Medpace Holdings Intrinsic Value Calculator – Medpace Holdings: A Leader in Clinical Research Organizations With Outstanding Performance

April 12, 2023

Trending News ☀️

Medpace Holdings ($NASDAQ:MEDP) is an international clinical research organization (CRO) that provides comprehensive services to the pharmaceutical and biotechnology industries. Through its impressive track record of successful clinical trials, Medpace Holdings has earned a reputation for providing high quality clinical research services with outstanding results. It boasts a strong balance sheet with an A+ rating from Standard & Poor’s, indicating its financial strength and long-term investment potential. With its track record of success and strong financial performance, Medpace Holdings is a safe bet for any investor looking to diversify their portfolio.

Share Price

Medpace Holdings, a leading clinical research organization, saw its stock price rise 0.4% on Tuesday. The stock opened at $192.8 and closed at $191.6, up from the previous closing price of $190.8. This uptick in price is indicative of the company’s outstanding performance as a leader in the industry. The company’s long-term success, combined with its innovative approaches to clinical research, has allowed it to remain one of the top players in the field. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Medpace Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.46k | 245.21 | 16.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Medpace Holdings. More…

| Operations | Investing | Financing |

| 388.05 | -38.74 | -775.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Medpace Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.35k | 966.11 | 12.43 |

Key Ratios Snapshot

Some of the financial key ratios for Medpace Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.2% | 29.9% | 19.1% |

