CRT dividend – Cross Timbers Royalty Trust Cuts Dividend by 36.5%, Payout Now $0.2446

April 19, 2023

Trending News ☀️

Cross Timbers Royalty ($NYSE:CRT) Trust (CRT) recently announced that their dividend has been cut by 36.5%, amounting to a payout of $0.2446. CRT’s portfolio consists of royalties, overriding royalties, minerals and other interests in various producing and non-producing properties. This major dividend cut comes as a result of low oil prices and the negative effects that have had on their production.

In an effort to conserve cash and increase liquidity, CRT had to make this difficult decision in order to maintain their long-term stability and ensure the trust’s financial health. The company expects the impact of these cuts to have a minimal effect on their operations, but they will continue to monitor their financial situation closely over the coming months and make adjustments as necessary.

Dividends – CRT dividend

This means that CROSS TIMBERS ROYALTY TRUST investors will receive a dividend yield of 10.79%, significantly lower than the average dividend yield of 10.79% over the last three years. Despite this steep cut, investors may still be interested in CROSS TIMBERS ROYALTY TRUST for its dividend payouts. It is worth considering for those looking for high dividend-yielding stocks.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CRT. More…

| Total Revenues | Net Income | Net Margin |

| 12.49 | 11.74 | 94.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CRT. More…

| Operations | Investing | Financing |

| 5.46 | – | -6.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.86 | 1.9 | 2.24 |

Key Ratios Snapshot

Some of the financial key ratios for CRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.2% | 30.9% | 93.9% |

| FCF Margin | ROE | ROA |

| 82.5% | 54.6% | 150.7% |

Stock Price

Cross Timbers Royalty Trust (CRT) made a major announcement on Tuesday, which had an impact on their current dividend payout. This dividend cut caused CRT’s stock to open at $20.6 but close at the same price, up 0.6% from the last closing price of $20.4. Consequently, investors may need to adjust their portfolios to ensure continued returns from CRT holdings. The sudden decrease in the dividend is a result of the decrease in crude oil production and lower oil prices. This has caused a significant decrease in cash flow for the trust, requiring it to reduce its distribution rate to stay afloat. The company has also announced plans to restructure its operations in an effort to mitigate the effects of this downturn.

In addition, it is exploring different investment opportunities that will allow it to generate additional revenue and increase its dividend payout in the future. Although this news is certainly not what investors expected, they can still benefit from the trust’s long-term potential. Given the current market conditions, investors should reassess their investment strategy and make sure that their portfolios are well diversified to minimize losses and maximize gains. Live Quote…

