DOT dividend – PRECINCT PROPERTIES NEW ZEALAND Declares 0.01675 Cash Dividend

March 4, 2023

Dividends Yield

DOT dividend – PRECINCT PROPERTIES NEW ZEALAND ($BER:DOT) has recently declared a 0.01675 cash dividend to be paid on March 3, 2023. This decision follows the preceding three-year development of the company’s annual dividend per share, which has been 0.07 NZD, 0.07 NZD and 0.06 NZD in the last three years, yielding an average of 4.33%. The board of directors of PRECINCT PROPERTIES NEW ZEALAND is confident that the company will continue to provide its shareholders with a steady return in the coming years.

This has been supported by the consistently positive financial results achieved by the company in recent years. As such, this dividend announcement is seen as further evidence of the company’s commitment to providing value to its shareholders.

Stock Price

Despite the announcement, its stock opened the same day at €0.8 and closed at the same price, a significant 2.6% drop from its previous closing price of €0.8. This decline in share price may have been due to external factors or simply investors taking profits, which has become increasingly common in the volatile stock market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DOT. More…

| Total Revenues | Net Income | Net Margin |

| 179.1 | 66 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DOT. More…

| Operations | Investing | Financing |

| 101.4 | -119.6 | 26 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DOT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.78k | 1.39k | 1.5 |

Key Ratios Snapshot

Some of the financial key ratios for DOT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 47.3% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

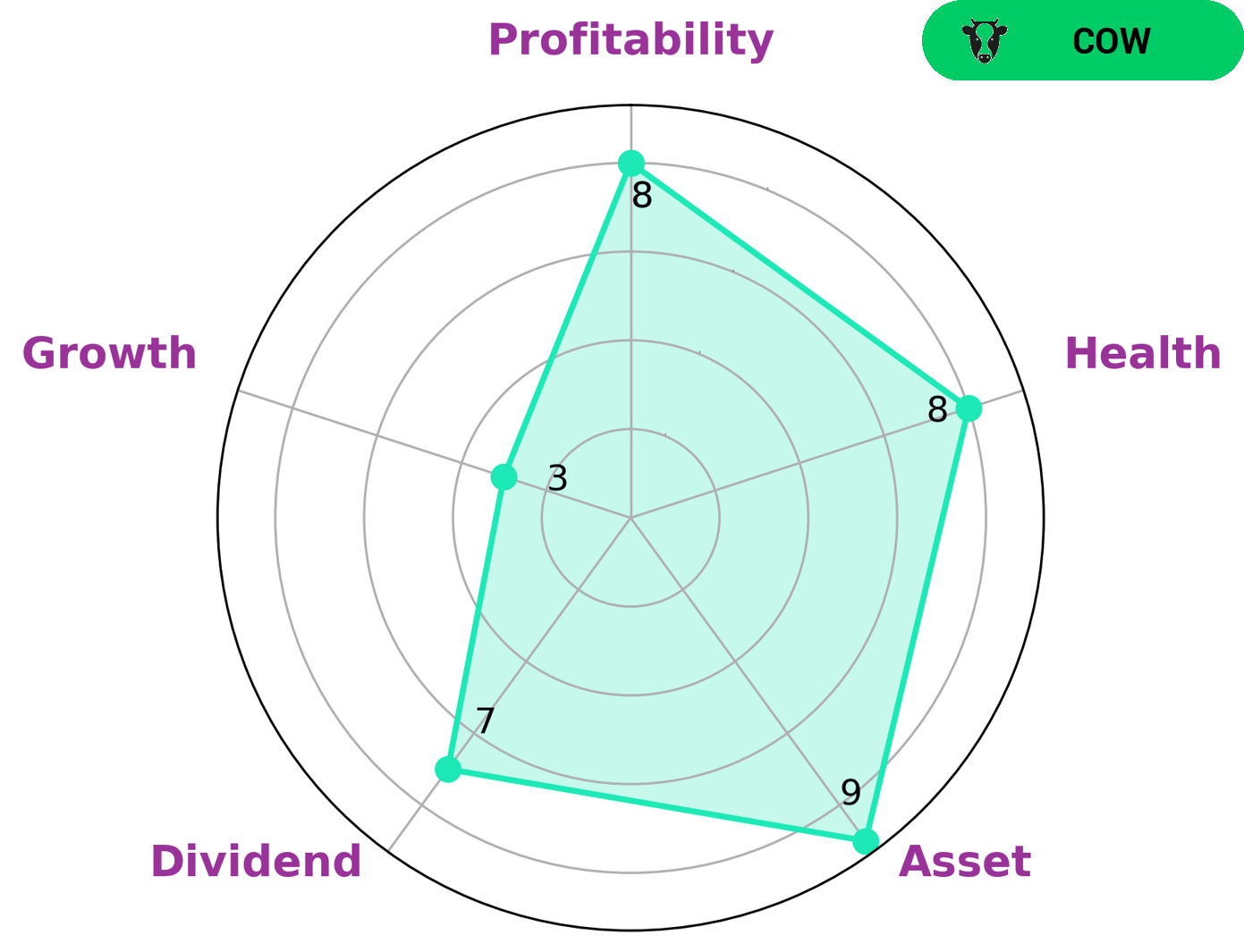

At GoodWhale, we performed a thorough analysis on the wellbeing of PRECINCT PROPERTIES NEW ZEALAND. According to our Star Chart classification, PRECINCT PROPERTIES NEW ZEALAND is classified as a ‘cow’, a type of company that pays out consistent and sustainable dividends. This type of investment is attractive for those investors seeking a steady return. Additionally, our analysis indicates that PRECINCT PROPERTIES NEW ZEALAND has a high health score of 8/10 considering its cashflows and debt. The company is capable to pay off any debt and fund future operations. All in all, PRECINCT PROPERTIES NEW ZEALAND is a great investment option for those looking for stability and consistent returns. More…

Summary

PRECINCT PROPERTIES NEW ZEALAND is an attractive investment option, offering compelling returns for investors. The company has issued an average dividend of 0.07 NZD per share over the past three years, leading to an average yield of 4.33%. This is significantly higher than the market average, making this an attractive dividend play for any investor looking for an income stream. The stock’s price-to-earnings ratio is also well below the industry average, suggesting that the stock is undervalued relative to its peers.

Furthermore, its profitability metrics are quite solid, with returns on assets, equity and invested capital all within the industry average. All things considered, PRECINCT PROPERTIES NEW ZEALAND offers solid investment potential that shouldn’t be overlooked by investors.

Recent Posts