BJ’s Wholesale Club Reports Fourth Quarter FY2023 Earnings Results on March 9 2023.

March 28, 2023

Earnings Overview

BJ’S ($BER:8BJ): BJ’s Wholesale Club reported their results for the fourth quarter of FY2023 on March 9 2023, with total revenue of USD 129.8 million; this marked a 20.6% increase from the same period the previous year. Reported net income also increased to USD 4929.6 million, a 13.1% increase year over year.

Stock Price

The stock opened at €72.0 and closed at €72.5, up by 2.8% from the previous closing price of €70.5. Going forward, BJ’s Wholesale Club remains committed to its growth strategy to expand its product offerings, invest in technology and expand its store footprint to remain competitive in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 8BJ. More…

| Total Revenues | Net Income | Net Margin |

| 19.32k | 513.18 | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 8BJ. More…

| Operations | Investing | Financing |

| 788.16 | -747.06 | -52.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 8BJ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 5.3k | 7.01 |

Key Ratios Snapshot

Some of the financial key ratios for 8BJ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.6% | 28.0% | 3.8% |

| FCF Margin | ROE | ROA |

| 2.2% | 48.9% | 7.3% |

Analysis

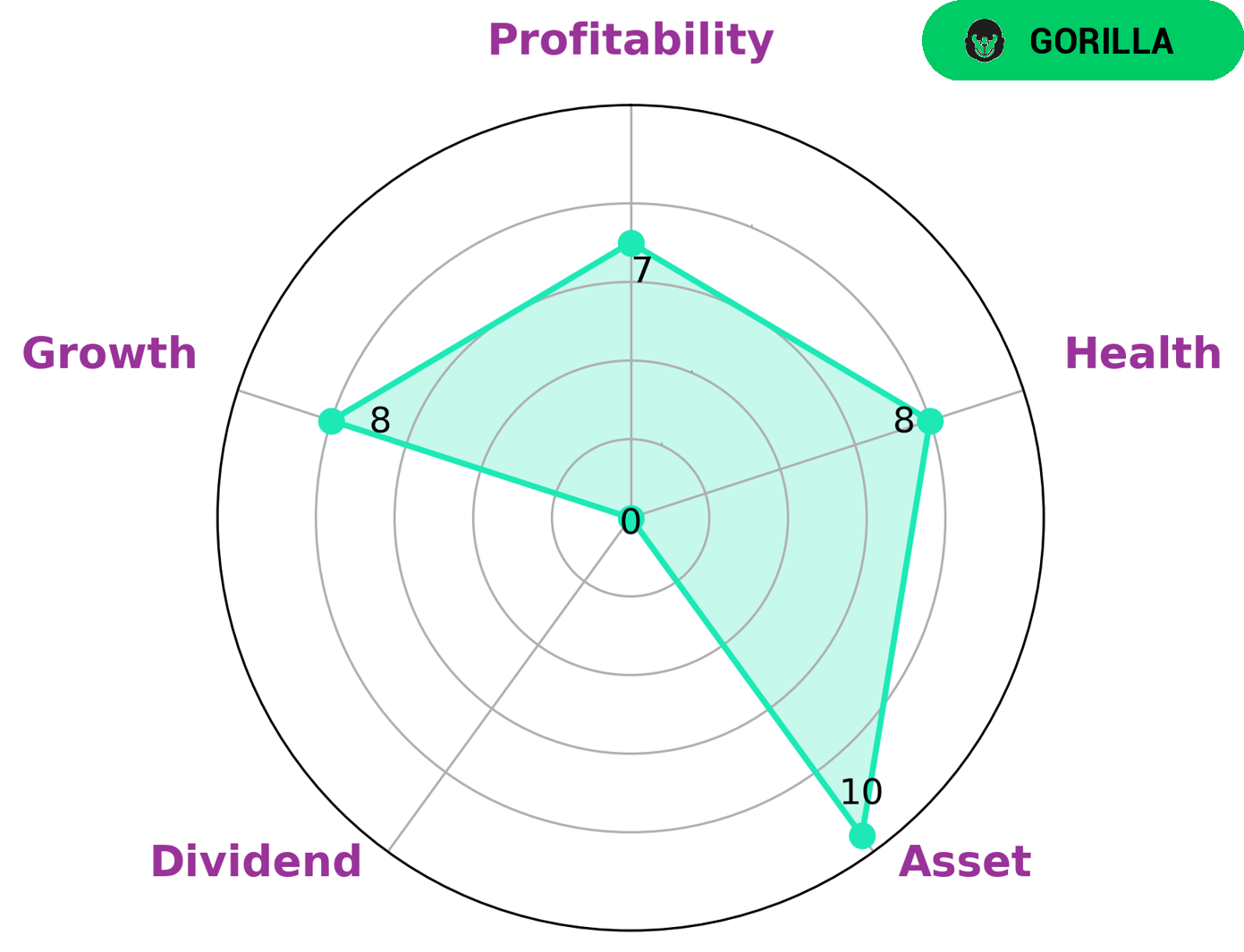

GoodWhale recently conducted an analysis of BJ’s WHOLESALE CLUB’s wellbeing. After reviewing the Star Chart, it was clear that BJ’S WHOLESALE CLUB is strong in asset, growth, and profitability, but weak in dividend. Based on this data, we classified the company as a ‘gorilla’, which means the company has achieved stable and high revenue or earnings growth due to a strong competitive advantage. Given the strong financial health of BJ’S WHOLESALE CLUB, with a health score of 8/10 in regards to cashflows and debt, it is likely to be attractive to a variety of investors. The ability to pay off debt and fund future operations with a high success rate makes BJ’S WHOLESALE CLUB an ideal investment opportunity. This company is poised for long-term success and is likely to be an attractive option for investors seeking stability and high returns. More…

Summary

Investing in BJ’s Wholesale Club appears to be a good decision, with their fourth quarter of FY2023 reporting a 20.6% increase in revenue, and a 13.1% increase in net income year over year. This is an impressive growth rate, especially when considering the overall economic conditions of the past year, indicating that BJ’s is a strong contender in the wholesale space. Investors should look closely at the company’s fundamentals, such as its balance sheet strength, customer base, and competitive position, to determine whether it is a good long-term bet. With their positive earnings results, BJ’s looks to be a good stock to consider for any investor who is looking for long-term growth potential.

Recent Posts