De Rucci Healthy dividend yield – De Rucci Healthy Sleep Co Ltd Announces 1.0 Cash Dividend

June 12, 2023

☀️Dividends Yield

On May 26 2023, De Rucci Healthy ($SZSE:001323) Sleep Co Ltd Announces 1.0 Cash Dividend. This is the third consecutive year the company has paid out an annual per-share dividend of 1.0 and 1.0 CNY in the last two years, making it a potential dividend investment opportunity with an average dividend yield of 2.47%. The company’s regular dividend payments are also a testament to its strong financial foundations and ability to generate consistent cash flow.

Investors should note that in order to receive the 1.0 CNY dividend payment, they must own the stock prior to the ex-dividend date of May 26 2023. After this date, the stock will go ex-dividend and no longer be eligible for the dividend payment.

Stock Price

The announcement sent DRHS stock down on the market, as it opened at CNY32.0 and closed at CNY31.5, representing a decrease of 4.3% from its previous closing price of 32.9. Investors reacted with caution to this news, as the yield was lower than expected. Despite this, DRHS remains one of the most popular stocks on the Shenzhen Stock Exchange, and analysts are still optimistic about its future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for De Rucci Healthy. More…

| Total Revenues | Net Income | Net Margin |

| 5.53k | 686.09 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for De Rucci Healthy. More…

| Operations | Investing | Financing |

| 1.3k | -510.42 | 956.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for De Rucci Healthy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.03k | 1.57k | 10.9 |

Key Ratios Snapshot

Some of the financial key ratios for De Rucci Healthy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.6% | 18.6% | 14.5% |

