Medpace Holdings Intrinsic Stock Value – Lindenwold Advisors INC Reduces Stake in Medpace Holdings, by 9.9% in Q4

June 12, 2023

🌥️Trending News

Medpace Holdings ($NASDAQ:MEDP), Inc. is a leading full-service clinical research organization providing Phase I-IV clinical development services to the biopharmaceutical industry. In its most recent filing with the Securities and Exchange Commission, Lindenwold Advisors INC reported that it reduced its stake in Medpace Holdings, Inc. by 9.9% during the fourth quarter. This suggests that Lindenwold Advisors INC may no longer be confident in the future performance of the company’s stock. The filing is particularly noteworthy because it reflects a shift in sentiment from a major investor.

For investors looking to assess a company’s stock, such filings can be a valuable source of information about the overall health of the company. Investors should monitor such filings closely to stay up-to-date with the latest news and developments for Medpace Holdings, Inc.

Analysis – Medpace Holdings Intrinsic Stock Value

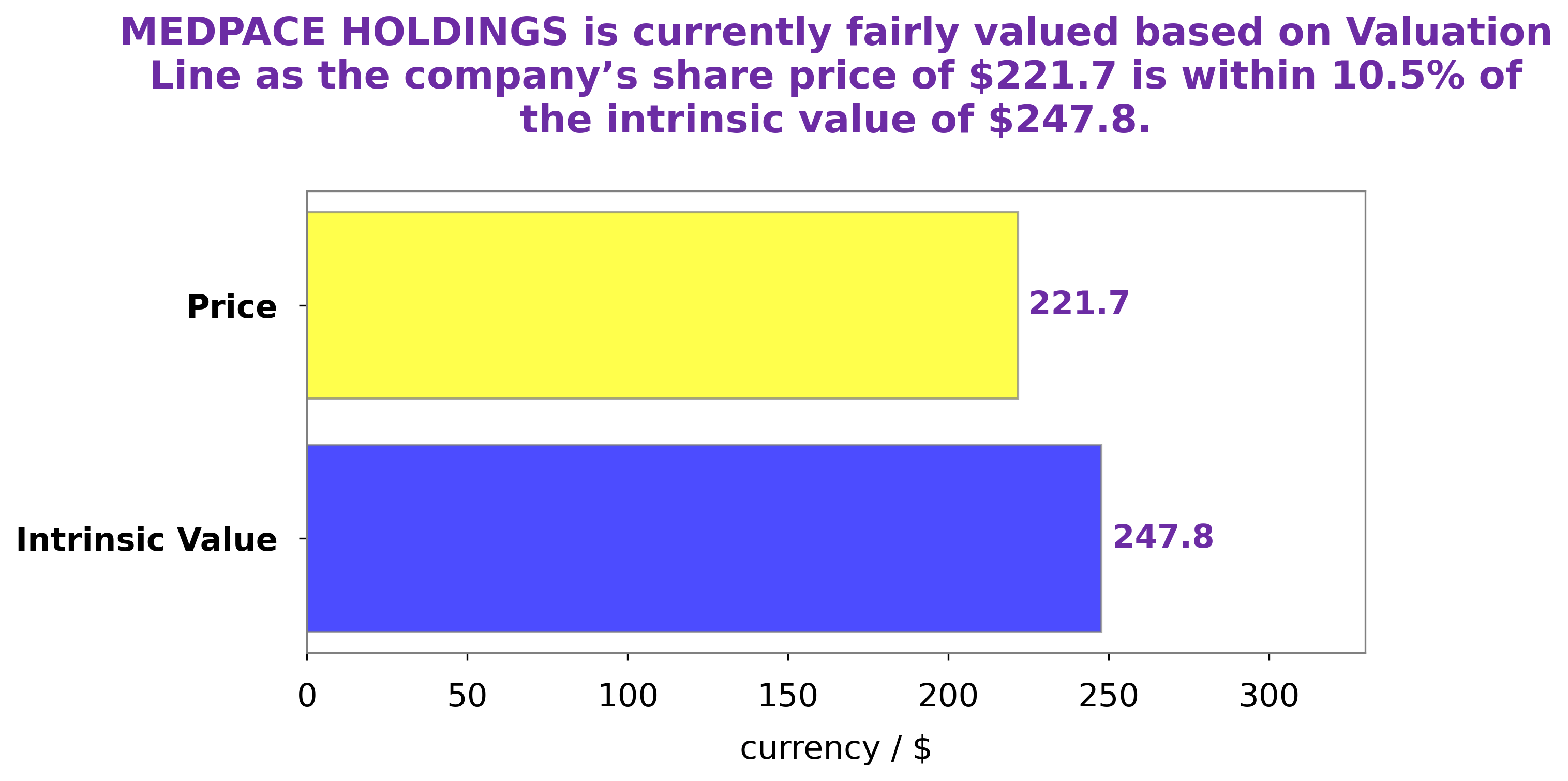

At GoodWhale, we have conducted a thorough analysis of MEDPACE HOLDINGS‘s fundamentals. Our proprietary Valuation Line has determined the intrinsic value of MEDPACE HOLDINGS share to be around $247.8. Currently, the stock is traded at $221.7, making it a fair price but slightly undervalued by 10.5%. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Medpace Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.56k | 256.83 | 16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Medpace Holdings. More…

| Operations | Investing | Financing |

| 421.87 | -37.04 | -416.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Medpace Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.4k | 1.05k | 11.28 |

Key Ratios Snapshot

Some of the financial key ratios for Medpace Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.6% | 30.0% | 19.2% |

| FCF Margin | ROE | ROA |

| 24.6% | 51.2% | 13.5% |

Peers

Medpace’s services include clinical trial management, data management, biostatistics, and medical writing. Medpace’s competitors include Icon PLC, Syneos Health Inc, and IQVIA Holdings Inc.

– Icon PLC ($NASDAQ:ICLR)

Icon PLC is a publicly traded company with a market capitalization of $14.59 billion as of March 2022. The company has a return on equity of 4.28%. Icon is a global provider of outsourced development services to the pharmaceutical, biotechnology and medical device industries. The company has a network of over 80 sites in 40 countries. Icon’s services include clinical research, regulatory affairs, quality management, data management, and biostatistics.

– Syneos Health Inc ($NASDAQ:SYNH)

Synoes Health Inc is a pharmaceutical company with a market cap of 4.81B as of 2022. The company has a Return on Equity of 9.89%. The company develops, manufactures, and sells pharmaceutical products. The company’s products include prescription drugs, over-the-counter drugs, and medical devices. The company operates in the United States, Europe, and Asia.

– IQVIA Holdings Inc ($NYSE:IQV)

IQVIA Holdings Inc is a global healthcare company that provides market research, data, and analytics solutions to help customers drive healthcare transformation and growth. The company’s market cap as of 2022 is 33.49B, and its ROE is 19.29%. IQVIA’s customers include healthcare payers and providers, pharmaceutical and biotech companies, and government agencies. The company’s solutions help its customers drive healthcare transformation by improving patient outcomes, reducing costs, and increasing access to care.

Summary

Medpace Holdings, Inc. is a biopharmaceutical services organization offering clinical trial management and other services to support the development of drugs, biologics, and medical devices. This has been seen as a cause of concern for investors as it may indicate a lack of confidence in the company’s near-term performance and long-term outlook. However, analysts are optimistic that Medpace Holdings, Inc. will continue to benefit from strong demand for its clinical trial management services and other offerings in the biopharmaceutical sector.

Recent Posts