Guardant Health Stock Intrinsic Value – Guardant Health Shares Rise Despite -1.23% Dip on Friday, 03/24/23, as Strong Demand Continues in 2023.

March 29, 2023

Trending News ☀️

On Friday, 03/24/23, Guardant Health ($NASDAQ:GH) Inc. shares rose despite a 1.23% dip in the stock price compared to the previous day’s close. The rise in stock value was caused by a surge in investor demand for the company’s shares. This interest is likely due to the company’s success in the medical diagnostics market over the past few years. Investors looking to invest in Guardant Health Inc. should be aware of the demand associated with its stock. Despite the slight decrease in share value on Friday, the overall outlook for the company is strong.

With its presence in the medical diagnostics market continuing to grow and its products gaining widespread recognition, it is likely that demand for its shares will continue into 2023. The long-term value of investing in Guardant Health Inc. should be considered before making any decisions. With the company’s current success and its potential for future growth, it may be a worthwhile investment for those looking to diversify their portfolios and gain exposure to the medical diagnostics sector.

Market Price

So far, media sentiment is mixed. On Monday, GUARDANT HEALTH stock opened at $24.5 and closed at $24.3, up by 0.6% from the prior closing price of 24.2. This shows that the company’s stock is still in demand despite the minor dip. Analysts expect that this trend will continue as more investors join in and capitalize on the strong performance of the company in the first quarter of 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Guardant Health. More…

| Total Revenues | Net Income | Net Margin |

| 449.54 | -654.59 | -145.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Guardant Health. More…

| Operations | Investing | Financing |

| -309.46 | 149.82 | -189.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Guardant Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.61k | 1.55k | 0.59 |

Key Ratios Snapshot

Some of the financial key ratios for Guardant Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.0% | – | -144.8% |

