Private Equity Interest Boosts Syneos Health Stock Prices

April 11, 2023

Trending News ☀️

Syneos Health ($NASDAQ:SYNH), a biopharmaceutical solutions organization, has seen a surge in its stock prices this week following reports of private equity interest. The news of private equity interest has been welcomed by investors, who are optimistic about the company’s future prospects. Syneos Health has been performing well in recent times and is seen as a market leader in its sector. Analysts believe that the company could be a good long-term investment opportunity, especially in light of the increased private equity interest.

Syneos Health has been slow in making acquisitions, but this recent development could give the company an additional boost to pursue strategic growth opportunities. Investors are watching closely to see how the company will capitalize on the increased interest and if it will be able to take advantage of potential opportunities that come its way.

Price History

Monday was a big day for SYNEOS HEALTH, who saw their stock prices soar by 13.7% from the prior closing price of 34.9, opening at 36.3 and closing at 39.7. This uptick in share prices was largely attributed to the private equity interest in the company, which is one of the leading contract research organizations (CRO) in the world, providing comprehensive clinical and commercialization services. The interest from private equity investors suggests that there is potential upside for SYNEOS HEALTH in the future and could be a sign of a more positive outlook for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Syneos Health. More…

| Total Revenues | Net Income | Net Margin |

| 5.39k | 266.5 | 5.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Syneos Health. More…

| Operations | Investing | Financing |

| 426.98 | -105.63 | -339.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Syneos Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.2k | 4.7k | 33.96 |

Key Ratios Snapshot

Some of the financial key ratios for Syneos Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | 10.5% | 7.4% |

