Extendicare Inc dividend yield – EXTENDICARE INC Announces 0.04 Cash Dividend

May 27, 2023

Dividends Yield

This brings the total dividend per share to 0.48 CAD over the past three years, with dividend yields of 6.86%, 6.63% and 6.43% in 2021, 2022 and 2023 respectively, giving an average dividend yield of 6.64%. With this announcement, EXTENDICARE INC ($TSX:EXE) has shown it is an attractive option to consider if you are looking for a dividend stock. EXTENDICARE INC is a Canadian company that operates in the health care industry with a variety of services, including long-term care, retirement living, home health care and assisted living. The company has a long history of providing quality care services for its clients, making it a reliable and attractive option for investors seeking a dividend stock.

If you’re looking for a dividend stock with a steady and reliable yield, then EXTENDICARE INC may be worth considering. With its recent announcement of a 0.04 CAD cash dividend and its consistent annual dividend per share over the past three years, it is certainly worth looking into as an option for your investment portfolio.

Market Price

The announcement came as the company’s stock opened at CA$7.2 and closed at CA$7.1, down by 1.0% from its last closing price of CA$7.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Extendicare Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.24k | 77.01 | 0.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Extendicare Inc. More…

| Operations | Investing | Financing |

| 17.24 | 142.64 | -172.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Extendicare Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 745.88 | 644.43 | 1.2 |

Key Ratios Snapshot

Some of the financial key ratios for Extendicare Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | -9.9% | 2.1% |

