CMIC HOLDINGS Reports Positive Earnings Results for Q1 of FY2023

March 26, 2023

Earnings Overview

CMIC HOLDINGS ($TSE:2309) announced their earnings report for the first quarter of FY2023, ending December 31 2022, on February 7 2023. Despite total revenues of JPY 1.9 billion reflecting a 7.6% decline from the previous year, net income was JPY 29.7 billion, up 20.5% year-over-year.

Price History

On Tuesday, CMIC HOLDINGS reported positive earnings results for the first quarter of FY2023. The company’s stock opened at JP¥1700.0 and ended the day at JP¥1725.0, up 2.6% from its prior closing price of JP¥1682.0. This surge in share price was attributed to the company’s higher-than-expected earnings figures, which exceeded analysts’ estimates. This strong financial performance was attributed to the company’s increased focus on operational efficiency and cost-cutting measures.

The company also announced that it expects to maintain its current growth trajectory in the upcoming quarters. The company’s impressive financial performance and future outlook has made it an attractive investment for those looking for long-term returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cmic Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 113.51k | 8.23k | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cmic Holdings. More…

| Operations | Investing | Financing |

| 11.21k | -8.04k | -1.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cmic Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 112.19k | 69.58k | 1.86k |

Key Ratios Snapshot

Some of the financial key ratios for Cmic Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.9% | 42.9% | 10.7% |

