Exact Sciences Intrinsic Value – Exact Sciences Surpasses Expectations with Record Revenue and Positive EPS

May 10, 2023

Trending News ☀️

Exact Sciences ($NASDAQ:EXAS) is a leading healthcare company that has just announced record revenue and a positive earnings per share (EPS). According to the latest earnings report, the company’s GAAP EPS of -$0.42 outperformed expectations by $0.34, while its total revenue of $602.45M beat anticipations by $59.27M. The company’s flagship product, Cologuard, is a non-invasive screening test for colorectal cancer.

With its impressive financial results, Exact Sciences has surpassed market expectations and continues to demonstrate its commitment to providing innovative healthcare solutions to people around the world. As the company continues to grow, investors can expect to see more positive returns in the future.

Earnings

EXACT SCIENCES reported positive revenue and earnings per share (EPS) for the fourth quarter of FY2022, surpassing expectations. As of December 31 2022, total revenue for the quarter was $553.0 million, an increase of 16.7 percent from the corresponding period a year earlier. This number was a new record for the company, with EXACT SCIENCES showing a steady growth in total revenue over the past three years, rising from $466.34 million to $553.0 million.

The company also reported that net income for the quarter was $127.74 million, down from the previous year. Despite this decrease in net income, EXACT SCIENCES was still able to report a positive EPS for the quarter, solidifying their status as a successful company in the exact sciences sector.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Exact Sciences. More…

| Total Revenues | Net Income | Net Margin |

| 2.08k | -623.51 | -28.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Exact Sciences. More…

| Operations | Investing | Financing |

| -223.56 | 74.07 | 76.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Exact Sciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.23k | 3.18k | 17.1 |

Key Ratios Snapshot

Some of the financial key ratios for Exact Sciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.5% | – | -29.7% |

| FCF Margin | ROE | ROA |

| -21.0% | -12.6% | -6.2% |

Market Price

On Tuesday, Exact Sciences demonstrated impressive financial results with the opening of their stock at $67.2 and the close at $71.0. This marked a 3.6% increase from the previous closing price of $68.6, showing that the company had surpassed investors’ expectations with record revenue and a positive EPS, as well as a notable market share growth. This impressive performance has solidified Exact Sciences’ position as a leader in the exact sciences sector, and investors are likely encouraged by the strong results. Live Quote…

