China Oriental stock dividend – China Oriental Group Co Ltd Declares Special Dividend of 0.03

June 12, 2023

☀️Dividends Yield

China Oriental ($BER:ORG) Group Co Ltd recently declared a special dividend of 0.03 CNY per share on June 1 2023. This follows a steady dividend policy which has seen the company pay an annual dividend per share of 0.11 CNY for the years 2020 to 2022, equating to a yield of 7.44% per annum. This makes China Oriental a great option for any investor looking for a reliable dividend stock. The ex-dividend date for this stock is June 15 2023, so investors must make sure they have purchased the shares before then in order to be eligible for the special dividend.

Overall, China Oriental Group Co Ltd is a strong option for investors seeking a reliable dividend stock. With their consistent policy and attractive yield, this company should be considered for any portfolio looking to benefit from dividend payments.

Price History

The announcement caused the stock to open at €0.1 and close at €0.1, up by 3.7% from the previous closing price of 0.1. This move will not only benefit the company’s existing shareholders but will also attract new investors and bolster confidence in the stock. With its impressive portfolio of businesses, the company has been able to deliver improved profits for the last few years, leading to this special dividend announcement. Moving forward, investors can expect China Oriental Group Co Ltd to continue rewarding its shareholders with generous dividends. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Oriental. More…

| Total Revenues | Net Income | Net Margin |

| 48.62k | 807.51 | 1.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Oriental. More…

| Operations | Investing | Financing |

| -301.11 | 73.18 | -2.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Oriental. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 48.02k | 22.74k | 6.31 |

Key Ratios Snapshot

Some of the financial key ratios for China Oriental are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | -48.7% | 2.5% |

| FCF Margin | ROE | ROA |

| -5.2% | 3.3% | 1.6% |

Analysis

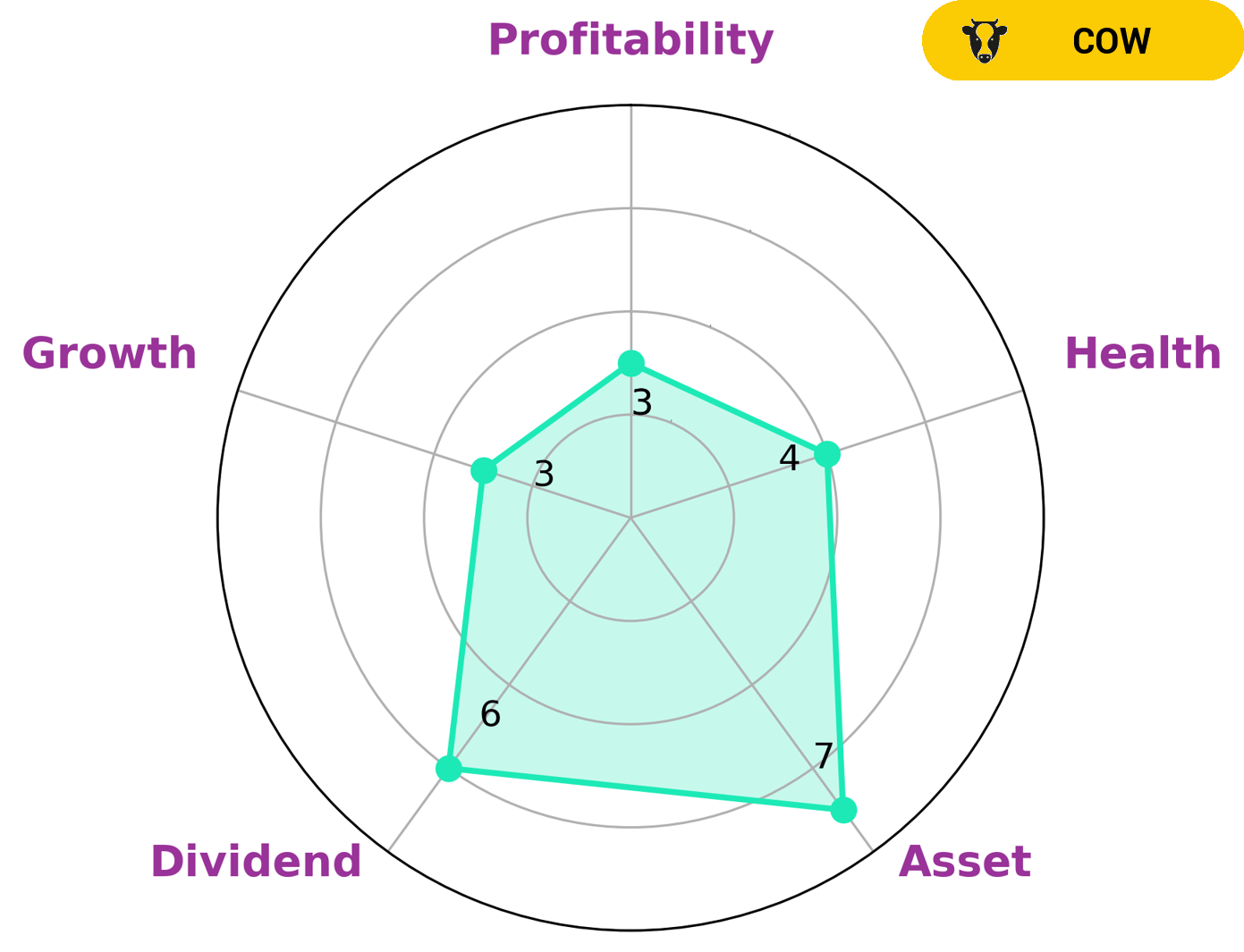

At GoodWhale, we conducted an analysis of CHINA ORIENTAL‘s financials and the results are displayed in the Star Chart. It appears that the company is strong in asset, medium in dividend and weak in growth, profitability. Additionally, CHINA ORIENTAL has an intermediate health score of 4/10 with regard to its cashflows and debt, which indicates that the company is likely to pay off debt and fund future operations. Based on these results, we classify CHINA ORIENTAL as a ‘Cow’, a type of company we conclude has the track record of paying out consistent and sustainable dividends. Investors who are looking for a steady and reliable source of income may be interested in investing in such a company. Those who are looking for more growth potential may want to look elsewhere. However, CHINA ORIENTAL offers good value in terms of their cash flows and ability to pay off debt, making them an attractive option for investors seeking to maintain a diversified portfolio. More…

Summary

CHINA ORIENTAL is an attractive option for dividend investors. From 2020 to 2022, the company issued an annual dividend per share of 0.11 CNY yielding a total of 7.44% annually. This is a considerable return given the current interest rate environment and stock market volatility.

Additionally, there is potential for the company to increase dividends in the future as it continues to grow. Investors should consider CHINA ORIENTAL when selecting dividend stocks, as it has established itself as a reliable and rewarding investment.

Recent Posts