| FCF Margin | ROE | ROA |

| -86.1% | -358.5% | -25.3% |

Analysis – Guardant Health Stock Intrinsic Value

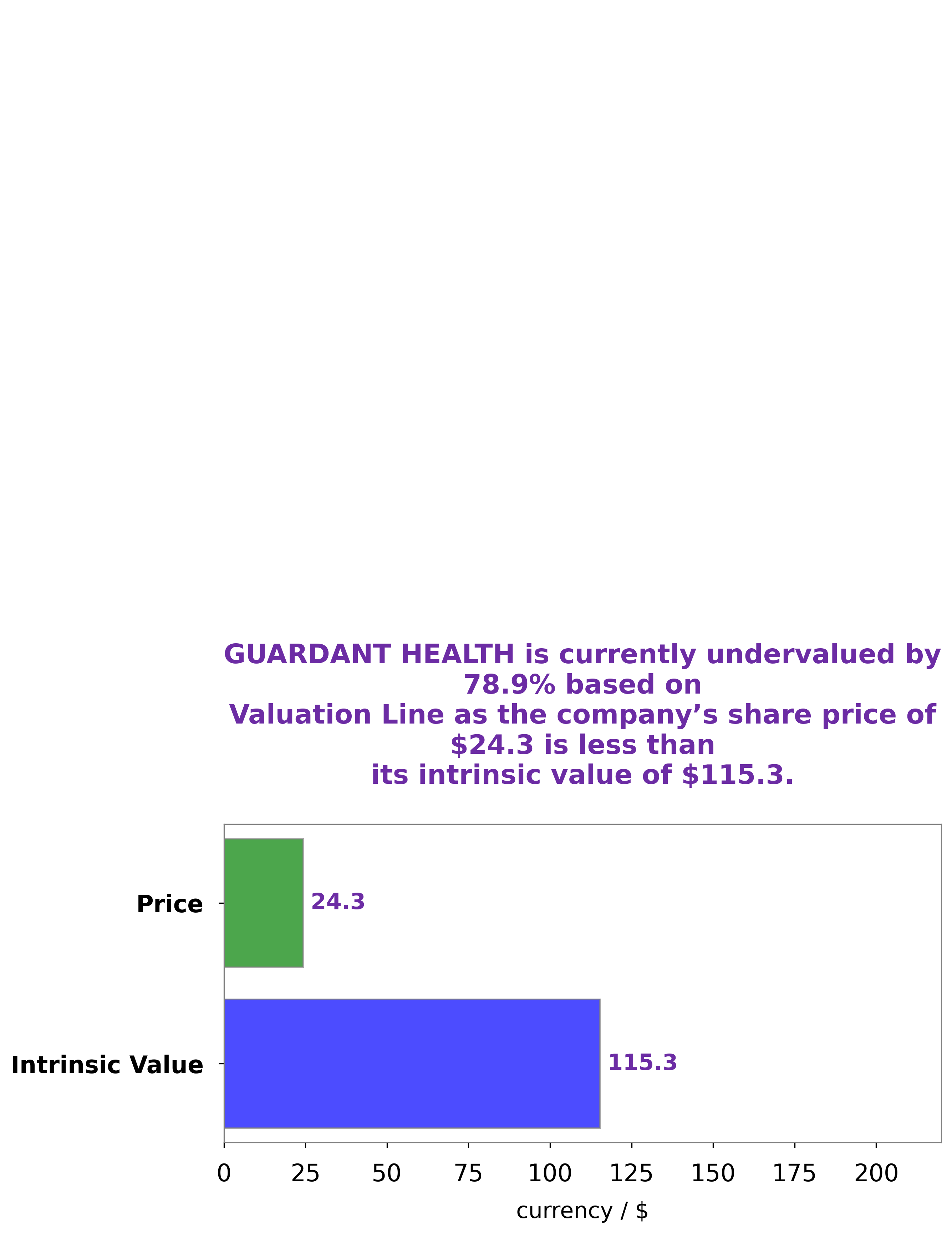

At GoodWhale, we have conducted an analysis of GUARDANT HEALTH‘s wellbeing. Our proprietary Valuation Line has calculated the intrinsic value of GUARDANT HEALTH share to be around $115.3. Currently, the stock is trading at $24.3, which represents a massive 78.9% discount to its intrinsic value. This makes it a great opportunity for investors to take advantage of the mispriced stock and reap the benefits of a potential upside in the future. More…

Peers

The competition in the market for cancer detection and treatment is heating up. Guardant Health Inc, a leading player in the field, is up against some stiff competition from the likes of Aclaris Therapeutics Inc, Inoviq Ltd, and Biomark Diagnostics Inc. All these companies are vying for a share of the pie in this rapidly growing market. While Guardant Health Inc has a strong product portfolio and a good track record, its competitors are not far behind and are also making inroads into this market. It remains to be seen who will emerge victorious in this battle.

– Aclaris Therapeutics Inc ($NASDAQ:ACRS)

Aclaris Therapeutics Inc is a clinical-stage biopharmaceutical company focused on the development and commercialization of drugs for the treatment of dermatological and immuno-inflammatory diseases. The company’s lead product candidates include ATI-502 for the treatment of seborrheic keratosis, and ATI-501 for the treatment of vitiligo. Aclaris Therapeutics Inc has a market cap of 1.11B as of 2022, a Return on Equity of -25.42%.

– Inoviq Ltd ($ASX:IIQ)

Inoviq Ltd is a publicly traded company with a market capitalization of 50.61M as of 2022. The company’s return on equity (ROE) is -13.68%. Inoviq Ltd is engaged in the development and commercialization of innovative drugs and therapies. The company’s products are designed to improve the lives of patients with serious medical conditions. Inoviq’s products are available in more than 60 countries worldwide.

– Biomark Diagnostics Inc ($OTCPK:BMKDF)

Biomark Diagnostics Inc is a company that provides diagnostic testing services. The company has a market capitalization of 10.88 million as of 2022 and a return on equity of 179.57%. The company’s diagnostic testing services include tests for cancer, cardiovascular disease, and infectious diseases. Biomark Diagnostics Inc is headquartered in the United States.

Summary

Guardant Health Inc. experienced a slight dip of 1.23% in their stock price on Friday, 03/24/2023, but the overall demand for their shares has remained strong in the current year. The media sentiment towards the company has been generally mixed, with investors analyzing the potential of investing in Guardant Health. Analysts have noted that the company has a strong history of profitability and is well positioned to continue to grow, with a number of strategic initiatives in place to make the most of its competitive advantages. Investors should continue to monitor the company’s progress as it seeks to increase its customer base and achieve continued success.

Recent Posts