| FCF Margin | ROE | ROA |

| 3.4% | 23.6% | 6.8% |

Analysis

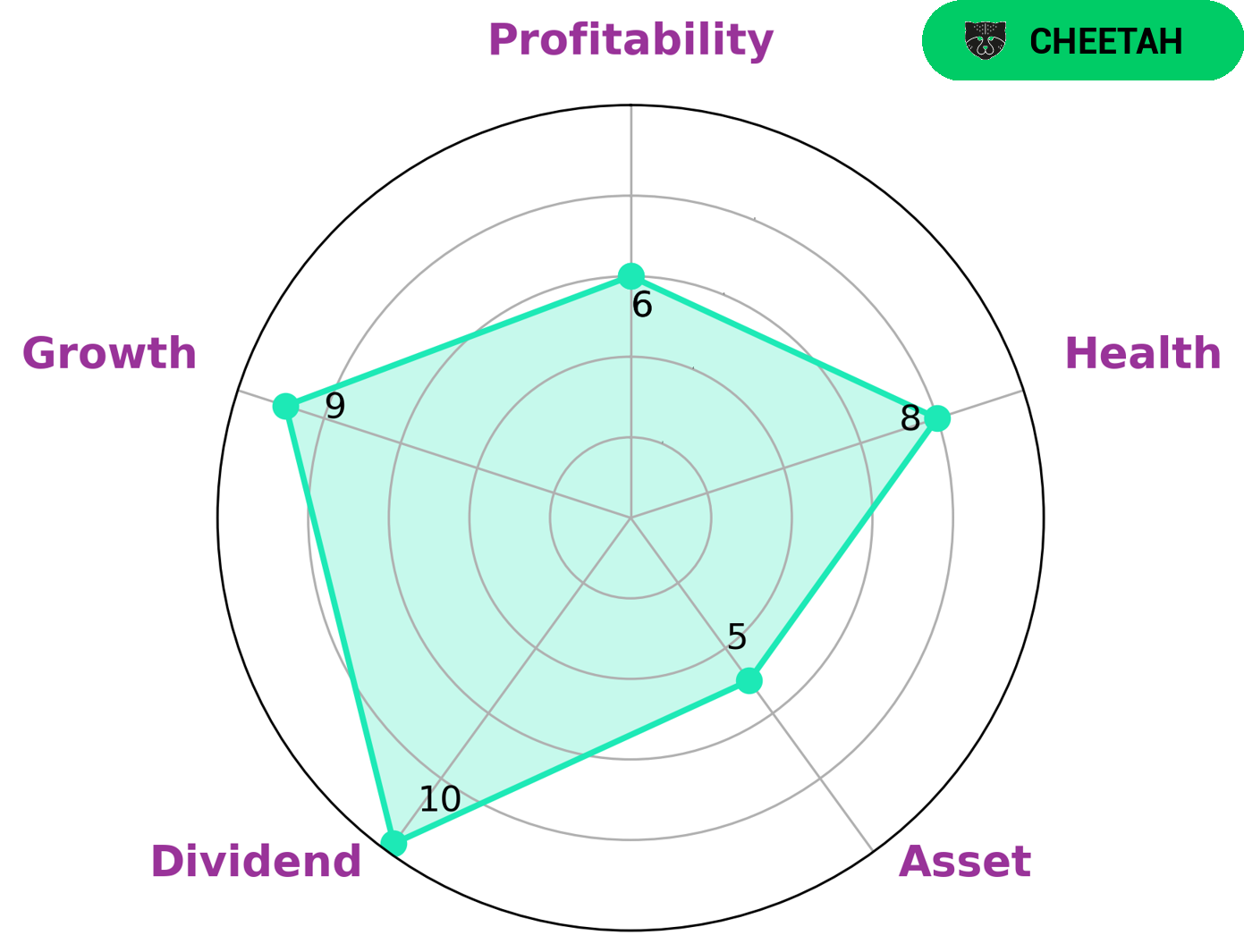

At GoodWhale, we have conducted an analysis of CMIC HOLDINGS‘s wellbeing. According to our Star Chart, CMIC HOLDINGS is classified as a ‘cheetah’ which implies that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are willing to take the risk of investing in companies with slightly lower stability may find CMIC HOLDINGS to be an attractive option. We are pleased to report that CMIC HOLDINGS has a high health score of 8/10 considering its cashflows and debt. This indicates that the company is capable of safely riding out any crisis without the risk of bankruptcy. Moreover, CMIC HOLDINGS is strong in dividend, growth and medium in asset and profitability. This marks CMIC HOLDINGS as a strong company with great potential for growth. More…

Peers

The competition between CMIC HOLDINGS Co Ltd and its competitors is fierce. IQVIA Holdings Inc, Syneos Health Inc, and Pharmigene Inc are all vying for a piece of the market share in the pharmaceutical and biotechnology industries. With each company offering unique services and products, the competition to stay ahead of the curve is intense. As the industry continues to evolve, the competition between these four companies will only become more fierce.

– IQVIA Holdings Inc ($NYSE:IQV)

IQVIA Holdings Inc is a global healthcare solutions company that provides integrated information and technology-enabled solutions to the world’s healthcare and life sciences industries. With a market cap of 40.03B as of 2023, IQVIA is one of the largest companies in the sector. Their Return on Equity (ROE) of 21.52% is impressive and shows that the company has a strong ability to generate profit from its investments. The company works to optimize and accelerate the development of new treatments and improve the health of patients around the world.

– Syneos Health Inc ($NASDAQ:SYNH)

Synos Health Inc is a leading global biopharmaceutical solutions company. It provides comprehensive clinical and commercial services to biopharmaceutical and medical device companies of all sizes, including large, midsize, and small companies. With a market cap of 3.64B as of 2023 and a Return on Equity of 8.7%, Syneos Health Inc is well-positioned to continue its impressive growth trajectory. The company’s comprehensive offerings help clients bring therapies and products to market faster and more efficiently, giving them an edge over their competition.

– Pharmigene Inc ($TPEX:7595)

Pharmigene Inc is a biotechnology company that specializes in developing treatments for rare and orphan diseases. The company has a market cap of 888.86 million dollars as of 2023 and a Return on Equity of -6.26%. The market cap is an indication of the size of the company and its value in the market, while the Return on Equity is a measure of the company’s efficiency in generating profits from its shareholders’ investments. Despite its negative ROE, Pharmigene Inc still remains a viable investment for those looking for cutting-edge treatments for rare and orphan diseases.

Summary

CMIC HOLDINGS reported their first quarter earnings results for FY2023, ending December 31 2022. Total revenue decreased 7.6% year-over-year to JPY 1.9 billion, while net income increased 20.5% year-over-year to JPY 29.7 billion. This indicates that the company has a positive outlook and may be a good investment opportunity.

A closer look at the company’s financials, business strategy, and competitive landscape can provide further insight into the potential returns of investing in CMIC HOLDINGS. Investors should conduct their own due diligence before making any investment decision.

Recent Posts