Apt Satellite stock dividend – APT Satellite Holdings Ltd Declares 0.17 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 2, 2023, APT Satellite Holdings Ltd Declares 0.17 Cash Dividend. This makes it the third consecutive year that the company has paid an annual dividend per share of 0.26 HKD, resulting in dividend yields of 11.41% from 2020 to 2022. This makes APT SATELLITE ($SEHK:01045) a lucrative option for those searching for dividend stocks as the average yield is 11.41%. The ex-dividend date is set at June 5, 2023.

This makes the stock a great choice for individuals who are looking to invest in dividend stocks as it offers good returns. This could potentially result in increased demand for the stock in the coming weeks.

Market Price

The stock opened the day at HK$2.4, and closed at the same price, up 0.4% from the prior closing price. This dividend is partially funded by a dividend reinvestment plan, allowing shareholders to receive the dividend in either cash or additional stock. The board believes that this dividend payment is a reflection of their commitment to increasing shareholder value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apt Satellite. More…

| Total Revenues | Net Income | Net Margin |

| 944.3 | 231.61 | 24.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apt Satellite. More…

| Operations | Investing | Financing |

| 661.57 | -585.52 | -272.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apt Satellite. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.13k | 1.06k | 6.53 |

Key Ratios Snapshot

Some of the financial key ratios for Apt Satellite are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.9% | -5.9% | 31.2% |

