23andMe Soars 12% in After-Hours Trading Following Impressive Q3 Results and Raised 2023 Guidance

February 9, 2023

Trending News ☀️

23ANDME ($NASDAQ:ME): 23andMe Holding, a leading consumer genetics and research company, has seen a surge in after-hours trading following the announcement of its impressive third quarter results and raised 2023 guidance. With a 12% increase in after-hours trading, the company has seen a significant boost to its stock value. Fiscal 2023 third quarter results exceeded expectations on both the top and bottom lines. For the full year, the company now anticipates revenue to range between $290M-$300M and a net loss of $325M-$335 million. This is a slight 3% increase from their net loss of the same quarter in the previous year.

This impressive performance was driven by a strong customer base and strong demand for 23andMe’s genetic testing kits and services. The raised 2023 guidance is an optimistic forecast for the company, as they look to continue to expand their customer base and increase their revenue. 23andMe also plans to invest heavily in research and development, which will further help them to unlock more potential and advance their capabilities in genomics and health insights. With the raised 2023 guidance, the company looks set to continue on an upward trajectory in the coming years.

Price History

On Wednesday, 23ANDME HOLDING stock opened at $2.5 and closed at $2.5, down by 0.4% from the prior closing price of $2.5.

However, the company saw significant gains in the after-hours trading session, spiking 12%. 23ANDME HOLDING attributed the impressive earnings to higher revenues from its monthly subscription program, AncestryHealth Plus, as well as its direct-to-consumer sales of genetic tests. The increase reflects 23ANDME HOLDING’s confidence in its ability to continue to grow and thrive in a competitive market. The impressive figures have led to an impressive 12% gain in after-hours trading, with investors expecting the stock to continue its upward trend in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 23andme Holding. More…

| Total Revenues | Net Income | Net Margin |

| 297.62 | -314.54 | -91.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 23andme Holding. More…

| Operations | Investing | Financing |

| -205.78 | -103.97 | 18.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 23andme Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.04k | 221.41 | 1.8 |

Key Ratios Snapshot

Some of the financial key ratios for 23andme Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -93.5% |