| FCF Margin | ROE | ROA |

| -7.8% | 16.5% | 2.2% |

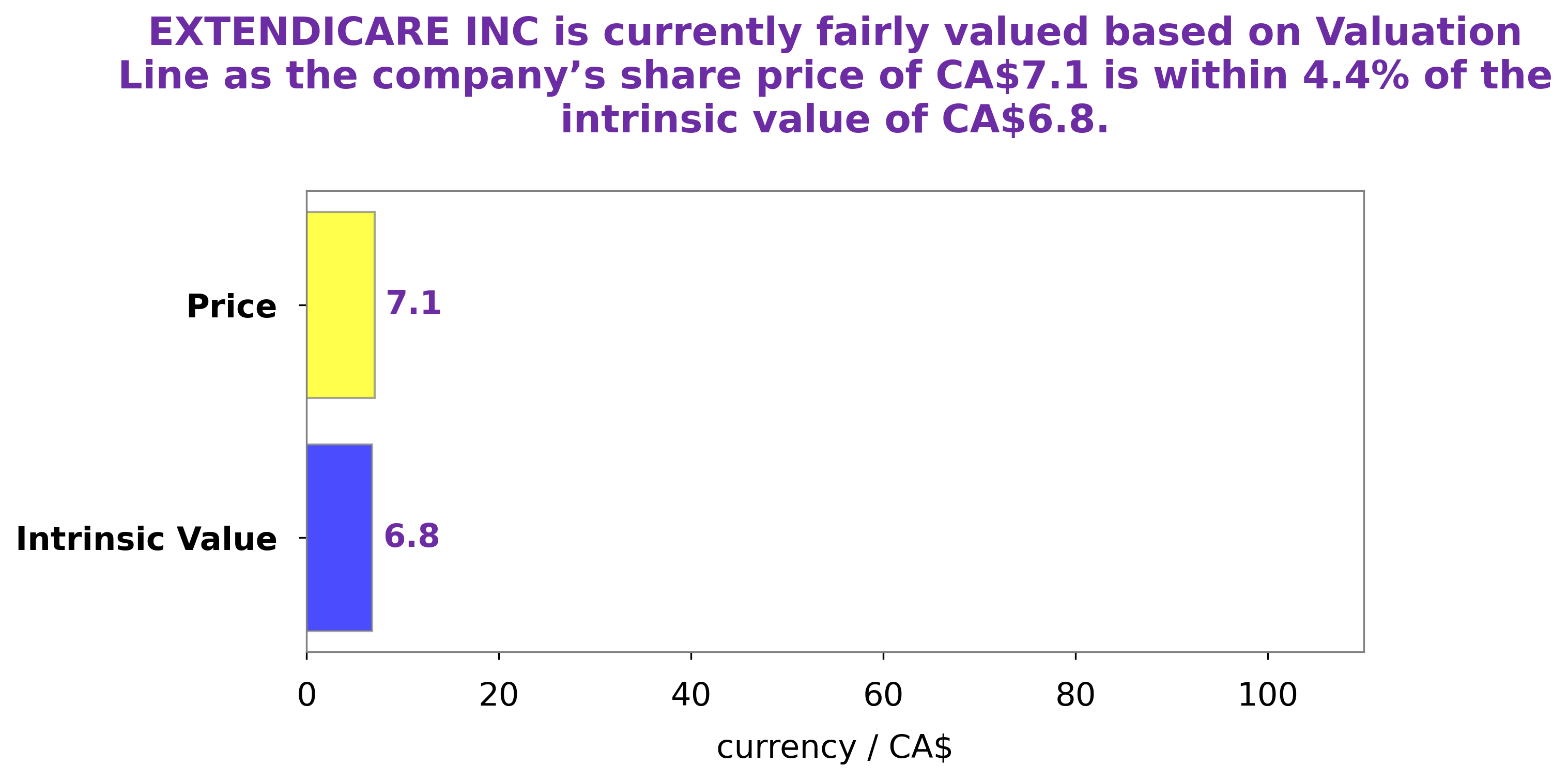

Analysis – Extendicare Inc Intrinsic Stock Value

GoodWhale has conducted an in-depth analysis of EXTENDICARE INC‘s financials, and our proprietary Valuation Line has determined that the fair value of EXTENDICARE INC’s share is CA$6.8. Currently, the stock is trading at CA$7.1, which is a fair price that is overvalued by 3.9%. This means that investors should be aware that they may be paying more than the fair market value for EXTENDICARE INC’s stock, and should consider their investment strategy accordingly. More…

Peers

In the healthcare industry, there is intense competition between Extendicare Inc and its closest rivals Ambea AB, Attendo AB, and Charm Care Corp. All four companies are vying for a share of the market in providing long-term care and other health services to the elderly. Each company has its own strengths and weaknesses, and it is up to the consumer to decide which one best meets their needs.

– Ambea AB ($LTS:0RNX)

As of 2022, Ambea AB had a market cap of 3.68B and a ROE of 9.28%. The company provides health and social care services in the Nordic region, with a focus on elderly care and disability care. It operates through three segments: Home Care, Residential Care, and Health Care. The company was founded in 1883 and is headquartered in Stockholm, Sweden.

– Attendo AB ($LTS:0RCY)

Attendo AB is a healthcare company that provides services to the elderly, disabled, and those with chronic illnesses. The company has a market cap of 3.38B as of 2022 and a Return on Equity of 8.46%. Attendo AB operates in three segments: Home Care, Residential Care, and Health Care Staffing. The company was founded in 1985 and is headquartered in Stockholm, Sweden.

– Charm Care Corp ($TSE:6062)

Charm Care Corp is a leading provider of home health care services. The company has a market cap of $34.15 billion as of 2022 and a return on equity of 23.73%. Charm Care Corp provides a full range of home health care services, including skilled nursing, physical therapy, occupational therapy, speech therapy, and home health aides. The company serves patients of all ages, from infants to the elderly. Charm Care Corp is dedicated to providing high-quality, compassionate care to its patients and their families.

Summary

EXTENDICARE INC is an attractive dividend stock for investors looking for steady income. The company has issued consistent annual dividends per share of 0.48 CAD over the past 3 years, providing a dividend yield averaging around 6.64%. The yield has remained relatively steady over the past few years, suggesting that the dividend is well-supported and likely to continue in the future. As a dividend stock, investors should consider the company’s financial strength and health, as well as its ability to generate sufficient cash flows to service its debt and sustain its dividend payments over the long term.

Recent Posts