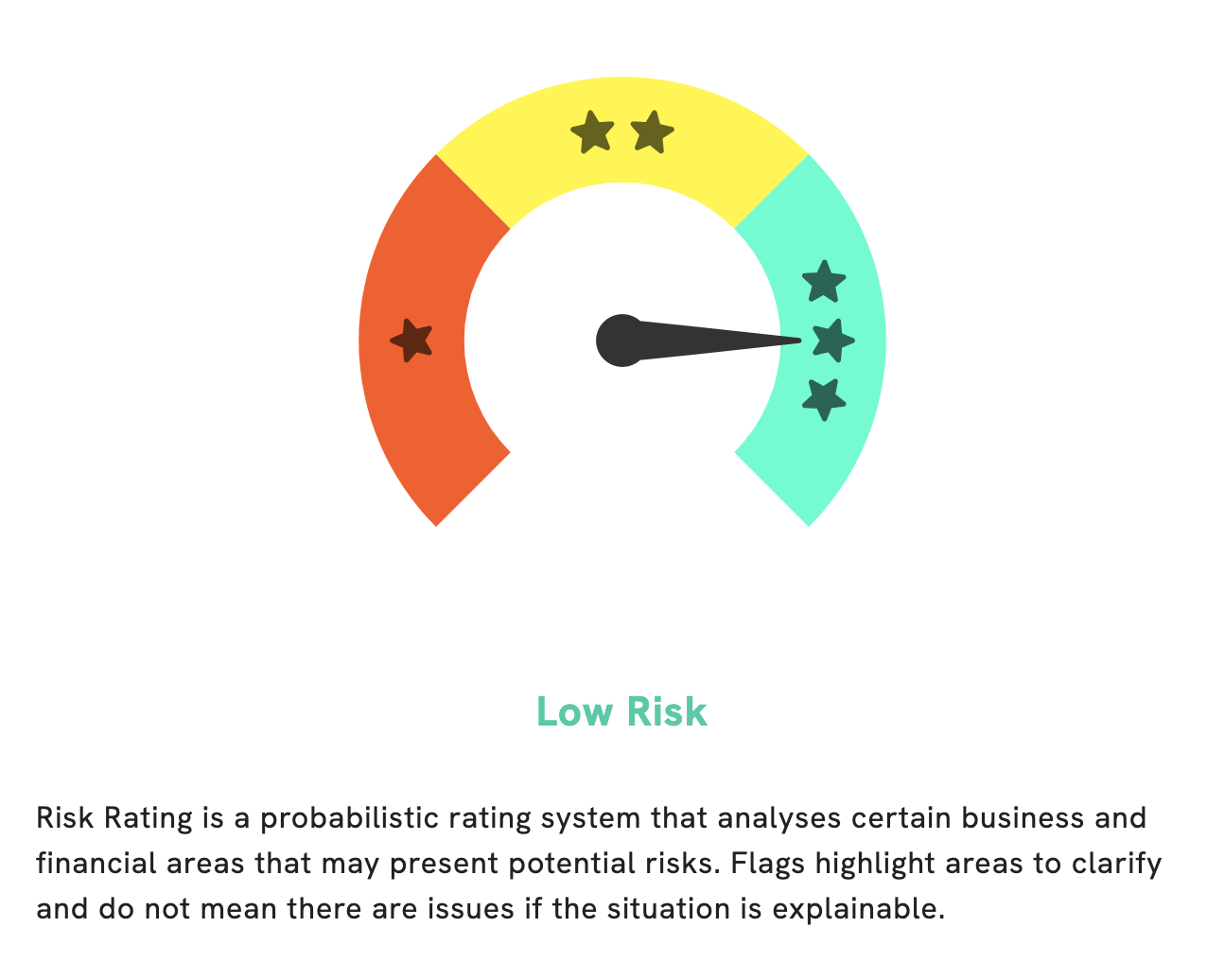

At GoodWhale, we’ve conducted an in-depth analysis of GRAPE KING BIO’s fundamentals, and our risk rating suggests that it is a low risk investment when it comes to financial and business aspects. However, our analysis did detect two risk warnings in GRAPE KING BIO’s income sheet and cash flow statement. If you’re interested in learning more, be sure to register on goodwhale.com to find out more information. More…

Peers

Grape King Bio Ltd faces fierce competition in the pharmaceutical industry from major competitors such as Biostar Pharmaceuticals Inc, Gufic Biosciences Ltd and Wockhardt Ltd. All of these companies have established track records in the industry and are constantly developing innovative products to gain market share. As such, Grape King Bio Ltd must maintain a competitive edge by offering the best quality products and services.

– Biostar Pharmaceuticals Inc ($OTCPK:BSPM)

Biostar Pharmaceuticals Inc is a Chinese pharmaceutical company that focuses on developing, manufacturing and marketing of products in the healthcare industry. As of 2023, Biostar Pharmaceuticals Inc has a market capitalization of 316.46k and a Return on Equity of 6.61%. The company’s market capitalization reflects the combined value of its outstanding shares and provides an indication of how much investors are willing to pay for it. Return on Equity measures the amount of net income in relation to stockholders’ equity; thus, it indicates the company’s profitability given its current equity.

– Gufic Biosciences Ltd ($BSE:509079)

Gufic Biosciences Ltd is a leading pharmaceutical and biotechnology company headquartered in India. It is involved in research and development, manufacturing, and marketing of a wide range of pharmaceutical and biotechnology products. With a market cap of 19.3B as of 2023, it is one of the largest and most successful publicly traded companies in India. The company has a very impressive Return on Equity (ROE) of 21.86%, indicating it’s well-run business strategy and ability to generate strong returns for its shareholders. Gufic Biosciences Ltd is committed to developing innovative medicines that address unmet medical needs and improve the lives of patients.

– Wockhardt Ltd ($BSE:532300)

Wockhardt Ltd is a global pharmaceutical and biotechnology company that develops, manufactures, and markets branded and generic pharmaceuticals, biopharmaceuticals, and advanced drug delivery systems. The company has a market capitalization of 24.29 billion as of 2023. Its Return on Equity (ROE) is -5.88%, which is lower than the industry average. This indicates that the company is not generating sufficient returns on its equity investments. The company’s weak ROE may be driven by its high costs and poor efficiency in generating returns. Nonetheless, the company continues to invest heavily in its research and development activities to remain competitive and strengthen its product portfolio.

Summary

Grape King Bio is a good option for investors looking for a consistent dividend paying stock. Over the past three years, the company has distributed 6.1, 6.1, and 6.4 TWD per share in dividends, with corresponding yields of 4.27%, 4.27%, and 3.74%. This results in an average dividend yield of 4.09%, making it a reliable source of passive income.

Furthermore, its long-term prospects appear promising, as the company continues to expand operations and increase sales. Investors should therefore consider adding Grape King Bio to their portfolios in order to take advantage of its strong track record and potential for future returns.

Recent Posts