Medpace Holdings Reports Record EPS and Revenue, Easily Surpassing Analyst Expectations

April 26, 2023

Trending News ☀️

Medpace Holdings ($NASDAQ:MEDP), a clinical contract research organization, recently reported record earnings per share (EPS) and revenue figures that easily exceeded analyst expectations. Furthermore, the revenue reported was an impressive $434.07M, which was $31.24M more than what was expected. Medpace Holdings is a global leader in providing comprehensive clinical research services to the biopharmaceutical and medical device industries. Medpace is committed to providing innovative solutions to complex clinical development challenges, helping companies bring new therapies to market faster and more efficiently.

Share Price

On Monday, MEDPACE HOLDINGS reported record earnings per share (EPS) and revenue for the third quarter, easily surpassing analyst expectations. The company’s stock opened at $189.2, up from its prior-day closing price of $189.0, and closed at $187.3, down 0.9% from last closing price. The strong performance was driven by higher revenues across all of the company’s operating segments, including its Clinical Development Solutions, Clinical Trials Support Services, Regulatory Solutions, and Site Management Services. The company is optimistic that its strong performance will continue in the coming quarters as it expands its portfolio of services and gains more business from clients. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Medpace Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.56k | 256.83 | 16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Medpace Holdings. More…

| Operations | Investing | Financing |

| 421.87 | -37.04 | -416.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Medpace Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.4k | 1.05k | 11.28 |

Key Ratios Snapshot

Some of the financial key ratios for Medpace Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.6% | 30.0% | 19.2% |