| FCF Margin | ROE | ROA |

| -72.4% | -24.2% | -19.4% |

Analysis

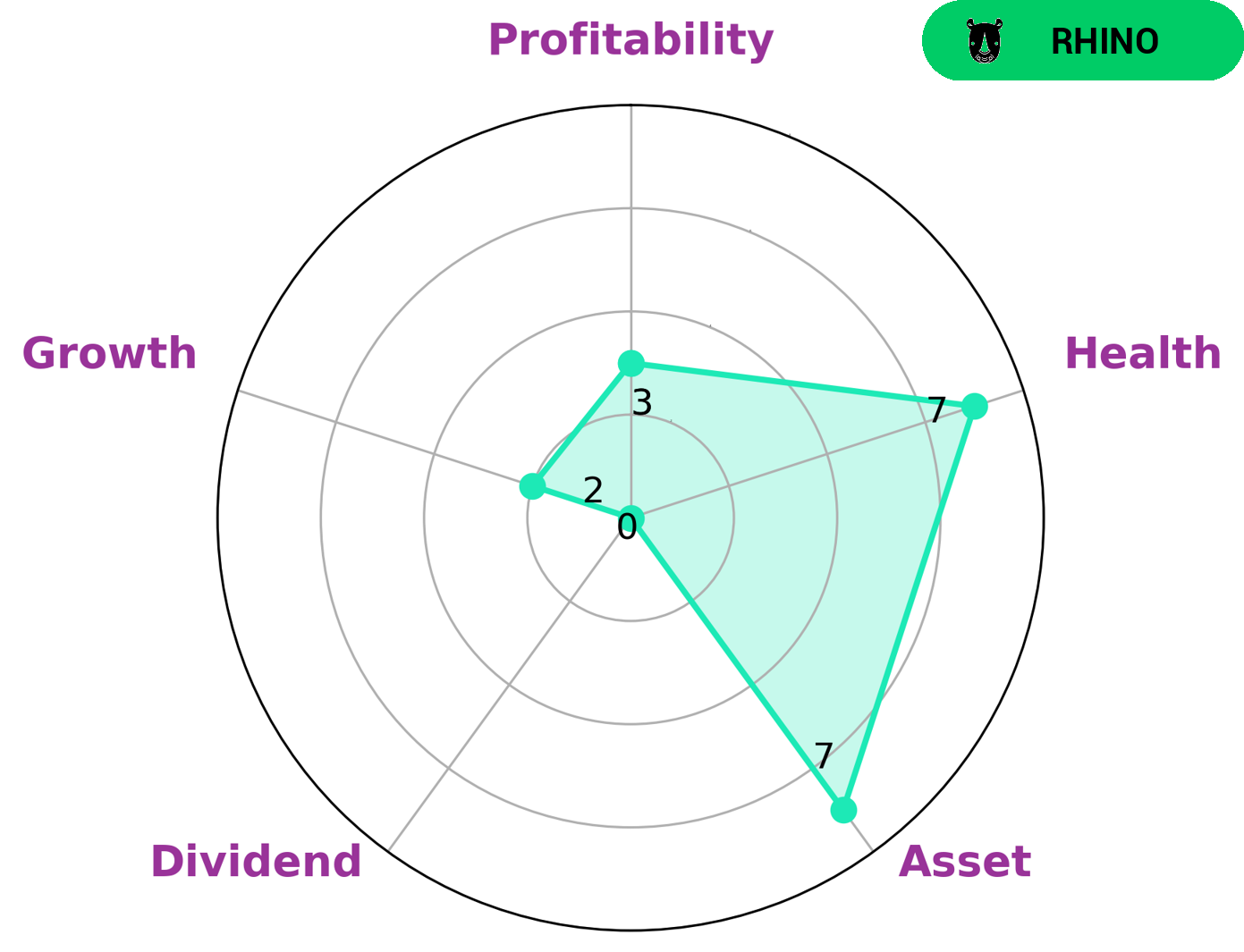

GoodWhale can provide valuable insights into the financials of 23ANDME HOLDING, a company that has achieved moderate revenue or earnings growth and is classified as a “rhino”. The GoodWhale Star Chart gives 23ANDME HOLDING a health score of 7/10 for its cashflows and debt, indicating that it is capable of sustaining future operations even in times of crisis. While the company is strong in its assets, it is weaker in dividend, growth, and profitability. These financials may be attractive to investors looking for a low-risk, steady return on their investments. Long-term investors might be interested in putting their money into a company with a reliable cashflow and a healthy balance sheet, as these are key indicators of a company’s future success. On the other hand, short-term investors may be attracted to 23ANDME HOLDING’s moderate revenue and earnings growth potential. In conclusion, 23ANDME HOLDING is an attractive investment opportunity for both short and long-term investors. Its strong asset base and moderate growth potential give it an edge over other companies, making it an attractive choice for those looking for a reliable return on their investments. More…

Peers

The company offers a range of tests, including those for ancestry, health, and wellness. Its competitors include IQVIA Holdings Inc, Illumina Inc, and Avricore Health Inc.

– IQVIA Holdings Inc ($NYSE:IQV)

In 2022, IQVIA Holdings Inc had a market capitalization of $40.44 billion and a return on equity of 21.52%. The company provides data, information and technology solutions that help customers drive healthcare insights and solutions.

– Illumina Inc ($NASDAQ:ILMN)

Illumina Inc has a market cap of 34.93B as of 2022, a Return on Equity of -29.49%. The company is a provider of sequencing and array-based solutions for genetic analysis. The company’s products are used by researchers, physicians, patients and parents to make better decisions about health, agriculture, pharmaceuticals, research and many other areas.

– Avricore Health Inc ($TSXV:AVCR)

Avricore Health Inc is a Canadian biotechnology company that develops and commercializes products for the early detection and prevention of chronic disease. The company has a market cap of 25.4 million as of 2022 and a return on equity of -46.21%. Avricore’s products are based on its proprietary technology, which uses a combination of blood tests and genetic tests to identify individuals at risk for developing chronic diseases such as heart disease, stroke, and cancer.

Summary

The company has also raised its 2023 guidance, indicating a bright outlook for the future. This is an attractive investment opportunity for traders, as the company has a strong balance sheet and continues to deliver impressive results. Additionally, the company is well-positioned to take advantage of the growing demand for personalized healthcare services. Investors looking to enter the market should view 23ANDME HOLDING as a safe option with a positive long-term outlook.

Recent Posts