LUMIRADX LIMITED Reports Q1 FY2023 Earnings Results on May 16 2023

June 2, 2023

🌧️Earnings Overview

For the first quarter of FY2023, LUMIRADX LIMITED ($NASDAQ:LMDX) reported total revenue of USD 22.2 million, a decrease of 82.5% year-over-year. Net income was USD -44.2 million, compared to the prior year’s -56.2 million. The earnings results, which cover the period ending March 31 2023, were released on May 16 2023.

Market Price

On Tuesday, May 16 2023, LUMIRADX LIMITED released their financial results for the first quarter of FY2023. The stock opened at $0.5 and closed at $0.5, down 4.7% from the previous day’s closing price of 0.5. The company also reported increased cash reserves, up by 10% over the same period last year, due to a combination of strong sales and cost-cutting measures.

Despite the positive results, investors were concerned about the company’s high debt-to-equity ratio and its declining stock price. The stock has been underperforming the broader market since the start of FY2023, but analysts remain optimistic that their long-term growth strategy will pay off in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lumiradx Limited. More…

| Total Revenues | Net Income | Net Margin |

| 150.24 | -436.26 | -255.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lumiradx Limited. More…

| Operations | Investing | Financing |

| -185.22 | -16.46 | 109.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lumiradx Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 392.31 | 545.91 | -0.33 |

Key Ratios Snapshot

Some of the financial key ratios for Lumiradx Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 122.4% | – | -267.8% |

