Beijing Caishikou Department dividend yield – Beijing Caishikou Department Store Co Ltd Announces 0.46 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 3 2023, Beijing Caishikou Department ($SHSE:605599) Store Co Ltd Announced a 0.46 Cash Dividend. This is great news for those who are interested in stocks with high dividend yields. The company is paying an annual dividend per share of 0.36 CNY for the past two years and the average dividend yield from 2022 to 2023 was 3.17%. Investors will be pleased to know that the ex-dividend date for this dividend is June 9 2023. Beijing Caishikou Department Store Co Ltd is a leading department store in Beijing.

They offer a wide selection of products and services at competitive prices. The company has also been investing heavily in new technologies and services to ensure the best customer experience possible. Investing in BEIJING CAISHIKOU DEPARTMENT STORE may be a wise decision for those looking for an investment with excellent long-term dividend yields.

Price History

Following the announcement, BEIJING CAISHIKOU DEPARTMENT STORE stock price opened at CNY11.8 and closed at CNY11.9, representing an increase of 1.0% from its previous closing price of CNY11.8. The dividend announcement follows BEIJING CAISHIKOU DEPARTMENT STORE Co Ltd’s announcement of its first quarter earnings which showed an increase in both net profit and total revenue from the same period last year. The company also announced plans to open new outlets across China, as well as expansion into new markets such as Southeast Asia and Africa. This is a sign that the company is confident in its performance and in its outlook for the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Beijing Caishikou Department. More…

| Total Revenues | Net Income | Net Margin |

| 12.57k | 515.05 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Beijing Caishikou Department. More…

| Operations | Investing | Financing |

| 704.62 | -207.07 | -355.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Beijing Caishikou Department. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.12k | 2.46k | 4.38 |

Key Ratios Snapshot

Some of the financial key ratios for Beijing Caishikou Department are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | -0.1% | 5.6% |