| FCF Margin | ROE | ROA |

| 14.3% | 11.4% | 8.3% |

Analysis

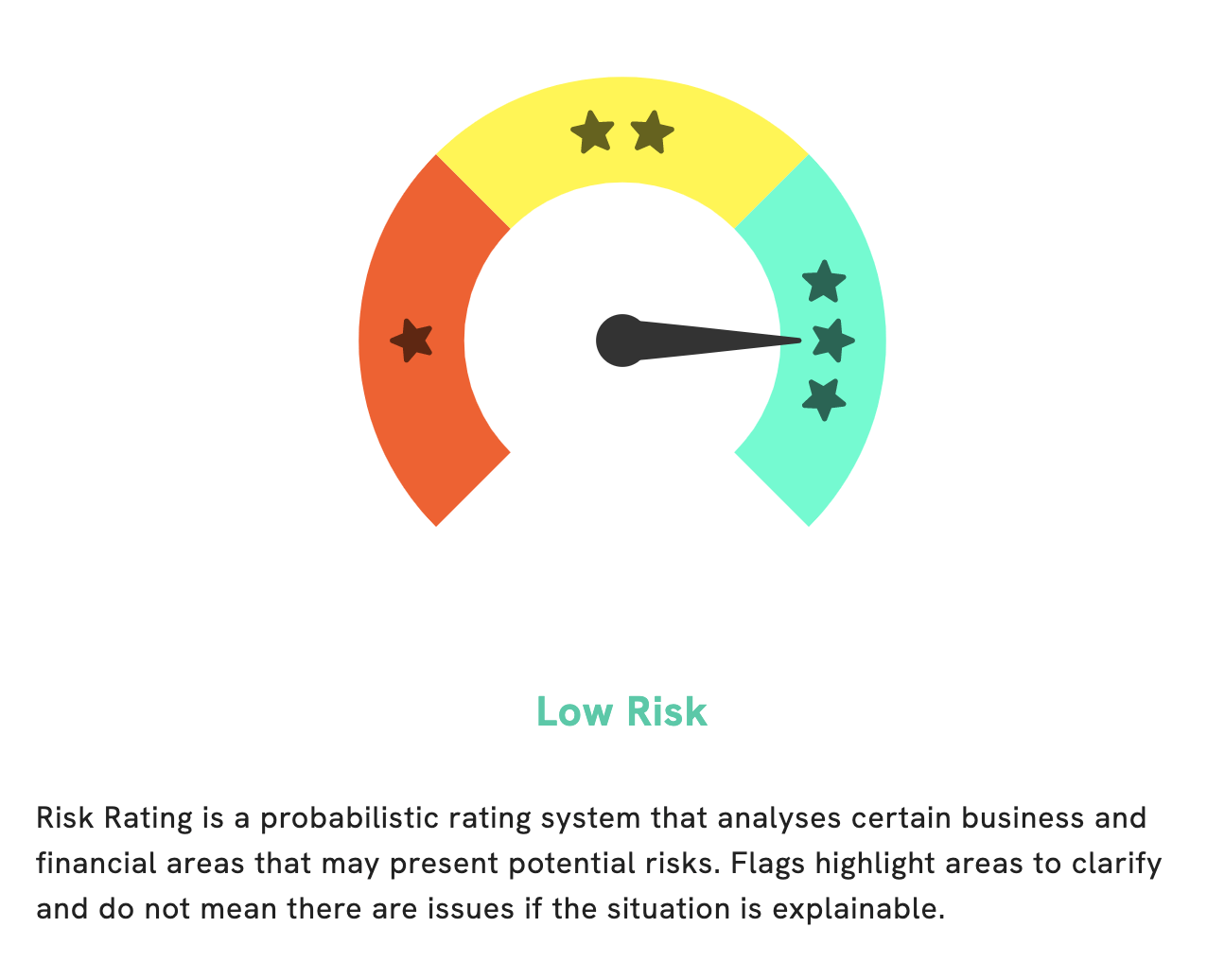

GoodWhale can help you analyze the financials of DE RUCCI HEALTHY SLEEP. Our Risk Rating system gives DE RUCCI HEALTHY SLEEP a low risk rating, meaning it is a safe investment in terms of financial and business aspects. If you want to get a closer look at areas with potential risks, become a registered user and check out our comprehensive reports. We’ll provide you with detailed insights into the company and its prospects. With GoodWhale, you can make the best possible decision when it comes to DE RUCCI HEALTHY SLEEP investments. More…

Peers

The competition between De Rucci Healthy Sleep Co Ltd and its competitors, Goldenhome Living Co Ltd, Zhejiang Tianzhen Technology Co Ltd, and Zhejiang Zhengte Co Ltd, is fierce in the mattress industry. Each company is striving to provide the best product to their customer base in order to gain an edge in the market.

– Goldenhome Living Co Ltd ($SHSE:603180)

Goldenhome Living Co Ltd is a leading global home furnishing and décor company. It designs, manufactures and markets home products to consumers and professional buyers in the United States, Europe, and Asia Pacific. The company’s market cap as of 2023 is 4.93B, indicating that it has a strong presence in the market and its size and performance have been steadily growing over the years. Furthermore, its Return on Equity (ROE) is 7.14%, which means that it is able to generate a good amount of profits from the money invested into the business. This suggests that the company has effective management and efficient operations, which have been able to successfully generate value for shareholders.

– Zhejiang Tianzhen Technology Co Ltd ($SZSE:301356)

Zhejiang Tianzhen Technology Co Ltd is a Chinese technology company which specializes in the development of industrial software and hardware. As of 2023, the company has a market capitalization of 5.14B, which speaks to its success in the industry. Additionally, the company has achieved an impressive Return on Equity of 7.03%, indicating a high level of profitability. The company is well-known in the technology world for its innovative products and services, as well as for its dedication to customer service.

– Zhejiang Zhengte Co Ltd ($SZSE:001238)

Zhejiang Zhengte Co Ltd is a Chinese publicly listed company with a market cap of 2.5B as of 2023. The company works in the automotive industry and focuses on the research and development, production, and sale of automotive interior and exterior supplies, U-type steel and other related products. Zhejiang Zhengte Co Ltd has achieved a Return on Equity of 3.5%, which indicates that the company has achieved a relatively efficient use of equity capital to generate profits. This helps to increase the shareholders’ return on their investments.

Summary

DE RUCCI HEALTHY SLEEP is a potential dividend investment opportunity, with an average dividend yield of 2.47% for the year ended 2023. In the last two years, the company has paid out an annual per-share dividend of 1.0 and 1.0 CNY, making it an attractive dividend stock. Investors should analyze the company’s financials and assess its current and future performance before investing, as well as explore other investment opportunities to determine which is the best fit for their portfolio. Additionally, they should consider factors such as the company’s size and growth potential, management team, competitive landscape, and dividend policy.

Recent Posts