Cardinal Energy stock dividend – Investors: Get the Dividend Before Cardinal Energy Ltd. Goes Ex-Dividend!

March 1, 2023

Trending News ☀️

Cardinal Energy stock dividend – Cardinal Energy ($TSX:CJ) Ltd. (TSX:CJ) is a great opportunity for dividend investors to cash in on quick returns. Their ex-dividend date is coming soon in just four days, so it is important for investors to take advantage of this lucrative offer before it passes by. Dividends are a great way to make money in the stock market; when you buy a stock before its ex-dividend date, you are entitled to the dividend payment that will be made on the date the stock goes ex-dividend. (TSX:CJ) is a great way to make an immediate return on your money.

Not only will you receive the dividend payment, but you also stand to benefit from any potential appreciation of the stock price in the future. Furthermore, dividends are often paid out every quarter which can help you create a steady income stream. (TSX:CJ) before their ex-dividend date, you can get the dividend payment and potentially increase your wealth over the long term. Investing in dividend stocks is a great way to diversify your portfolio and protect your wealth from market volatility. (TSX:CJ) before their ex-dividend date in four days.

Dividends – Cardinal Energy stock dividend

Investors looking for dividend income should take a closer look at CARDINAL ENERGY before it goes ex-dividend. Over the last two years, CARDINAL ENERGY has issued an annual dividend per share of 0.2 CAD and 0.03 CAD. The dividend yields from 2020 to 2022 are 2.72%, 1.19% respectively, with an average dividend yield of 1.96%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cardinal Energy. More…

| Total Revenues | Net Income | Net Margin |

| 727.25 | 227.78 | 32.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cardinal Energy. More…

| Operations | Investing | Financing |

| 320.55 | -89.53 | -231.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cardinal Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.06k | 222.88 | 5.38 |

Key Ratios Snapshot

Some of the financial key ratios for Cardinal Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.7% | 107.9% | 32.5% |

| FCF Margin | ROE | ROA |

| 29.7% | 17.5% | 13.9% |

Stock Price

In addition to the potential dividend payment, CARDINAL ENERGY has been receiving mostly positive media coverage as of late. At the time of writing, CARDINAL ENERGY stock opened at CA$7.3 and closed at CA$7.2, which is a decrease of 1.6% from the previous closing price of CA$7.3. This presents an opportunity for investors to invest in the company before the ex-dividend date and reap the benefits of the dividend payment. Live Quote…

