Illumina Intrinsic Value – ILLUMINA Reports Record Earnings for Second Quarter of FY2023

August 23, 2023

🌥️Earnings Overview

ILLUMINA ($NASDAQ:ILMN) reported on June 30th 2023 that their total revenue for the second quarter of FY2023 was USD 1176.0 million, representing a 1.2% growth compared to the same period last year. Additionally, their reported net income was USD -234.0 million, a decrease from the -535.0 million from the previous year.

Price History

The stock opened at $186.6 and closed at $184.5, down by 0.9% from last closing price of 186.2. ILLUMINA’s CEO Francis deSouza commented on the impressive performance, noting that the company’s “innovative technologies, proprietary data and deep scientific expertise” have enabled it to continue its strong financial performance. He also noted that “despite the challenging economic environment”, ILLUMINA remains well-positioned to drive long-term value for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Illumina. More…

| Total Revenues | Net Income | Net Margin |

| 4.46k | -4.19k | -40.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Illumina. More…

| Operations | Investing | Financing |

| 210 | -445 | 508 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Illumina. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.77k | 5.22k | 41.49 |

Key Ratios Snapshot

Some of the financial key ratios for Illumina are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | -84.8% | -88.6% |

| FCF Margin | ROE | ROA |

| -5.0% | -37.3% | -21.0% |

Analysis – Illumina Intrinsic Value

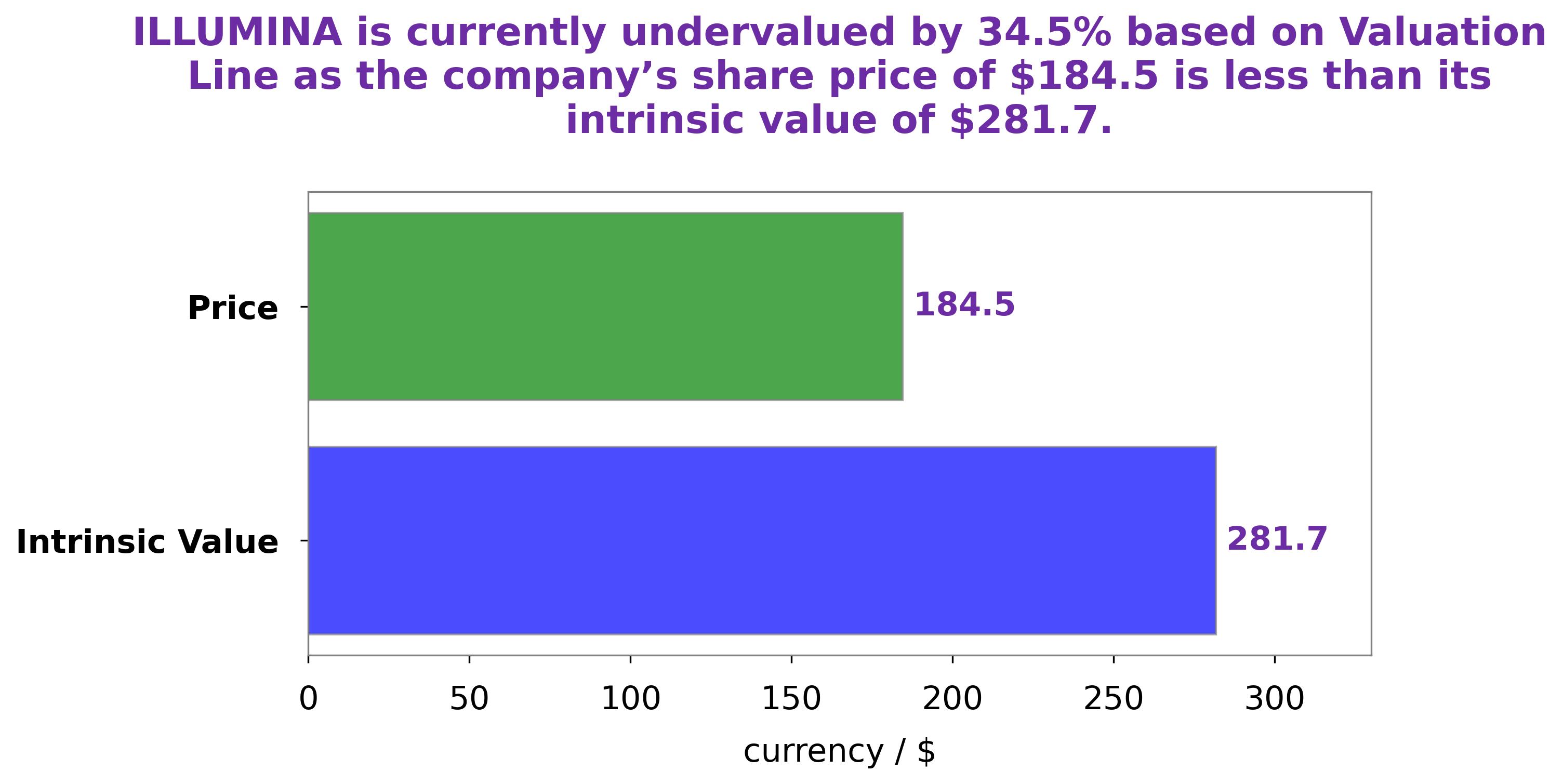

We at GoodWhale have conducted an analysis of ILLUMINA‘s fundamentals and our proprietary Valuation Line has calculated the intrinsic value of ILLUMINA share at around $281.7. Currently, the ILLUMINA stock is being traded at $184.5, making it 34.5% undervalued in the market. This is a great opportunity for potential investors to capitalize on the current market conditions. More…

Peers

Its products are used by researchers in a variety of fields, including cancer, immunology, and neuroscience. Illumina‘s main competitors are Immunovia AB, Standard BioTools Inc, and BCAL Diagnostics Ltd.

– Immunovia AB ($LTS:0G8X)

Immunovia is a Swedish company that specializes in the development of blood-based diagnostics for the early detection of cancer. The company was founded in 2003 and has since then developed a number of ground-breaking products, including the world’s first blood test for the early detection of pancreatic cancer. Immunovia’s products are based on cutting-edge technology that allows for the detection of very small changes in the levels of certain proteins in the blood, which can be indicative of the presence of cancer. The company’s flagship product, the PancraFIT test, has been shown to be more than twice as accurate as current standard-of-care tests for pancreatic cancer, and is currently being used in clinical trials in Europe and the United States.

Immunovia’s market cap as of 2022 is 793.92M. The company’s Return on Equity (ROE) for the same year is -27.88%.

– Standard BioTools Inc ($NASDAQ:LAB)

Standard BioTools Inc is a company that manufactures and sells medical devices and equipment. The company has a market capitalization of $89.67 million and a return on equity of 1,331.32%. The company’s products include surgical instruments, medical devices, and laboratory equipment. Standard BioTools Inc is a publicly traded company on the Nasdaq Stock Market under the ticker symbol STBT.

Summary

Illumina Inc. reported its second quarter earnings of FY2023, with total revenue of USD 1176.0 million, a 1.2% increase year-on-year. Net income for the period was USD -234.0 million, a marked improvement compared to the same period in the previous year, when it had reported a net income of -535.0 million. Investors may take this as a positive sign of the company’s financial performance, despite the slight revenue growth. For those considering investing in Illumina, it is important to further evaluate the company’s finances and business prospects.

Recent Posts