CSS dividend yield calculator – Communication and System Solution PCL Announces 0.05 Cash Dividend

June 12, 2023

☀️Dividends Yield

Communication ($SET:CSS) and System Solution PCL announced on May 25 2023, that it will be giving a 0.05 cash dividend. This comes after three consecutive years of distributing dividend per share of 0.14 THB, 0.14 THB, and 0.06 THB respectively. As a result, the dividend yield from 2021 to 2023 reached 7.63%, 7.63%, and 3.22% respectively, with the average yield being 6.16%. For those looking for a dividend stock, this company might be the right option for you. With its steady, albeit lower than average yield, this could be a great way to increase your income and get a good return on investment.

Additionally, the ex-dividend date for this company is May 8 2023, so you still have time to make your decision and invest accordingly.

Share Price

The stock opened and closed at THB1.3, a decrease of 0.8% from its previous closing price of 1.3. This dividend payout will be the third one in the past year, emphasizing the company’s commitment to rewarding its shareholders for their long-term support and investment. This dividend payout would be the first one in five years, providing a much needed boost to the company’s stock price and market sentiment.

Overall, this dividend distribution is seen as a positive development for COMMUNICATION & SYSTEM SOLUTION PUBLIC Company and its shareholders. It is a sign of the company’s commitment to rewarding its shareholders and a positive step towards building long-term value for those who have invested in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CSS. More…

| Total Revenues | Net Income | Net Margin |

| 4.55k | 114.3 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CSS. More…

| Operations | Investing | Financing |

| 169.94 | 57.48 | -179.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CSS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.3k | 1.43k | 1.51 |

Key Ratios Snapshot

Some of the financial key ratios for CSS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | 39.2% | 3.5% |