| FCF Margin | ROE | ROA |

| -134.2% | 194.5% | -64.1% |

Analysis

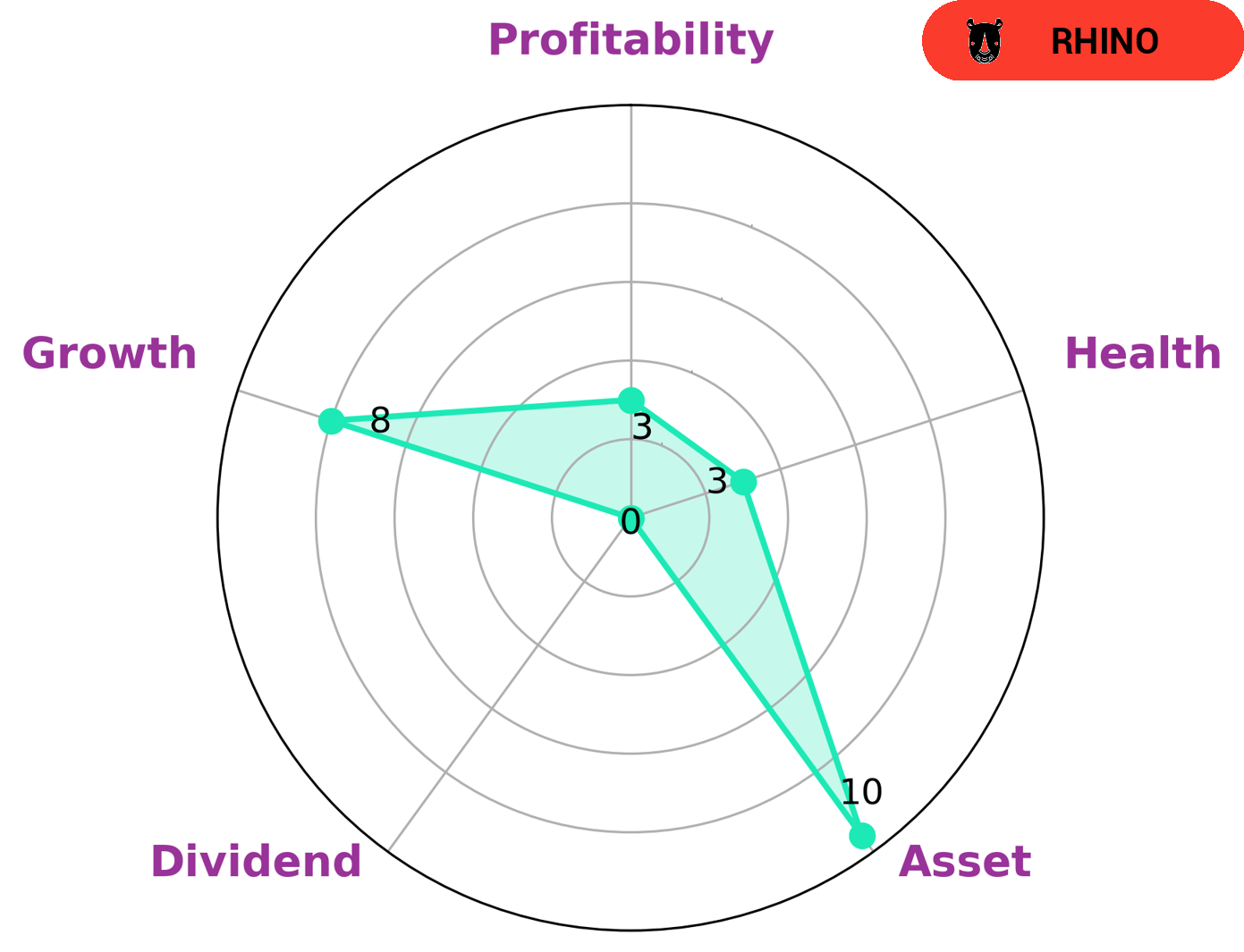

GoodWhale has analyzed the financials of LUMIRADX LIMITED and uncovered the company’s strengths and weaknesses. According to our Star Chart, LUMIRADX LIMITED is strong in asset, growth, and weak in dividend, profitability. After further research, we concluded that LUMIRADX LIMITED is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given its strengths and weaknesses, investors with different risk-appetites may find this company attractive. However, LUMIRADX LIMITED’s health score is relatively low, at 3/10. This suggests that the company is less likely to pay off debt and fund future operations. Thus, investors should take this into consideration before making an investment decision. More…

Peers

It is a major player in the healthcare industry, competing with other major players such as ConvaTec Group PLC, Rainbow Childrens Medicare Ltd, and Radius Residential Care Ltd. These companies offer a range of products and services to meet the needs of the healthcare industry, and it is up to LumiraDx Ltd to stay competitive in order to maintain its position.

– ConvaTec Group PLC ($LSE:CTEC)

ConvaTec Group PLC is a global medical technology company that develops, manufactures, and markets innovative medical products and services for wound care, ostomy care, continence and critical care, and infusion devices. The company has an impressive market capitalization of 4.77B as of 2023 and a Return on Equity of 4.96%, indicating its strong financial performance. The high market cap reflects investor confidence in the company’s ability to deliver consistent returns on investments and its long-term potential. Furthermore, the company’s impressive ROE indicates that it has been able to generate profits from its total shareholder equity.

– Rainbow Childrens Medicare Ltd ($BSE:543524)

Rainbow Childrens Medicare Ltd is a healthcare company that provides quality medical services to children. The company has a market capitalization of 72.75B as of 2023, and its Return on Equity (ROE) is 26.79%. This indicates that for every dollar of equity invested in the business, it generates 26.79 cents of earnings. Rainbow Childrens Medicare Ltd has a strong balance sheet and is well-positioned to take advantage of growth opportunities in the healthcare sector. The company is committed to providing quality healthcare services to its customers and strives to remain the leader in the industry.

– Radius Residential Care Ltd ($NZSE:RAD)

Radius Residential Care Ltd is a leading provider of residential care services for individuals and families in the United Kingdom. With a market cap of 88.22M as of 2023, the company has shown strong growth in terms of its market capitalization. The company has also achieved a strong return on equity (ROE) of 11.56%, indicating that the company is generating value for its shareholders. Radius Residential Care Ltd is committed to offering quality care and support to the people that rely on their services and continues to strive for excellence in the care industry.

Summary

Investors in LUMIRADX LIMITED received disappointing news when the company reported their first quarter of FY2023 earnings results on May 16 2023. Revenue for the quarter was USD 22.2 million, a 82.5% decrease from the previous year. Net income was USD -44.2 million, compared to last year’s -56.2 million.

The stock price reacted accordingly, dropping on the same day. Going forward, investors will want to monitor how the company performs in the coming quarters to get a better understanding of their financial health.

Recent Posts