Target Corporation Reports Strong Earnings Results for Second Quarter of FY2024

August 23, 2023

☀️Earnings Overview

On August 16 2023, TARGET CORPORATION ($NYSE:TGT) released their financial results for the second quarter of FY2024, which ended on July 31 2023. Total revenue for the quarter amounted to USD 24773.0 million, a 4.9% decrease compared to the same period of the previous year. Net income was reported to be USD 835.0 million, a significant increase from the USD 183.0 million reported in the same quarter of FY2023.

Stock Price

The stock opened at $135.0 and closed at $128.8, up 3.0% from the prior closing price of $125.0. These impressive results show that TARGET CORPORATION is continuing to deliver strong earnings results. The company has successfully adapted to the changing retail landscape, and is now reaping the benefits of its investments in technology and store expansion. While the remainder of FY2024 remains uncertain, Target Corporation’s strong performance in the second quarter, coupled with the opening of new stores, suggest a positive outlook for the remainder of the fiscal year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Target Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 108.01k | 3.37k | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Target Corporation. More…

| Operations | Investing | Financing |

| 7.46k | -5.81k | -1.16k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Target Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 53.21k | 41.22k | 25.97 |

Key Ratios Snapshot

Some of the financial key ratios for Target Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | -1.8% | 4.4% |

| FCF Margin | ROE | ROA |

| 1.5% | 25.3% | 5.6% |

Analysis

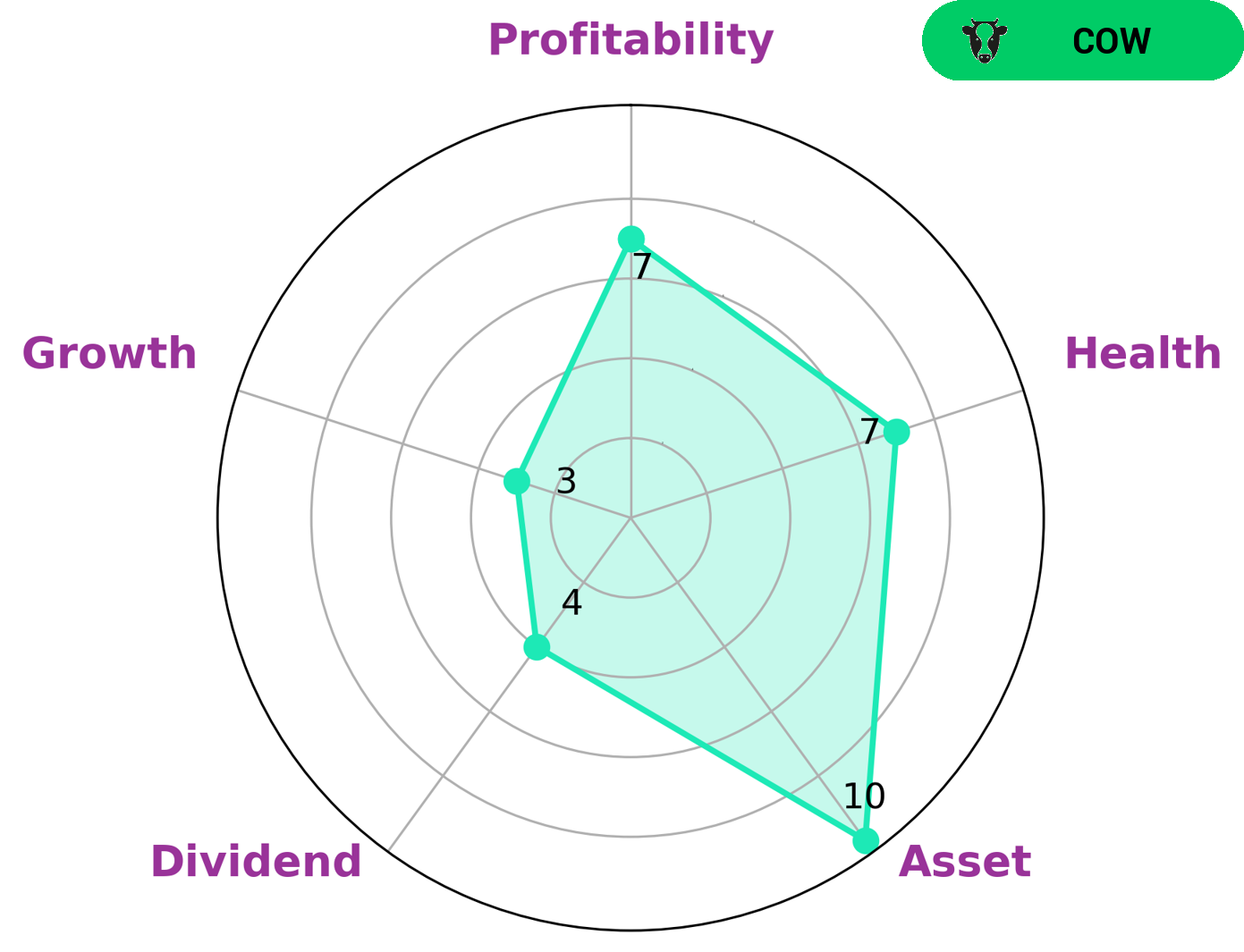

At GoodWhale, we recently took a look at the financials of TARGET CORPORATION. After analyzing the company’s Star Chart, we classified it as a ‘cow’, meaning that the company has a track record of paying out consistent and sustainable dividends. As such, investors seeking to generate steady income streams may find TARGET CORPORATION an attractive option. The company boasts an impressive health score of 8/10, meaning that in the event of a crisis, it has the cashflows and debt capacity to safely ride out the storm without the risk of bankruptcy. On top of this, TARGET CORPORATION is strong in asset, medium in dividend, profitability and weak in growth. This means that the company has a solid foundation upon which to continue its dividend payouts, and that its profits are steadily climbing. With this in mind, we believe that TARGET CORPORATION is an excellent choice for investors looking to generate reliable income. More…

