Eita Resources Bhd dividend yield calculator – EITA Resources Bhd Declares 0.01 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1 2023, EITA Resources Bhd declared a 0.01 cash dividend. This dividend is lower than the average dividends paid over the past three years. The average dividend yield from these three years is 3.81%. EITA RESOURCES BHD ($KLSE:5208) is a good stock to consider for investors looking for stocks with high dividend yields.

Its ex-dividend date is scheduled for June 15 2023, so if you would like to receive the payment, you must be registered as a shareholder on or before this date. The company’s dividend yield is lower than the previous year but it still offers a good return for investors.

Share Price

This was welcomed news to shareholders who watched the stock open at RM0.7 and close at the same price at the end of the trading day. The dividend payout will be made to all shareholders on record as of the announcement date. This marks the second dividend payout in the company’s history and is an indication of the company’s continued success in navigating difficult market conditions.

It is also a sign of the company’s commitment to providing returns to its shareholders in the form of dividends. With a strong performance in the past year, EITA Resources Bhd is expected to continue to reward its investors in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eita Resources Bhd. More…

| Total Revenues | Net Income | Net Margin |

| 303.02 | 10.77 | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eita Resources Bhd. More…

| Operations | Investing | Financing |

| 10.39 | -4.14 | -28.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eita Resources Bhd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 331.64 | 121.91 | 0.8 |

Key Ratios Snapshot

Some of the financial key ratios for Eita Resources Bhd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.0% | -32.0% | 3.9% |