| FCF Margin | ROE | ROA |

| 5.2% | 12.5% | 7.2% |

Analysis – Beijing Caishikou Department Intrinsic Value

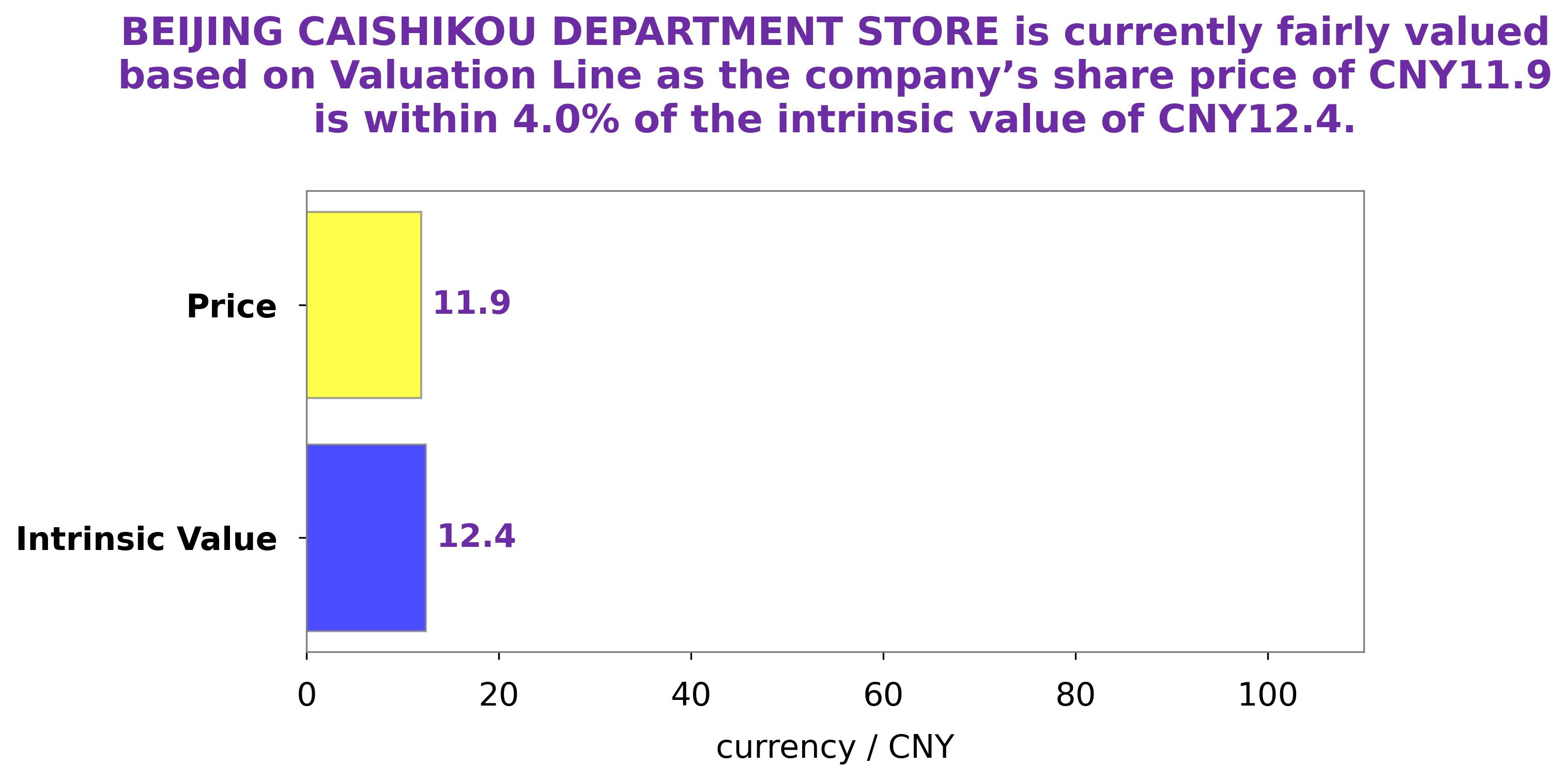

At GoodWhale, we have conducted a comprehensive analysis of BEIJING CAISHIKOU DEPARTMENT STORE’s financials. Our proprietary Valuation Line has determined the intrinsic value of BEIJING CAISHIKOU DEPARTMENT STORE share to be around CNY12.4. Currently, BEIJING CAISHIKOU DEPARTMENT STORE stock is traded at CNY11.9, making it a fair price that is undervalued by 4.1%. Therefore, we believe that it presents an opportunity for investors to add value to their portfolios. More…

Peers

Beijing Caishikou Department Store Co Ltd faces stiff competition in the jewelry market from some of the leading companies in the industry, such as Shenyang Cuihua Gold and Silver Jewelry Co Ltd, Leysen Jewelry Inc, and China National Gold Group Gold Jewellery Co Ltd. These companies are all powerful contenders in the highly competitive jewelry market, and Beijing Caishikou Department Store Co Ltd must use their innovative strategies and cutting-edge technology to stay ahead of the competition.

– Shenyang Cuihua Gold and Silver Jewelry Co Ltd ($SZSE:002731)

Shenyang Cuihua Gold and Silver Jewelry Co Ltd is a leading jewelry company in China with a market cap of 3.27B as of 2023. The company has experienced continuous growth and has achieved a return on equity of 7.04%, indicating that the company is efficient with its capital management decisions. Shenyang Cuihua specializes in creating gold and silver jewelry products for the fashion conscious consumer. The company has a wide selection of high quality jewelry pieces that are perfect for special occasions or everyday use. Shenyang Cuihua has become one of the most reputable players in the jewelry market and its products are highly sought after.

– Leysen Jewelry Inc ($SHSE:603900)

Leysen Jewelry Inc is a global jewelry company located in the USA. The company specializes in manufacturing and selling luxury jewelry, watches, and other accessories. As of 2023, the company has a market cap of 2.21B, with an ROE of -1.41%. This market cap is relatively large compared to other companies in the industry, indicating that Leysen Jewelry Inc is a well-established business with strong brand recognition. The negative ROE suggests that the company is not utilizing its assets efficiently and may not be generating sufficient profits to cover its costs.

– China National Gold Group Gold Jewellery Co Ltd ($SHSE:600916)

China National Gold Group Gold Jewellery Co Ltd is one of the largest gold jewellery companies in China. It has a market cap of 20.06B as of 2023, a Return on Equity of 9.5%. This indicates that the company is doing well financially and is able to generate profits for its shareholders. The company also boasts strong balance sheets, liquidity, and competitive position in the industry. It operates more than 1,400 stores in China and overseas, most of which are focused on the retail sale of gold jewellery products. The company also engages in gold mining, exploration and refinery activities.

Summary

BEIJING CAISHIKOU DEPARTMENT STORE is an appealing investment option for those looking for high dividend yield. In the past two years, the company has issued an annual dividend per share of 0.36 CNY and this has resulted in a dividend yield of 3.17%. For investors, this presents a reliable and consistent income stream. Analysing the performance of the company may also give insight into the potential of appreciation in share prices.

Additionally, scrutinizing recent financial statements can give an idea of current performance as well as future outlook. This, in turn, can help determine if investing in BEIJING CAISHIKOU DEPARTMENT STORE is a worthwhile endeavour.

Recent Posts