Aurizon Holdings stock dividend – Aurizon Holdings Ltd Declares 0.07 Cash Dividend

February 16, 2023

Dividends Yield

Aurizon Holdings stock dividend – On February 14 2023, AURIZON HOLDINGS ($ASX:AZJ) declared a 0.07 cash dividend, making it their fourth annual dividend payment of the year. AURIZON HOLDINGS has issued an annual dividend per share of 0.21 AUD, 0.25 AUD, and 0.28 AUD over the last 3 years, yielding 5.69%, 6.43%, and 6.5%, respectively, with an average dividend yield of 6.21%. If you are looking for dividend stocks, AURIZON HOLDINGS might be worth considering, with an ex-dividend date of February 27 2023. AURIZON HOLDINGS is an Australian publicly listed transportation and logistics company with operations spanning the eastern and western coasts of Australia. The company provides freight and logistics services to a range of clients, including miners, steel producers, rail operators, and other key customers in the freight and infrastructure marketplaces. Through its operations and investments, AURIZON HOLDINGS has earned a reputation as one of Australia’s leaders in the transportation and logistics sector. As a dividend stock, AURIZON HOLDINGS has proven to be a reliable source of income for its investors. With a solid track record of paying out a steady stream of dividends, AURIZON HOLDINGS is likely to remain an attractive option for income-seeking investors in the future. Furthermore, the company’s diverse operations and investments also make it an attractive option for investors who are looking for diversification within their portfolios. It is important to note that investing in AURIZON HOLDINGS does come with some risks. As with any other stock purchase, investors need to be aware that the market can fluctuate and prices may move in either direction without any warning.

Additionally, AURIZON HOLDINGS may be subject to certain economic and political factors that could affect the stock price and dividend payments. All in all, AURIZON HOLDINGS is a strong dividend stock choice for investors looking for reliable income streams.

Price History

The stock opened at AU$3.5 and then closed at AU$3.3, dropping 3.2% from its previous closing price of AU$3.4. This decrease in stock price was largely attributed to the dividend payout and the uncertainty surrounding the current market conditions. Aurizon Holdings Ltd is an Australia-based freight rail operator and logistics provider, providing a range of services to customers in the resources sector. The company operates in two main divisions, which are freight rail and logistics services. In addition to these two divisions, the company owns and operates a variety of other services such as locomotives, track, infrastructure and other assets. Aurizon Holdings Ltd is committed to creating shareholder value through delivering a safe, reliable and efficient service.

Its goal is to create a sustainable business for the benefit of shareholders and customers alike. The new 0.07 cash dividend will be paid out shortly, providing shareholders with a return on their investments. The outlook for Aurizon Holdings Ltd is positive as the company is well-positioned to take advantage of the growing demand for rail services in Australia. With its strong presence in the market and solid financial performance, the company is well-positioned to benefit from the current economic environment and move forward with its plans for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aurizon Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 3.18k | 340.1 | 12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aurizon Holdings. More…

| Operations | Investing | Financing |

| 1.03k | -2.06k | 1.5k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aurizon Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.21k | 7.93k | 2.32 |

Key Ratios Snapshot

Some of the financial key ratios for Aurizon Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.7% | -8.5% | 22.7% |

