ARR dividend calculator – ARMOUR Residential REIT Announces 0.08 Cash Dividend

April 7, 2023

Dividends Yield

ARMOUR ($NYSE:ARR) Residential REIT Inc. recently announced on April 1 2023 that they would be paying out a 0.08 Cash Dividend. The stock has been paying out a consistent dividend of 1.2 USD per share over the last three years, giving an average dividend yield of 16.27%. This makes ARMOUR Residential REIT a great choice for investors looking for dividend stocks. Furthermore, the ex-dividend date for this stock is April 14 2023, which gives investors plenty of time to weigh their options and decide whether to invest in the stock or not.

Given the consistent dividend yields, ARMOUR Residential REIT is a great choice for investors who are seeking steady dividend income. The company is well established and has a solid history of success, making it a reliable option for those seeking to invest in dividend stocks. With the ex-dividend date for this stock being April 14 2023, investors have until then to make their decision and invest in this stock if they deem it to be a good fit for their investment portfolio.

Price History

This cash dividend, along with the company’s other distributions, provides income security to ARMOUR Residential REIT’s investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ARR. More…

| Total Revenues | Net Income | Net Margin |

| -225.87 | -241.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ARR. More…

| Operations | Investing | Financing |

| 124.08 | -3.89k | 3.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ARR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.44k | 8.32k | 6.83 |

Key Ratios Snapshot

Some of the financial key ratios for ARR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

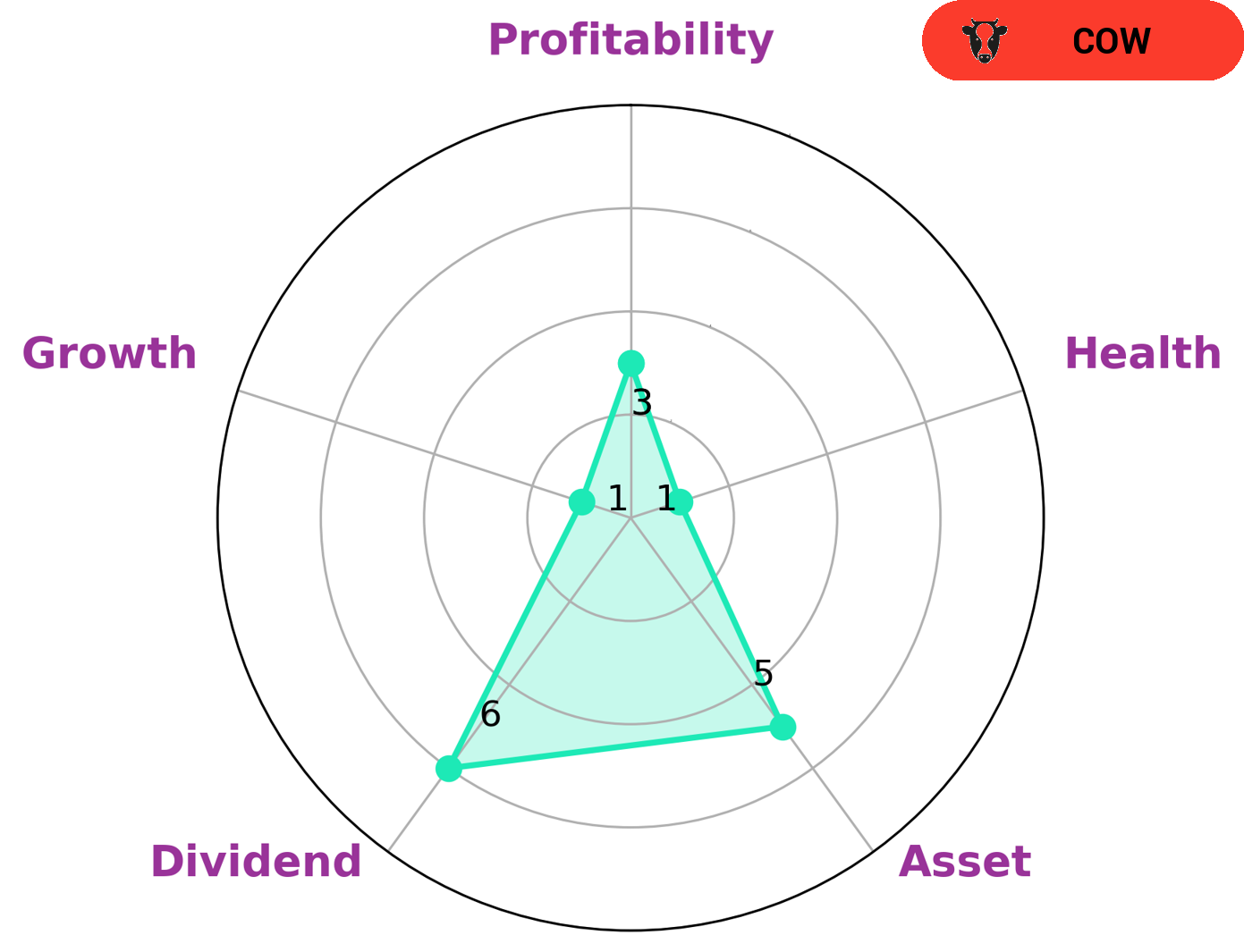

At GoodWhale, we have conducted an analysis of ARMOUR RESIDENTIAL REIT’s fundamentals. According to our Star Chart, the company is relatively strong in its asset base, medium in its dividend and weak in growth and profitability. We have therefore classified ARMOUR RESIDENTIAL REIT as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. We believe this type of company may be of interest to investors looking for regular dividend income. However, it is worth noting that ARMOUR RESIDENTIAL REIT has a low health score of 1/10 with regard to its cashflows and debt, suggesting that it is less likely to sustain future operations in times of crisis. More…

Peers

The company is headquartered in Boca Raton, Florida and was founded in 2006. ARMOUR operates as a holding company that owns subsidiaries which are engaged in the business of acquiring, investing in, and managing residential mortgage-backed securities. The company competes against Chimera Investment Corp, Dynex Capital Inc, and Annaly Capital Management Inc.

– Chimera Investment Corp ($NYSE:CIM)

Chimera Investment Corporation is a real estate investment trust that primarily invests in adjustable-rate and fixed-rate residential mortgage loans, commercial mortgage loans, real estate-related securities, and other asset classes. The company has a market cap of $1.57 billion as of 2022.

– Dynex Capital Inc ($NYSE:DX)

Dynex Capital, Inc. is a publicly traded real estate investment trust. The company invests in a variety of real estate-related assets, including commercial mortgage loans, commercial mortgage-backed securities, and other real estate-related investments.

– Annaly Capital Management Inc ($NYSE:NLY)

Analysts have estimated that Annaly Capital Management Inc’s market cap would be around 10.08B as of 2022. The company’s main focus is on providing mortgage financing and servicing to the US residential and commercial real estate markets. In recent years, the company has expanded its operations into other areas such as healthcare and student housing.

Summary

Investing in ARMOUR RESIDENTIAL REIT can be a solid option for dividend seekers. This stock has paid out a consistent annual dividend of 1.2 USD per share for the past three years, giving an average dividend yield of 16.27%. It is important to note that dividend yield can vary from year to year, which makes it important to do your research and keep an eye on any changes. Additionally, make sure to factor in the current market conditions and the potential risks associated with investing in this stock.

Recent Posts