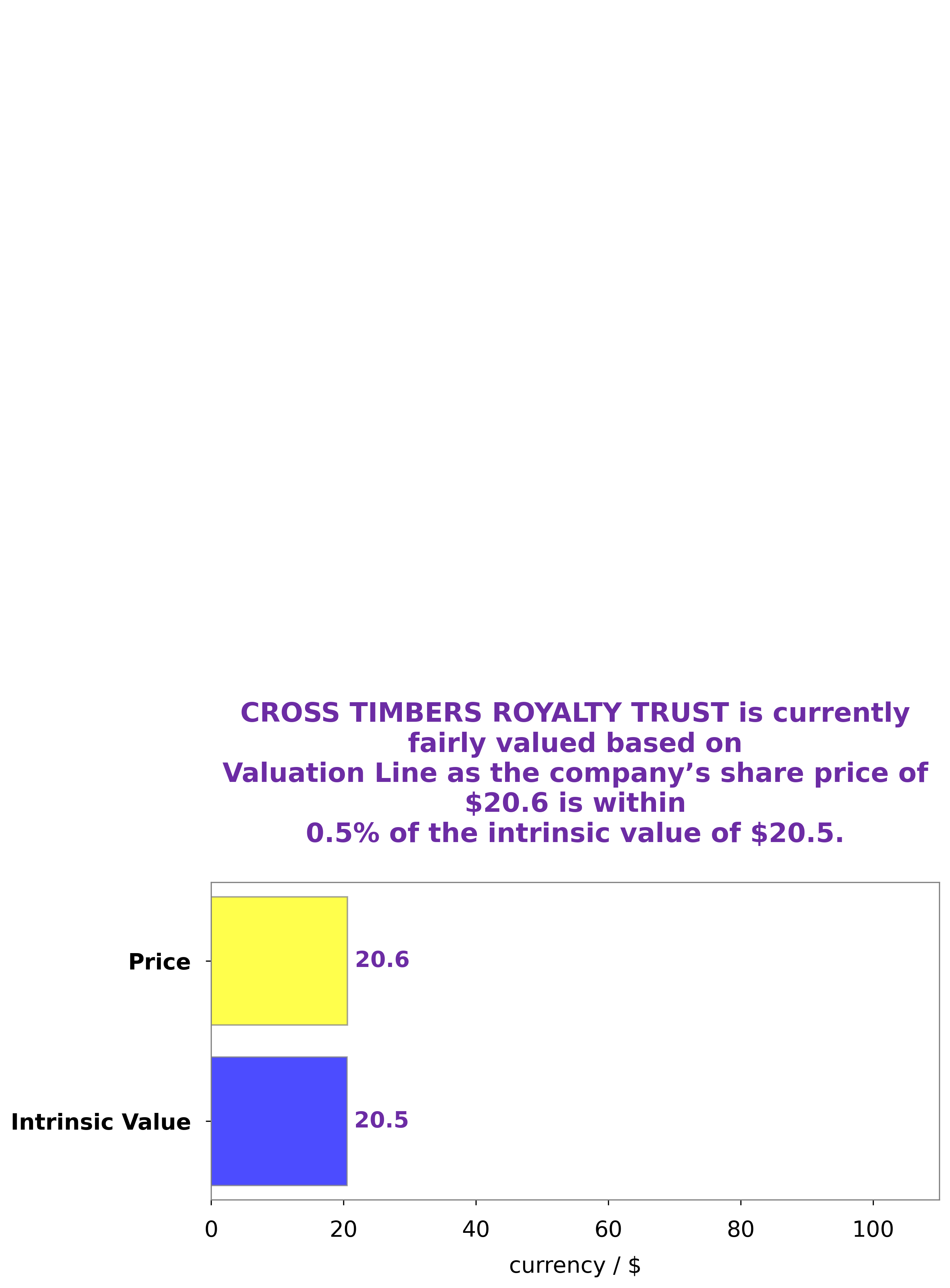

Analysis – CRT Stock Fair Value

At GoodWhale, we have conducted a thorough analysis of the fundamentals of CROSS TIMBERS ROYALTY TRUST. After taking into account various factors, our proprietary Valuation Line has calculated a fair value for CROSS TIMBERS ROYALTY TRUST shares to be around $20.5. Currently, the share price of CROSS TIMBERS ROYALTY TRUST is trading at $20.6, which is a fair price. More…

Peers

The oil and gas industry is a highly competitive field, with many players vying for market share. Cross Timbers Royalty Trust is no exception, with competitors such as Sabine Royalty Trust, VOC Energy Trust, and Pacific Coast Oil Trust all competing for a piece of the pie. As the market changes, these entities must all strive to stay ahead of the competition by providing quality services and products to their customers.

– Sabine Royalty Trust ($NYSE:SBR)

The Sabine Royalty Trust is a publicly-traded trust that owns royalty interests in oil and gas properties located in the United States. It has a market cap of 1.2 billion as of 2022, making it one of the larger trusts in this sector. The trust has a return on equity of 628.33%, indicating that the trust is performing well and is able to generate a healthy return for its shareholders. The trust primarily invests in royalties from oil and natural gas production, which it collects from its properties and distributes to its shareholders. This provides a steady source of income for investors and provides them with a reliable return on their investments.

– VOC Energy Trust ($NYSE:VOC)

VOC Energy Trust is a publicly traded company that is primarily engaged in the acquisition and exploitation of oil and natural gas properties in the United States. With a market cap of 158.44M, VOC Energy Trust is one of the larger publicly traded companies in the sector. The company has a Return on Equity (ROE) of 4.06%, which is below the industry average. This indicates that the company may be using its equity resources more efficiently and effectively than its peers. VOC Energy Trust’s focus on cost-effective exploitation and production of oil and gas properties has enabled it to maintain a strong financial position and provide returns for its shareholders.

– Pacific Coast Oil Trust ($OTCPK:ROYTL)

Pacific Coast Oil Trust is an independent energy trust focused on providing stable, long-term cash flows to its shareholders through the acquisition and development of crude oil and natural gas assets. The company has a market cap of 3.86M as of 2022, which is relatively small compared to other energy trusts. Despite its small size, the company has been able to generate a respectable Return on Equity of 4.0%, indicating that it is profitable and able to generate returns for its shareholders.

Summary

Cross Timbers Royalty Trust (CRT) is a trust that owns interests in oil and natural gas properties in North America. Recently, the trust saw a significant decrease in its dividend payments, with a 36.5% reduction to $0.2446 per share. This may be concerning news for investors, but it’s also important to consider why this happened.

There may have been changes in the market for oil and natural gas that impacted the properties owned by the trust, or more expenses associated with managing the trust itself. Ultimately, investors should closely examine the trust’s operational and financial performance to get a better understanding of the current situation and make an informed decision when evaluating whether to invest in it.

Recent Posts