Adecoagro S.a dividend yield calculator – Adecoagro SA Announces 0.16260252 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Adecoagro SA announced a 0.16260252 cash dividend on May 26 2023, making it an attractive option for investors looking for dividend stocks. Over the past two years, the company has declared an annual dividend of 0.32 USD per share, yielding 3.0% in both 2022 and 2023. This has resulted in an average dividend yield of 3.0% over the two-year period. The ex-dividend date for this announcement is May 8 2023, so investors must own the stock before then to be eligible for the dividend payment.

For investors who are searching for steady dividend returns, ADECOAGRO S.A ($NYSE:AGRO) may be a wise choice as they have consistently delivered dividends in the past two years. Furthermore, since they are paying out a dividend of 0.16260252, investors can expect a good return on their investment. Therefore, investors looking to diversify their investments or add more dividend stocks to their portfolio may consider adding ADECOAGRO S.A to their list of considerations.

Share Price

This dividend marks the company’s tenth consecutive year of dividend payments to its shareholders. ADECOAGRO S.A has consistently rewarded its shareholders with dividends, demonstrating its commitment to share value creation. The company has been focusing on improving operational efficiency, strengthening its balance sheet, and generating robust cash flows in order to ensure long-term investor returns. ADECOAGRO S.A has also been expanding its operations by increasing acreage and improving yields, further consolidating its position as a leader in Latin America’s agricultural sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adecoagro S.a. More…

| Total Revenues | Net Income | Net Margin |

| 1.39k | 66.45 | 8.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adecoagro S.a. More…

| Operations | Investing | Financing |

| 340.05 | -261.01 | -113 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adecoagro S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.06k | 1.86k | 10.79 |

Key Ratios Snapshot

Some of the financial key ratios for Adecoagro S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.2% | 25.2% | 11.2% |