| FCF Margin | ROE | ROA |

| 24.6% | 51.2% | 13.5% |

Analysis

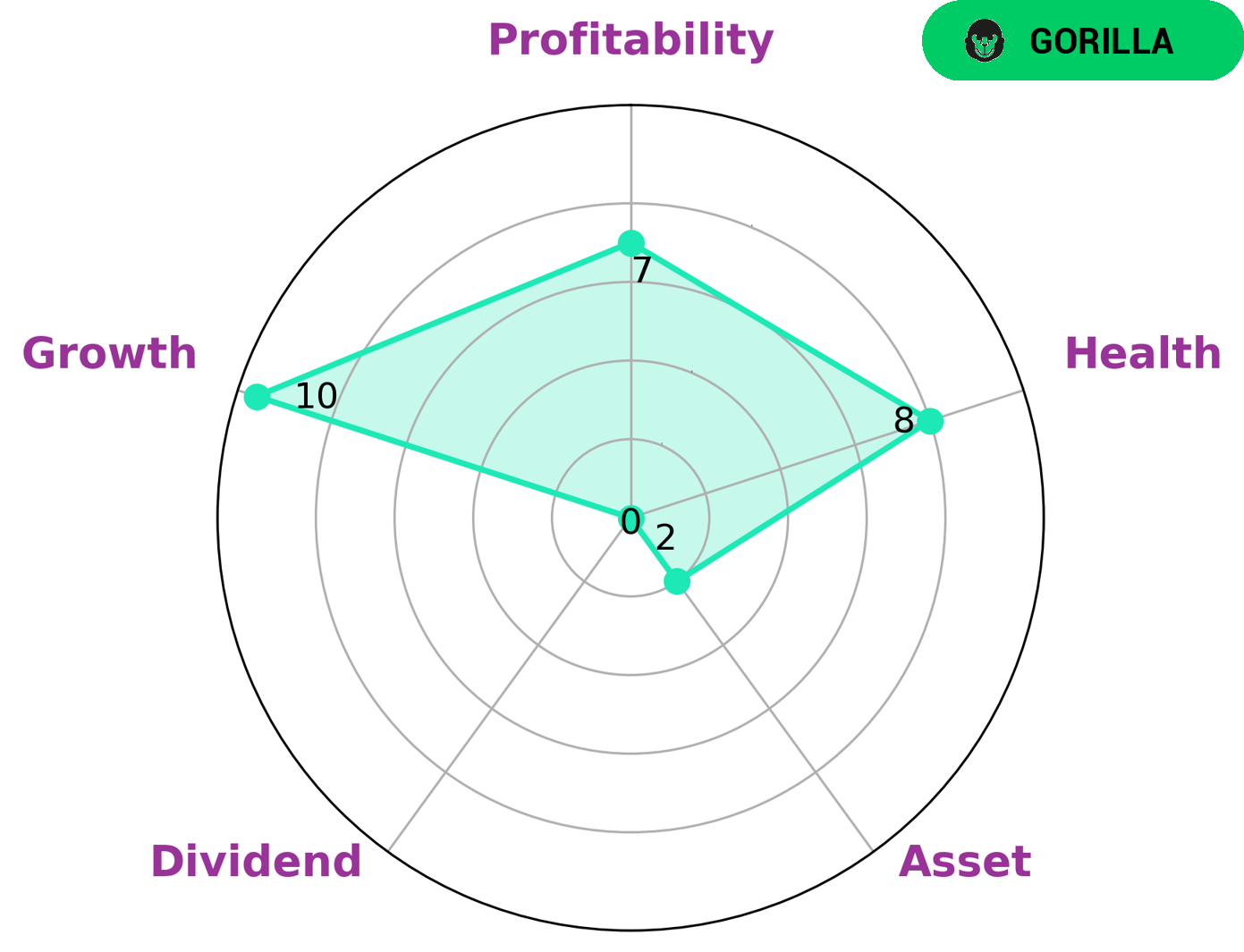

As a financial analysis firm, GoodWhale conducted an analysis of MEDPACE HOLDINGS‘ financials. Following our Star Chart, MEDPACE HOLDINGS can be classified as a ‘gorilla’, meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. As such, this company may be attractive to many types of investors, particularly those looking for high growth investments. When evaluating MEDPACE HOLDINGS’ financials, GoodWhale determined that the company is strong in growth and profitability, but weak in asset and dividend. However, its high health score of 8/10 with regards to cashflows and debt indicates that MEDPACE HOLDINGS is capable of sustaining future operations in times of crisis. More…

Peers

Medpace’s services include clinical trial management, data management, biostatistics, and medical writing. Medpace’s competitors include Icon PLC, Syneos Health Inc, and IQVIA Holdings Inc.

– Icon PLC ($NASDAQ:ICLR)

Icon PLC is a publicly traded company with a market capitalization of $14.59 billion as of March 2022. The company has a return on equity of 4.28%. Icon is a global provider of outsourced development services to the pharmaceutical, biotechnology and medical device industries. The company has a network of over 80 sites in 40 countries. Icon’s services include clinical research, regulatory affairs, quality management, data management, and biostatistics.

– Syneos Health Inc ($NASDAQ:SYNH)

Synoes Health Inc is a pharmaceutical company with a market cap of 4.81B as of 2022. The company has a Return on Equity of 9.89%. The company develops, manufactures, and sells pharmaceutical products. The company’s products include prescription drugs, over-the-counter drugs, and medical devices. The company operates in the United States, Europe, and Asia.

– IQVIA Holdings Inc ($NYSE:IQV)

IQVIA Holdings Inc is a global healthcare company that provides market research, data, and analytics solutions to help customers drive healthcare transformation and growth. The company’s market cap as of 2022 is 33.49B, and its ROE is 19.29%. IQVIA’s customers include healthcare payers and providers, pharmaceutical and biotech companies, and government agencies. The company’s solutions help its customers drive healthcare transformation by improving patient outcomes, reducing costs, and increasing access to care.

Summary

MEDPACE HOLDINGS has seen encouraging results in its latest financials. The company reported a GAAP earnings per share of $2.27, an increase of $0.46 from the same period last year. Revenue totaled $434.07M, beating expectations by $31.24M.

These figures indicate that the company is successfully executing its strategies and growing its operations. Investors should consider these positive results when evaluating the company’s stock performance.

Recent Posts