Peers

Its competitors are Walmart Inc, Costco Wholesale Corp, and Dollar Tree Inc. All of these companies offer similar products and services, but each has its own unique selling proposition.

– Walmart Inc ($NYSE:WMT)

Walmart Inc is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores. Headquartered in Bentonville, Arkansas, the company was founded by Sam Walton in 1962 and incorporated on October 31, 1969. As of January 31, 2020, Walmart has 11,484 stores and clubs in 27 countries, operating under 55 different names. The company operates under the name Walmart in the United States and Canada, as Walmart de México y Centroamérica in Mexico and Central America, as Asda in the United Kingdom, as the Seiyu Group in Japan, and as Best Price in India. It has wholly owned operations in Argentina, Chile, Canada, and South Africa. Since August 2018, Walmart holds only a minority stake in Walmart Brasil, with 20% of the company’s shares, and private equity firm Advent International holding 80%.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is a membership-only warehouse club that provides a wide selection of merchandise. They carry brand-name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources. Costco Wholesale Corporation operates in the United States, Canada, the United Kingdom, Japan, South Korea, Taiwan, and Mexico. As of 2022, the company had a market cap of 211.64B and a return on equity of 24.62%. Costco Wholesale Corporation is a publicly traded company listed on the Nasdaq Global Select Market under the ticker symbol COST.

– Dollar Tree Inc ($NASDAQ:DLTR)

Dollar Tree Inc is a retail company that operates dollar stores across the United States. The company has a market cap of $32.16 billion as of 2022 and a return on equity of 15.97%. Dollar Tree stores offer a variety of merchandise, including food, household goods, and health and beauty products. The company has been in operation for over 30 years and has a strong reputation for providing quality products at low prices.

Summary

This news was met with positive investor reaction, with the stock price moving up following the report. The solid performance is an encouraging sign for investors, as it suggests that TARGET CORPORATION is prepared for a successful year ahead. It remains to be seen whether the company can maintain its current momentum, but for now, it appears to be a good bet for investors.

Recent Posts