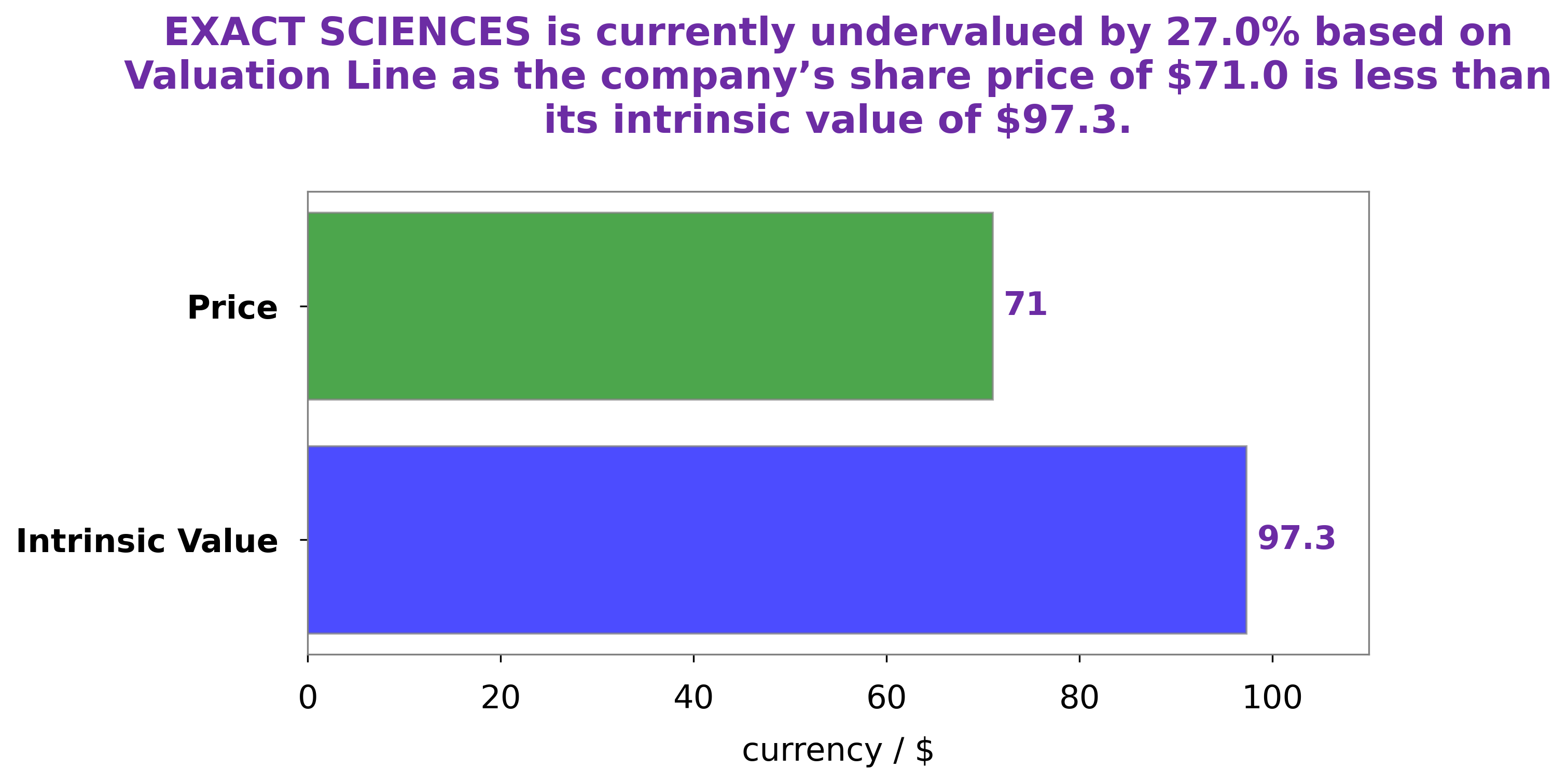

Analysis – Exact Sciences Intrinsic Value

At GoodWhale, we conducted an analysis of EXACT SCIENCES‘s wellbeing. Using our proprietary Valuation Line, we calculated the intrinsic value of EXACT SCIENCES share to be around $97.3. However, the stock is currently traded at $71.0, which is undervalued by 27.1%. This presents a great opportunity for investors to buy into this stock and benefit from its potential upside. We believe that by investing in EXACT SCIENCES, investors can reap rewards in the long run. More…

Peers

The market for cancer diagnostics is highly competitive. Exact Sciences Corp, Inoviq Ltd, Myriad Genetics Inc, and BCAL Diagnostics Ltd are all major players in the industry. Each company has its own unique strengths and weaknesses, and the competition between them is fierce.

– Inoviq Ltd ($ASX:IIQ)

Inoviq Ltd has a market cap of 55.21M as of 2022. The company’s Return on Equity for the same year is -13.68%.

Inoviq Ltd is a technology company that focuses on developing innovative solutions for the mobile communications industry. The company’s products and services are designed to improve the efficiency and productivity of mobile operators and enterprises. Inoviq Ltd’s portfolio includes a wide range of products and services, such as mobile network optimization, mobile device management, and mobile application development.

– Myriad Genetics Inc ($NASDAQ:MYGN)

Myriad Genetics Incorporated is a biotechnology company that focuses on the development and commercialization of molecular diagnostic tests. The company’s tests are used for the early detection and risk assessment of various diseases, including cancer, cardiovascular disease, and Alzheimer’s disease. Myriad Genetics Incorporated is headquartered in Salt Lake City, Utah.

Summary

Exact Sciences is a company engaged in the development, manufacturing, and commercialization of products for detecting various forms of cancer. It recently posted its quarterly earnings report which beat market expectations. The company reported a GAAP EPS of -$0.42, beating analysts’ estimates by $0.34. Revenue for the quarter was also higher than expected, coming in at $602.45M, beating estimates by $59.27M.

On the back of these strong results, the stock price reacted positively, moving up the same day. Overall, it appears that investors are optimistic about the company’s prospects and are bullish on the stock. Analysts appear to be confident in the company’s ability to deliver higher returns going forward and recommend Exact Sciences as a good investment opportunity.

Recent Posts