| FCF Margin | ROE | ROA |

| 7.8% | 8.5% | 3.2% |

Analysis

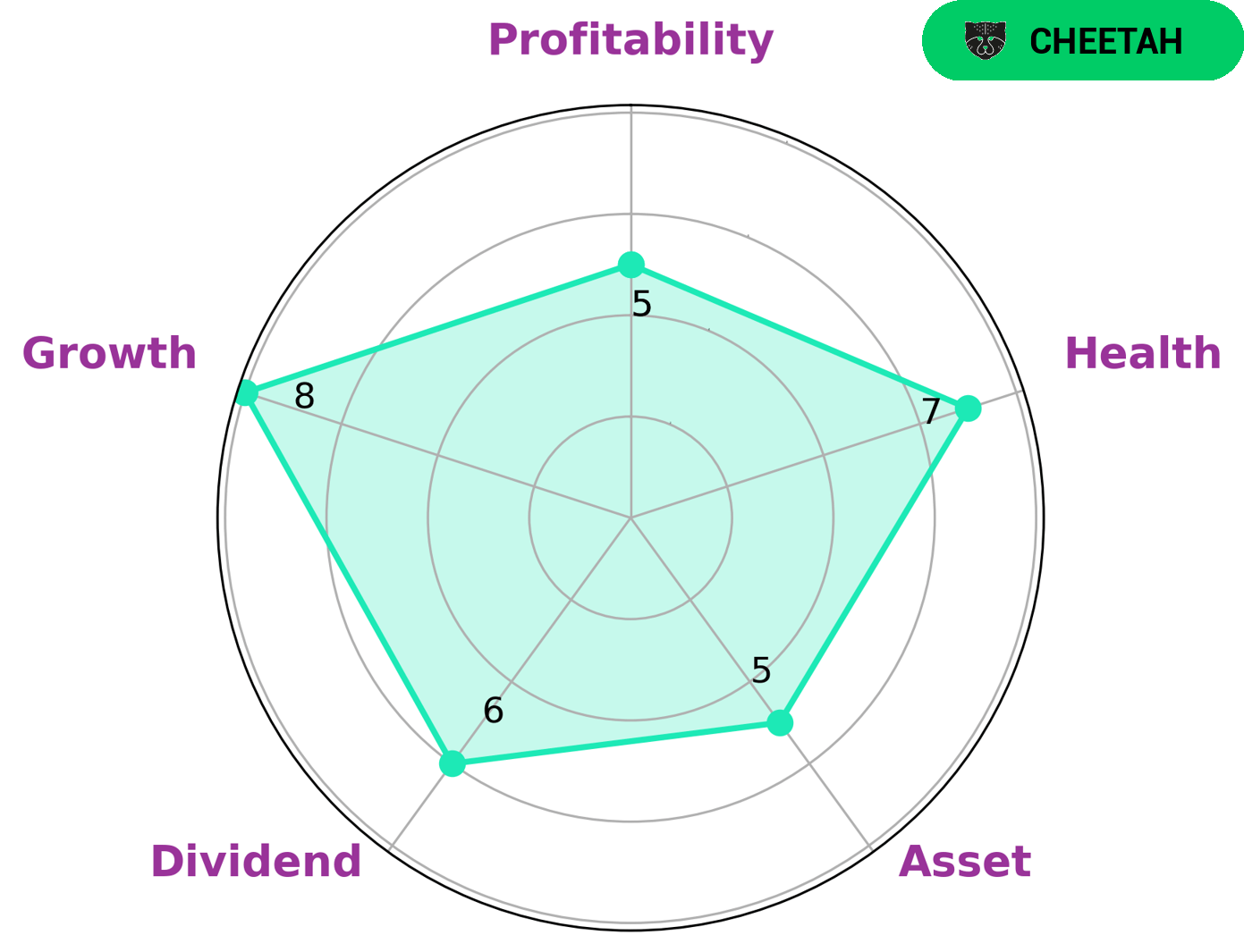

As GoodWhale, we have conducted an analysis of ADECOAGRO S.A.’s fundamentals. Our Star Chart shows that ADECOAGRO S.A is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Despite this, the company has a high health score of 7/10 with regards to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. Furthermore, ADECOAGRO S.A is strong in growth, and medium in asset, dividend, and profitability. Given that ADECOAGRO S.A has a strong record of growth and the ability to sustain its operations in difficult market conditions, investors who are focused on capital growth may be interested in this company. Those who are looking for stability may opt for other investments. More…

Peers

The company faces competition from ASTARTA Holding NV, PT Aman Agrindo Tbk, and Magadh Sugar & Energy ltd, all of which are engaged in similar agricultural activities. With a presence in Brazil, Argentina, Uruguay, Paraguay and other countries, Adecoagro SA has managed to remain competitive in a highly dynamic sector.

– ASTARTA Holding NV ($LTS:0O0C)

ASTARTA Holding NV is an agricultural holding company based in Ukraine. It operates in the agribusiness sector, processing and selling agricultural products produced by its subsidiaries. As of 2022, the company has a market capitalization of 495.91M, making it one of the largest agricultural companies in Ukraine. Its Return on Equity (ROE) of 14.43% indicates that the company is generating returns that are higher than its cost of capital. This suggests that ASTARTA Holding NV is creating value for its shareholders.

– PT Aman Agrindo Tbk ($IDX:GULA)

Magadh Sugar & Energy Ltd is an Indian-based sugar, ethanol, and power generation company. It operates nine sugar mills in the state of Bihar, and has a total sugarcane crushing capacity of over 11,500 tons per day. The company also produces ethanol from molasses and has an installed capacity of 6.2 MW of power generation from bagasse. As of 2022, Magadh Sugar & Energy Ltd has a market capitalization of 4.44 billion and a return on equity of 10.61%. This data indicates that the company is performing well financially and has a strong presence in its industry. Its ability to produce sugar, ethanol, and power from its sugar mills makes it a unique player within its sector.

Summary

ADECOAGRO S.A is an attractive investment option for dividend investors, with an average yield of 3.0% over the past two years. The company has consistently paid a dividend of 0.32 USD per share since 2022, making it a reliable source of income for investors. Fundamental analysis suggests that ADECOAGRO S.A has sound financials and a promising outlook for the future, making it a worthwhile investment choice. Investors should carefully research the company’s financial performance and risk profile before investing in order to make an informed decision.

Recent Posts