| FCF Margin | ROE | ROA |

| 24.1% | 47.3% | 12.9% |

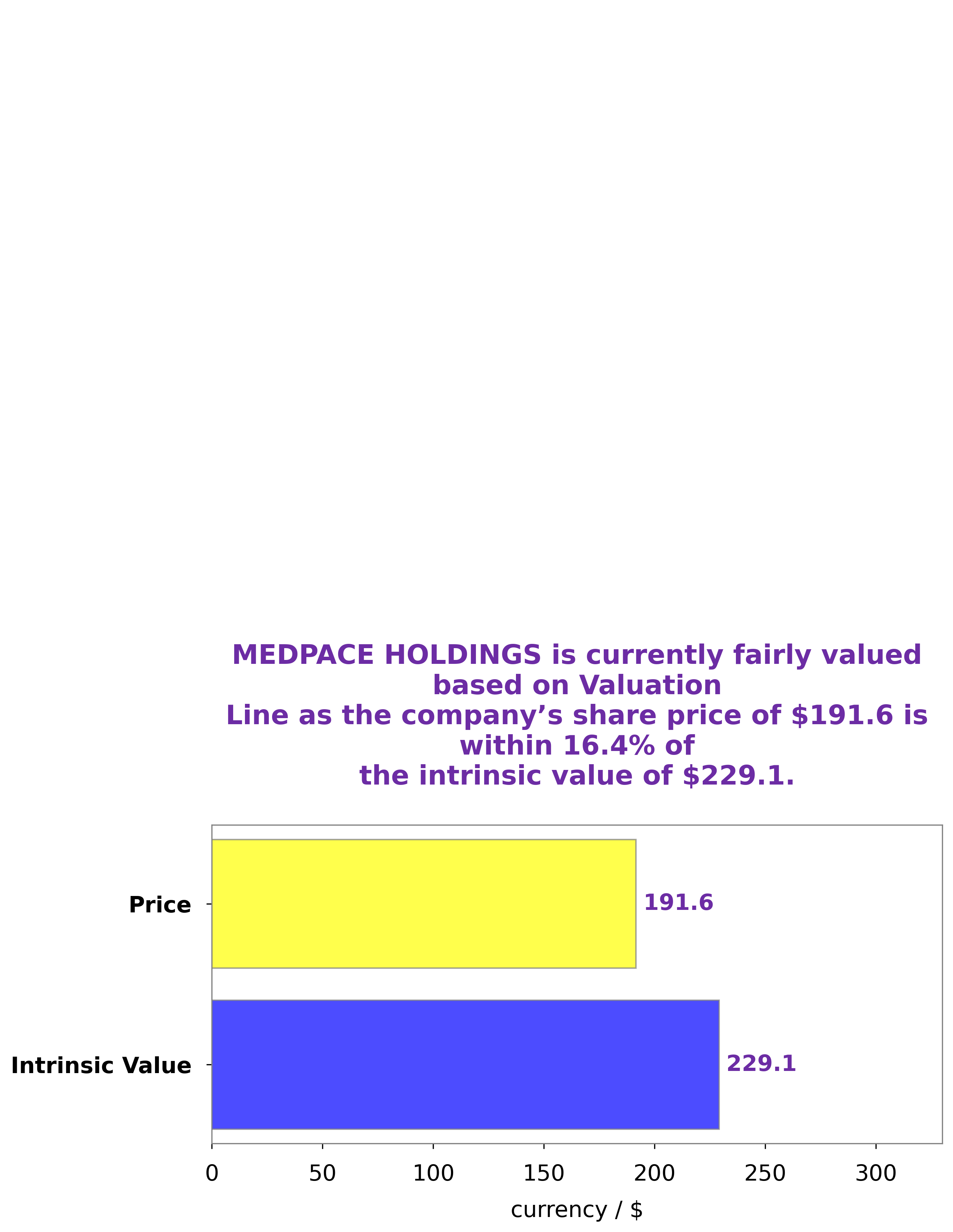

Analysis – Medpace Holdings Intrinsic Value Calculator

At GoodWhale, we have conducted an analysis of the financial data of MEDPACE HOLDINGS. Our proprietary Valuation Line has determined that the intrinsic value of the MEDPACE HOLDINGS share is around $229.1. However, the stock is currently being traded for $191.6, which is a fair price that is undervalued by 16.4%. This implies that investors should consider buying MEDPACE HOLDINGS stock at its current price, as it could provide a good return on investment. More…

Peers

Medpace’s services include clinical trial management, data management, biostatistics, and medical writing. Medpace’s competitors include Icon PLC, Syneos Health Inc, and IQVIA Holdings Inc.

– Icon PLC ($NASDAQ:ICLR)

Icon PLC is a publicly traded company with a market capitalization of $14.59 billion as of March 2022. The company has a return on equity of 4.28%. Icon is a global provider of outsourced development services to the pharmaceutical, biotechnology and medical device industries. The company has a network of over 80 sites in 40 countries. Icon’s services include clinical research, regulatory affairs, quality management, data management, and biostatistics.

– Syneos Health Inc ($NASDAQ:SYNH)

Synoes Health Inc is a pharmaceutical company with a market cap of 4.81B as of 2022. The company has a Return on Equity of 9.89%. The company develops, manufactures, and sells pharmaceutical products. The company’s products include prescription drugs, over-the-counter drugs, and medical devices. The company operates in the United States, Europe, and Asia.

– IQVIA Holdings Inc ($NYSE:IQV)

IQVIA Holdings Inc is a global healthcare company that provides market research, data, and analytics solutions to help customers drive healthcare transformation and growth. The company’s market cap as of 2022 is 33.49B, and its ROE is 19.29%. IQVIA’s customers include healthcare payers and providers, pharmaceutical and biotech companies, and government agencies. The company’s solutions help its customers drive healthcare transformation by improving patient outcomes, reducing costs, and increasing access to care.

Summary

Medpace Holdings (MEDP) is an attractive investment opportunity for its strong growth, excellent fundamentals and promising position in the Contract Research Organization (CRO) space. Furthermore, Medpace’s competitive advantage is supported by its extensive experience and expertise in clinical trial activities, which has enabled strong organic growth. Additionally, its strategic acquisitions and partnerships have allowed the company to accelerate its entry into new markets and broaden its product portfolio. As such, MEDP’s financial and operational performance make it a compelling investment for those seeking exposure to the CRO industry.

Recent Posts