| FCF Margin | ROE | ROA |

| 3.4% | 5.6% | 3.0% |

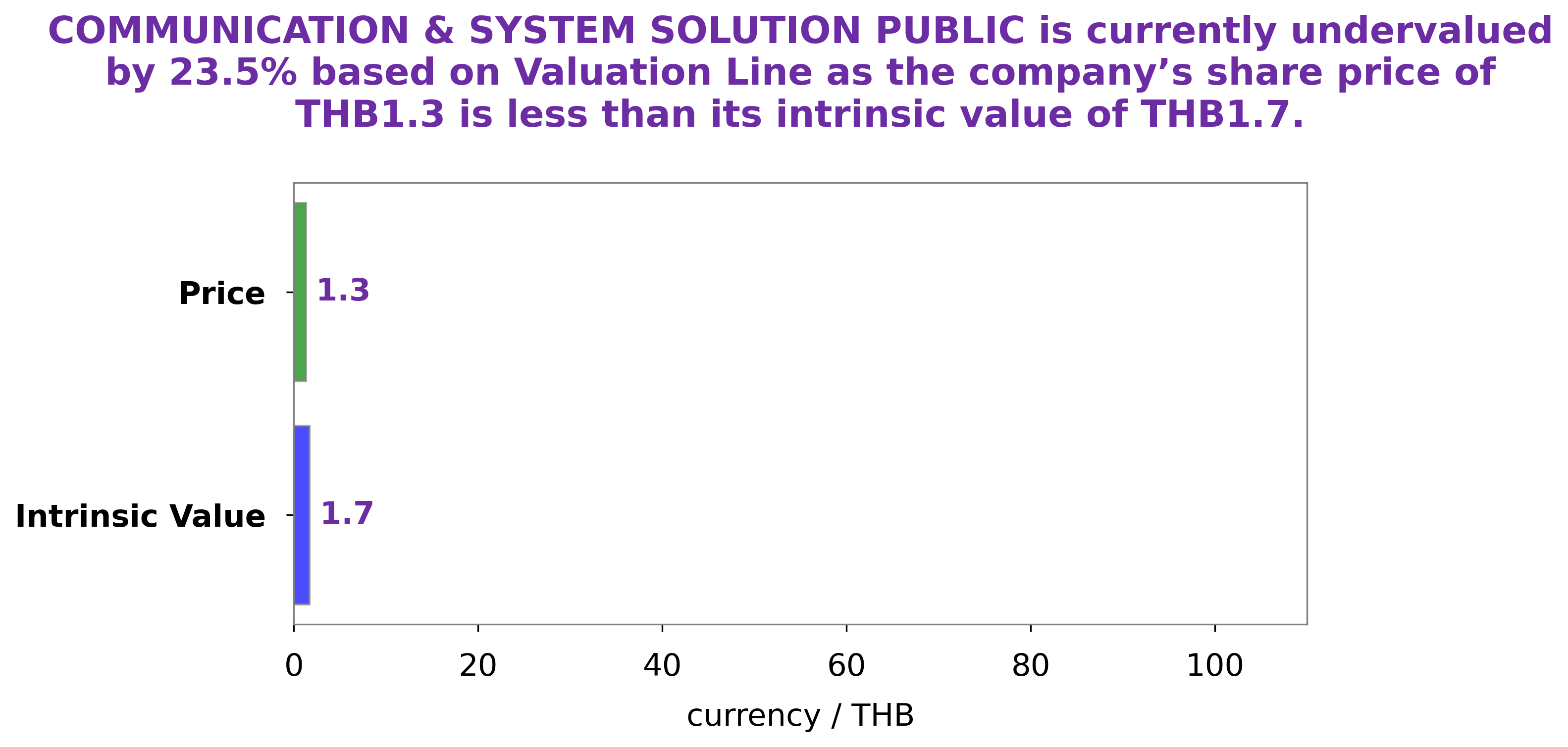

Analysis – CSS Stock Fair Value

We at GoodWhale have performed an analysis on COMMUNICATION & SYSTEM SOLUTION PUBLIC’s wellbeing. Our proprietary Valuation Line shows that the fair value of the company’s share should be around THB1.7. Currently, COMMUNICATION & SYSTEM SOLUTION PUBLIC’s stock is trading at THB 1.3, which means that it is undervalued by 25.5%. We believe that this presents a great opportunity for investors who are looking for long-term investments with a higher return on investments. More…

Peers

It is well-known for its cutting-edge technology and solutions that help businesses stay connected and competitive in today’s quickly changing digital landscape. C&SS is a main player in the industry and faces stiff competition from other companies such as Senshu Electric Co Ltd, TIM SA, and Hioki E.E. Corp. All of these companies offer advanced communication and system solutions, but C&SS stands out with its ability to provide comprehensive, cost-effective solutions tailored to meet the needs of its customers.

– Senshu Electric Co Ltd ($TSE:9824)

Senshu Electric Co Ltd is a leading electronics manufacturer based in Japan that specializes in consumer and industrial products. The company has a market cap of 62.43B as of 2023, reflecting its strong financial position in the industry. Additionally, Senshu Electric Co Ltd has a Return on Equity (ROE) of 10.09%, illustrating its ability to generate profits from the shareholders’ equity. This is an impressive figure, especially compared to the industry average of 6%. Overall, Senshu Electric Co Ltd has demonstrated solid financial performance and is well-positioned to capitalize on further growth opportunities.

– TIM SA ($LTS:0LZ3)

TIM SA is a leading telecommunications and technology provider in Brazil. The company has a market capitalization of 1.09 billion USD as of 2023, indicating its significant presence in the industry. TIM SA’s return on equity stands at a very healthy 26.71%, which implies that the company is efficiently utilizing its shareholders’ capital. This is a testament to its strong financial performance and sound business strategies. TIM SA offers a range of services such as mobile telephony, internet access, and digital television. The company also operates one of the largest mobile networks in Brazil and provides internet services to both consumers and businesses.

– Hioki E.E. Corp ($TSE:6866)

Hioki E.E. Corp is a Japanese-based electronics company that specializes in the production of testing and measuring instruments. As of 2023, the company has a market cap of 121.1B, indicating that it is a well-established and profitable business. Its Return on Equity (ROE) of 14.71% indicates that the company is reasonably successful at maximizing returns for its shareholders. Hioki E.E. Corp has also grown significantly in recent years, demonstrating the potential for long-term success.

Summary

The Communication & System Solution Public (CSP) is a worthwhile company to consider for dividend investing. Over the past three years, CSP has distributed dividends of 0.14 THB, 0.14 THB, and 0.06 THB, with respective dividend yields of 7.63%, 7.63%, and 3.22%. This translates to an average yield of 6.16%, which is relatively higher than the market average. As such, dividend investors should keep a close eye on CSP in order to maximize their returns.

Recent Posts