Analysis

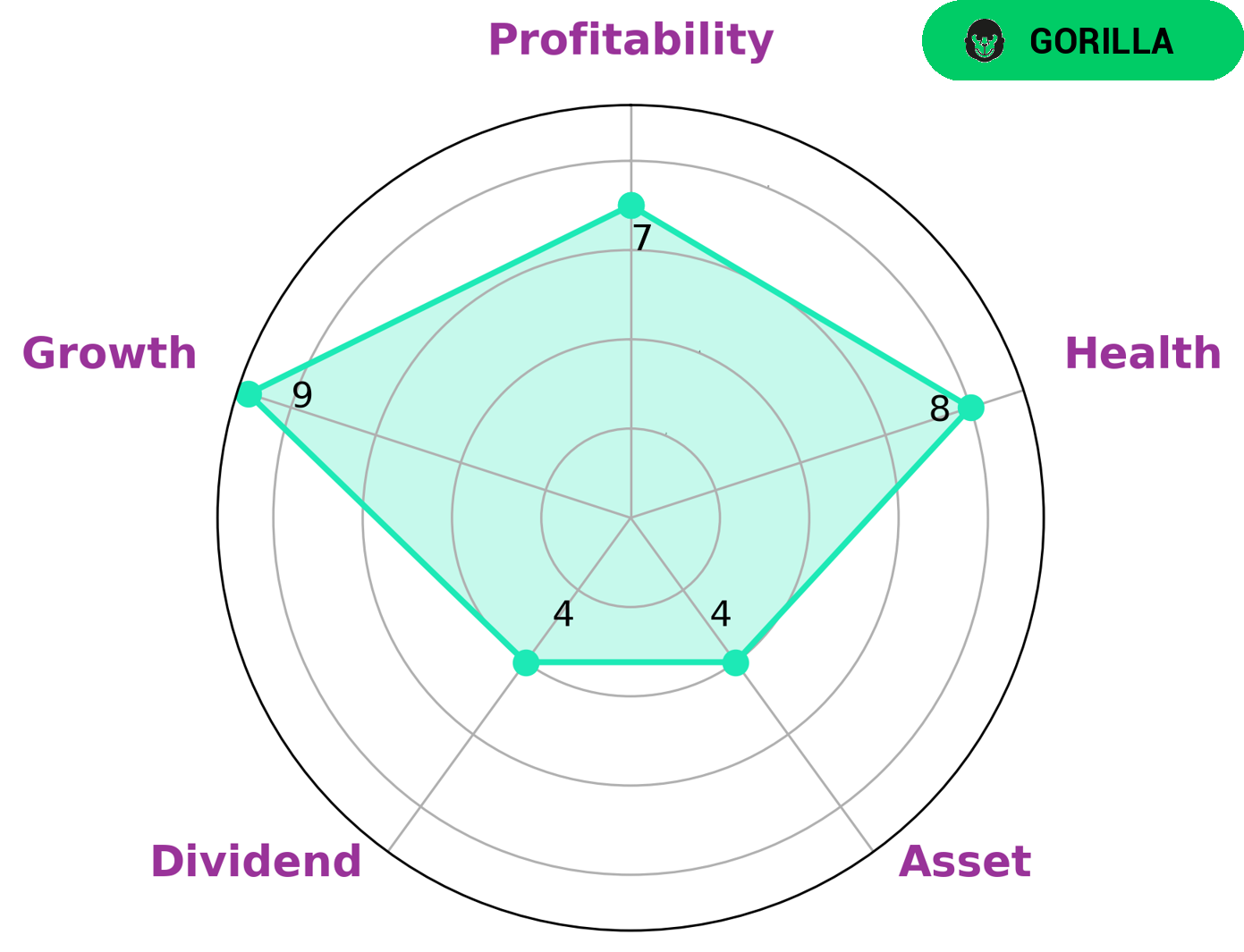

GoodWhale conducted an analysis of CARDINAL ENERGY‘s wellbeing using the Star Chart method. According to the results, CARDINAL ENERGY is classified as a ‘gorilla’ – a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. CARDINAL ENERGY exhibits strength in growth, profitability, and medium levels of asset, dividend. Additionally, CARDINAL ENERGY has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. Given these qualities, CARDINAL ENERGY may be particularly attractive to value investors looking for a steady stream of returns, as well as growth investors seeking exposure to a robust and successful firm with strong competitive advantages. Additionally, CARDINAL ENERGY may offer a good balance of risk and reward for more conservative investors looking for safe haven investments. More…

Peers

The company has operations in Alberta, Saskatchewan, and Manitoba. Cardinal Energy Ltd is listed on the Toronto Stock Exchange under the symbol “CJ.” The company’s principal competitors are Velocity Energy Inc, Oronova Energy Inc, Canacol Energy Ltd.

– Velocity Energy Inc ($OTCPK:VCYE)

Velocity Energy Inc is a Canadian oil and gas company with a market cap of 2.29M as of 2022. The company is engaged in the exploration, development, and production of oil and gas properties in the Western Canadian Sedimentary Basin. Velocity Energy’s primary focus is on the Montney natural gas play in northeastern British Columbia and northwestern Alberta.

– Oronova Energy Inc ($TSXV:ONV.H)

Oronova Energy Inc is a publicly traded company with a market capitalization of $876.06 thousand as of 2022. The company has a return on equity of 33.35%. Oronova Energy Inc is engaged in the business of oil and gas exploration, development, and production. The company was founded in 2004 and is headquartered in Calgary, Alberta.

– Canacol Energy Ltd ($TSX:CNE)

Canacol Energy Ltd is an oil and gas exploration and production company with operations in Colombia, Guyana, and Brazil. The company has a market capitalization of $365.64 million and a return on equity of 39.95%. Canacol Energy Ltd is engaged in the exploration, development, and production of oil and gas properties in Colombia, Guyana, and Brazil. The company was founded in 1984 and is headquartered in Calgary, Canada.

Summary

Cardinal Energy Ltd. (CARD) provides investors with a strong dividend yield, making it an attractive option for income-seeking investors. At the moment, the overall sentiment surrounding CARD is mostly positive, with analysts expecting the stock to continue to appreciate in the short and medium-term.

CARD’s underlying fundamentals are also strong, with its balance sheet indicating a low debt to equity ratio and its reserves providing a stable revenue stream. All this makes it a viable long-term investing opportunity with the potential to generate returns over a sustained period of time.

Recent Posts