| FCF Margin | ROE | ROA |

| 69.7% | 3.0% | 2.6% |

Analysis

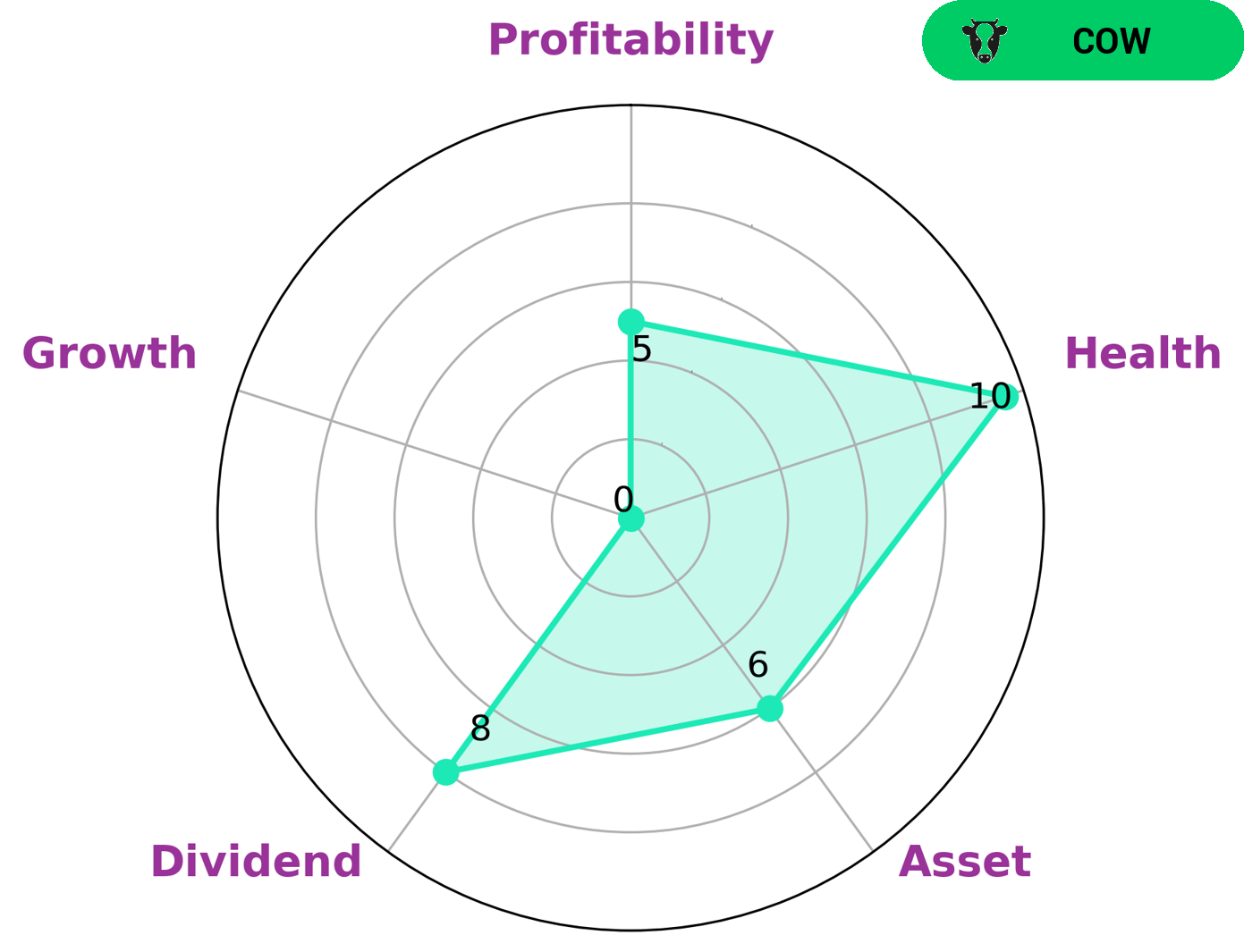

GoodWhale has recently analyzed the wellbeing of APT SATELLITE and according to our Star Chart, they have a remarkable health score of 10/10 when it comes to cashflows and debt sustainability. This indicates that APT SATELLITE is capable to sustain future operations in times of crisis. Furthermore, our analysis reveals that APT SATELLITE is strong in dividend and medium in asset, profitability and growth. As a result of these findings, we have classified APT SATELLITE as a ‘cow’, which is a type of company that has the track record of paying out consistent and sustainable dividends. Given the strong sustainability and dividend capabilities, investors who are looking for a stable and reliable return would be interested in such a company as APT SATELLITE. Those who prioritize long-term capital growth may also be drawn to this company due to its consistent performance despite economic fluctuations. More…

Peers

APT Satellite Holdings Ltd is one of the leading satellite communications and technology companies in the world. It provides a variety of services, including satellite broadcasting and telecommunications, to a wide range of customers around the globe. APT Satellite Holdings Ltd has several major competitors in the market, including SmarTone Telecommunications Holdings Ltd, PCCW Ltd, and PLDT Inc. These companies all offer similar services, and are constantly striving to expand their customer base and improve their services to remain competitive in the market.

– SmarTone Telecommunications Holdings Ltd ($SEHK:00315)

SmarTone Telecommunications Holdings Ltd is a leading telecommunications service provider in Hong Kong that provides mobile network, fixed network and international roaming services to customers. The company has a current market capitalization of 5.78 billion as of 2023 and a Return on Equity (ROE) of 8.87%. This indicates that the company is able to generate an attractive return from the investors’ funds. The company has established itself as a leading telecommunications service provider in Hong Kong, and is well-positioned to continue to grow and expand its operations in the future.

– PCCW Ltd ($SEHK:00008)

PCCW Ltd is a Hong Kong-based telecommunications and technology company. The company is the world’s largest integrated communications service provider, with operations in both the fixed-line and mobile markets. As of 2023, PCCW has a market cap of 30.11B and a Return on Equity (ROE) of 26.65%, indicating that the company is highly profitable and a good investment for shareholders. This figure is well above the ROE average for companies in the HKSE Hang Seng Index, which stands at approximately 17%. PCCW’s strong performance is likely due to its dominant position in the telecommunications market, as well as its successful diversification into new technologies such as artificial intelligence, big data, cloud computing, and internet of things.

– PLDT Inc ($PSE:TEL)

PLDT Inc is a Philippine-based telecommunications and digital services provider, with operations in the fixed line, wireless and digital segments. The company has a market cap of 314.06 billion US dollars as of 2023, which is a testament to its success in the telecommunications and digital services industry. Its Return on Equity (ROE) of 27.8% is also impressive, indicating that the company is able to generate a considerable amount of income from its investments. PLDT Inc is one of the leading telecommunications and digital services providers in the Philippines, providing services to millions of households and businesses across the country.

Summary

Investing in APT SATELLITE has provided a lucrative opportunity for investors. Over the past three years, the company has paid out an average annual dividend of 0.26 HKD per share, resulting in an impressive yield of 11.41%. This provides investors with an attractive income stream and is especially beneficial for those looking to achieve dividend returns. With a consistent payout rate and high dividend yield, APT SATELLITE is an attractive option for investors.

Recent Posts