| FCF Margin | ROE | ROA |

| 2.5% | 3.5% | 2.2% |

Analysis

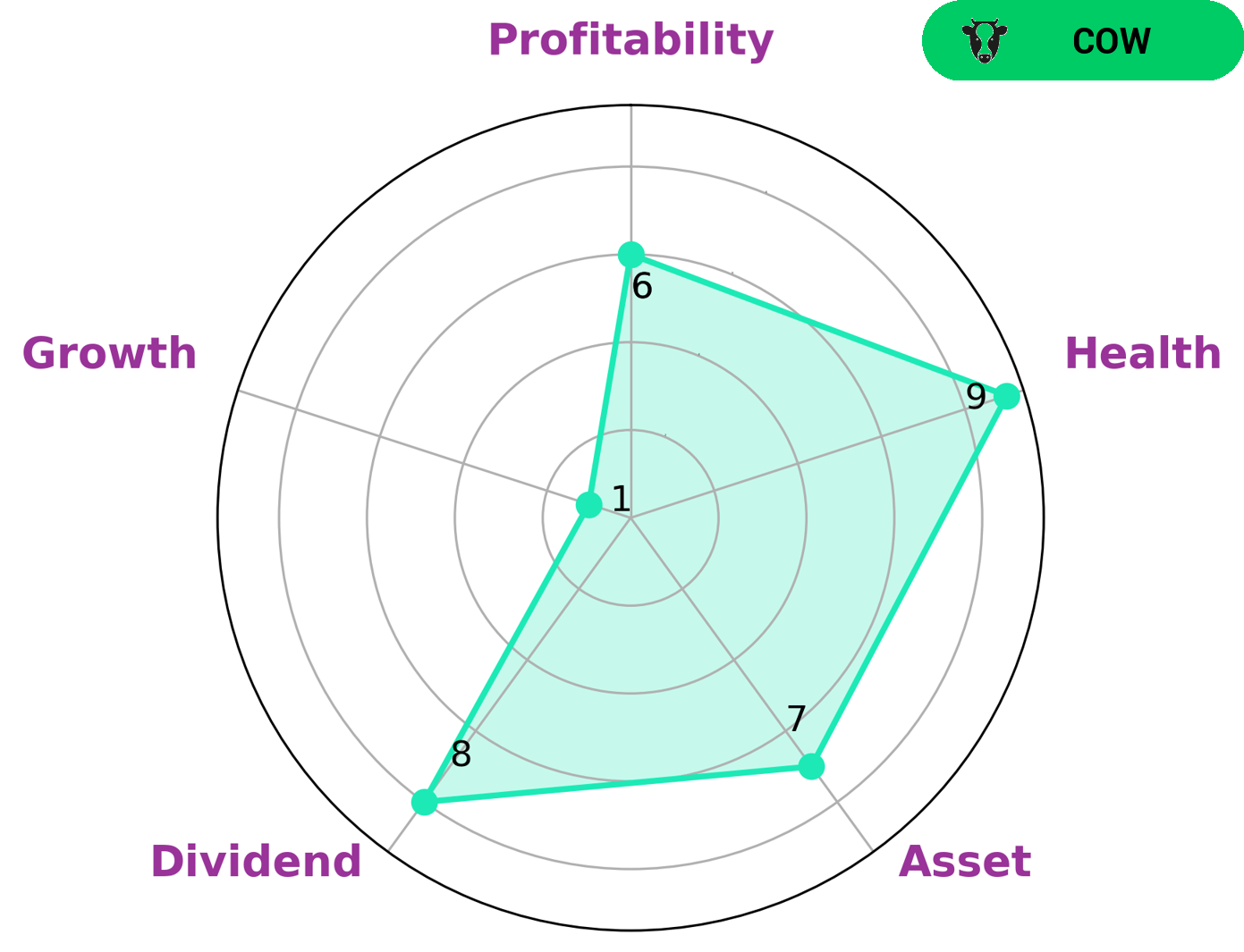

We at GoodWhale have conducted an analysis of EITA RESOURCES BHD’s wellbeing. Based on our Star Chart, EITA RESOURCES BHD is strong in asset, dividend, and medium in profitability and weak in growth. Using this information, we have classified EITA RESOURCES BHD as a ‘cow’, which is a company with a track record of paying out consistent and sustainable dividends. Investors who are looking for steady and reliable returns may be interested in investing in EITA RESOURCES BHD. Furthermore, our analysis showed that EITA RESOURCES BHD has a high health score of 9/10 considering its cashflows and debt, which indicates that the company is capable to sustain future operations in times of crisis. More…

Peers

The competition between EITA Resources Bhd and its competitors – Hind Rectifiers Ltd, Sichuan Kexin Mechanical and Electrical Equipment Co Ltd, and Sinoseal Holding Co Ltd – is fierce in the industry. Each of these companies has their own unique strategies, capabilities, and services that they offer to customers, all of which have created a competitive landscape that requires the utmost attention and innovation in order to stay ahead.

– Hind Rectifiers Ltd ($BSE:504036)

Hind Rectifiers Ltd is a publicly-traded company based in India that specializes in the production and supply of power electronics products and solutions. It has a market capitalization of 4.81 billion as of 2023, demonstrating a strong presence in the industry. The company’s Return on Equity (ROE) is -0.33%, which indicates that it is not performing well financially. This could be due to a number of factors, including weak management decisions, high operating costs, or inefficient use of resources. Overall, Hind Rectifiers Ltd is an important player in the industry, but it needs to improve its financial performance if it wants to remain competitive.

– Sichuan Kexin Mechanical and Electrical Equipment Co Ltd ($SZSE:300092)

Sichuan Kexin Mechanical and Electrical Equipment Co Ltd is a Chinese company that specializes in engineering and manufacturing of electrical and mechanical equipment. With a market capitalization of 4.33 billion as of 2023, it is a well-established company in the industry. Its Return on Equity (ROE) of 8.47% indicates that the company is performing well and returning a healthy profit to its shareholders. With its focus on producing quality products, it looks poised to continue to gain market share in the industry.

– Sinoseal Holding Co Ltd ($SZSE:300470)

Sinoseal Holding Co. Ltd is a Chinese company offering a range of services and products across the financial, construction, and automotive sectors. Its market cap of 9.18 billion as of 2023 reflects its strong position in the industry and its ability to generate significant long-term value for its shareholders. Sinoseal Holding Co. Ltd’s Return on Equity is 9.66%, indicating that the company is able to effectively use its assets to generate profits. This is an impressive figure considering the company’s large market cap and wide variety of services.

Summary

Investing in EITA RESOURCES BHD could provide investors with a steady income stream and moderate total return. Over the last three years, the company’s dividend per share has been consistently 0.03 MYR, with an average dividend yield of 3.81%. This could present a relatively low risk, and potentially an attractive option for those seeking a secure and consistent return on their investments.

Recent Posts