| FCF Margin | ROE | ROA |

| 6.2% | 7.2% | 3.0% |

Analysis

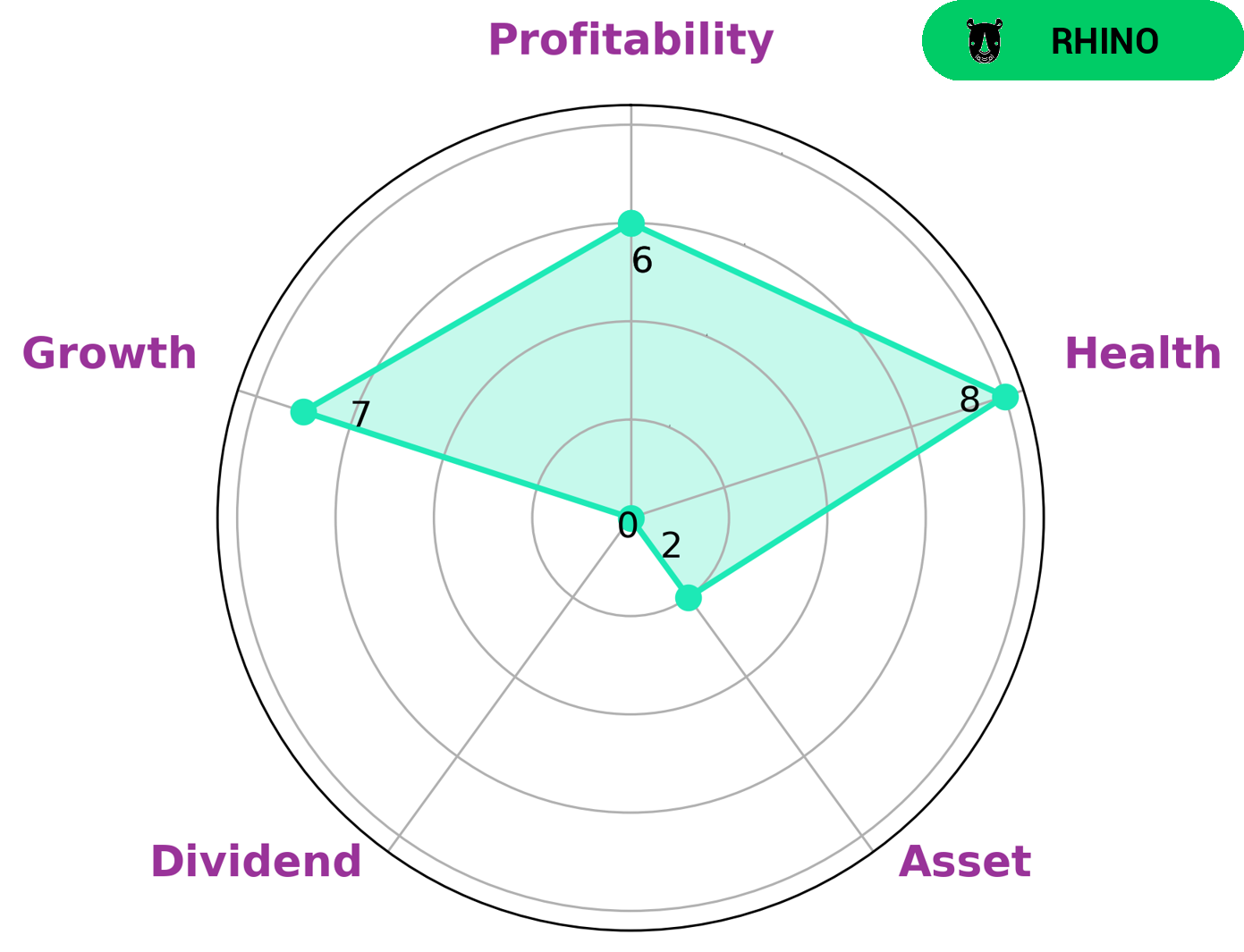

At GoodWhale, we conducted an analysis of SYNEOS HEALTH‘s financials and our Star Chart shows that SYNEOS HEALTH has a high health score of 8/10 due to its robust cashflows and low debt levels. We believe that the company is capable to sustain future operations in times of crisis. Additionally, our analysis shows that SYNEOS HEALTH is strong in growth, medium in profitability and weak in asset and dividend. Based on this analysis, we have classified SYNEOS HEALTH as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. Given the company’s overall financial health and potential for moderate growth, we believe that long-term investors such as value investors or income investors may be interested in investing in SYNEOS HEALTH. Value investors may be looking for opportunities to buy stocks at a low price relative to their intrinsic value, while income investors may seek companies with a reliable dividend payout. More…

Peers

The company competes with Shin Nippon Biomedical Laboratories Ltd, Icon PLC, and Guardant Health Inc, among a few other companies in the biopharmaceutical services industry. Syneos Health Inc provides an end-to-end solution for customers with deep expertise and a focus on service excellence.

– Shin Nippon Biomedical Laboratories Ltd ($TSE:2395)

Shin Nippon Biomedical Laboratories Ltd, or SNBL, is a Japanese-based company specializing in the development and manufacture of laboratory animal models for the pharmaceutical and medical industries. The company has a market cap of 94.46B as of 2022, which reflects its strong financial performance and industry leadership. Additionally, SNBL has a Return on Equity of 27.97%, indicating a strong return on its investments. SNBL is well-positioned to continue to deliver strong returns for investors and to remain a leader in the laboratory animal model industry.

– Icon PLC ($NASDAQ:ICLR)

Icon PLC, founded in 1977, is a global provider of outsourced development services to the pharmaceutical, biotechnology and medical device industries. Based in Dublin, Ireland, the company operates in over 30 countries and employs over 11,500 professionals. With a market capitalization of 15.9 billion as of 2022, Icon PLC is one of the largest companies in its space. The company boasts a Return on Equity of 4.96%, indicating a strong level of profitability and efficient use of capital. Icon PLC focuses on providing a wide range of services such as clinical trial management, regulatory affairs outsourcing, safety and pharmacovigilance, biometrics, and medical writing.

– Guardant Health Inc ($NASDAQ:GH)

Guardant Health Inc is a biotechnology company based in Redwood City, California, and is focused on developing non-invasive cancer diagnostics. The company has a market cap of 4.75 billion as of 2022. Guardant Health Inc had a return on equity of -150.22%, which illustrates that the company had a negative profitability from its investments. This suggests that the company has not been able to generate enough profits from its investments to cover its cost of capital and grow its value for shareholders. Although this is not a positive sign for investors, it may be a sign that the company is investing heavily into research and development of new products and technologies that could eventually bring profits in the future.

Summary

Syneos Health is a leading fully integrated biopharmaceutical solutions company. Recently, the company gained considerable attention in the stock market following a report of private equity interest in the company. In response, the stock price moved up noticeably on the same day, indicating investor confidence in Syneos Health’s future prospects. Analysts suggest that Syneos Health is well-positioned to capitalize on growth opportunities in the evolving biopharmaceutical industry, making it an attractive investment opportunity.

The company has a solid track record of delivering strong financial performance, and further growth is expected as the industry continues to evolve. With a wide range of services and expertise in the biopharmaceuticals sector, Syneos Health is likely to remain an attractive investment opportunity for investors.

Recent Posts