| FCF Margin | ROE | ROA |

| 11.3% | 10.4% | 3.7% |

Analysis

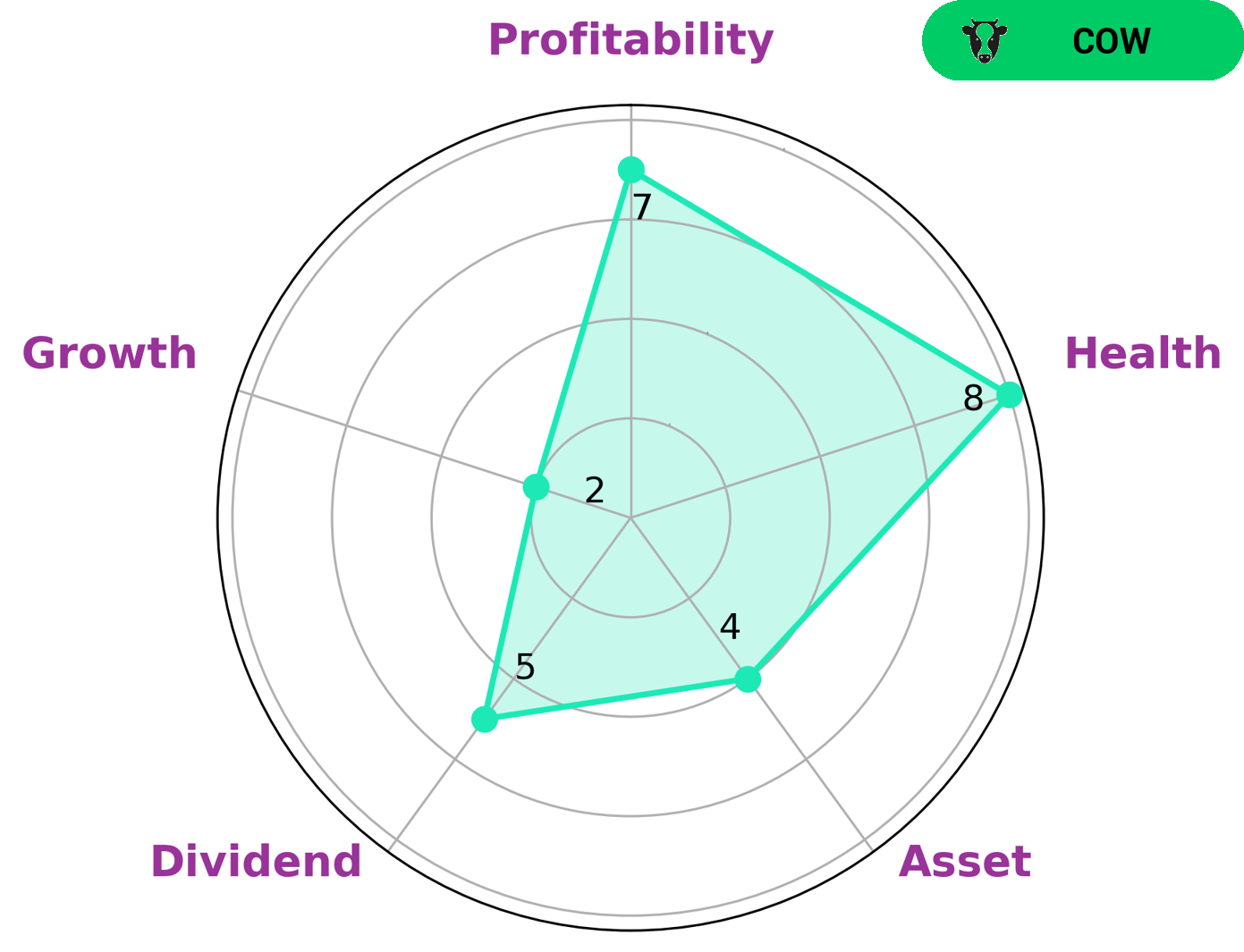

AURIZON HOLDINGS is a strong performer when it comes to profitability. Its Star Chart indicates that its asset, dividend, and growth performance are average. GoodWhale’s analysis of AURIZON HOLDINGS’ financials shows it to have an 8/10 health score, which suggests that it is capable of withstanding a crisis without the risk of bankruptcy. AURIZON HOLDINGS is classified as a ‘cow’, indicating that it has a track record of consistently paying out dividends that are both sustainable and reliable. Investors who are seeking stable dividends and stability in their investments may be interested in AURIZON HOLDINGS. Its strong profitability and highly rated health score make it an attractive option for those who are looking for companies that can be relied upon to deliver on their dividends and protect their investments in times of crisis. Moreover, its classification as a ‘cow’ provides assurance that dividends are likely to remain consistent over the long term. Investors who value steady income from their investments may find AURIZON HOLDINGS to be an attractive option. More…

Peers

The company operates a fleet of locomotives and freight cars, and provides rail freight services to a range of customers across a variety of industries. Aurizon competes with a number of other freight rail operators in Australia, including Daqin Railway Co Ltd, EuroDry Ltd, Dalrymple Bay Infrastructure Ltd, and a number of smaller regional operators. Aurizon has a strong market position and a well-established brand, and is well-positioned to continue to grow its business in the Australian freight rail market.

– Daqin Railway Co Ltd ($SHSE:601006)

Daqin Railway Co Ltd has a market cap of 101.99B as of 2022, a Return on Equity of 9.64%. The company operates a railway network in China, connecting major cities in the country. The company also provides railway transportation services, including freight and passenger services.

– EuroDry Ltd ($NASDAQ:EDRY)

EuroDry Ltd is a world leader in the seaborne transportation of dry bulk commodities. The company has a market cap of 42.35M as of 2022 and a return on equity of 32.26%. EuroDry Ltd transports dry bulk commodities such as iron ore, coal, grain, and other materials across the world’s oceans. The company has a strong focus on safety and environmental protection.

– Dalrymple Bay Infrastructure Ltd ($ASX:DBI)

Dalrymple Bay Infrastructure Ltd is a Australian company that focuses on infrastructure investments. The company’s market cap as of 2022 is 2.38B and its ROE is -7.9%. Dalrymple Bay Infrastructure Ltd’s focus on infrastructure investments includes but is not limited to: airports, seaports, roads, railways, and utilities.

Summary

Aurizon Holdings is a potential investment option for those looking for dividend stocks. The company has been consistently paying out dividends over the last three years, with an average yield of 6.21%. In 2021 alone, their dividend per share was 0.28 AUD, yielding 6.5%. The ex-dividend date is February 27th 2023, so investors should factor that in before making a decision.

Despite the yield being slightly lower than average, the company has demonstrated a strong commitment to dividend payments, which makes it an attractive option for those looking for steady, reliable income. Furthermore, Aurizon Holdings has a strong presence in the rail freight transport industry, making it well-positioned to benefit from global economic trends. Investors should keep an eye on the company’s financials and any potential changes to their dividend policy when considering investing in Aurizon Holdings.

Recent Posts