MACY’S Reports Q3 FY2024 Earnings Results as of October 31 2023

November 20, 2023

🌥️Earnings Overview

MACY’S ($NYSE:M) announced their FY2024 Q3 financial results on November 16 2023, with figures taken as of October 31 2023. The total revenue for the quarter came in at USD 5038.0 million, 7.3% less than the same quarter of the previous year. Net income decreased significantly by 60.2%, amounting to USD 43.0 million.

Stock Price

On Thursday, October 31 2023, MACY’S reported its quarterly financial results for the third quarter of FY2024. The company’s stock opened at $14.2 and closed at $13.3 – a rise of 5.7% from the previous closing price of 12.6. The rise in sales was attributed to successful marketing campaigns and promotional activities in the prior quarter.

Overall, MACY’S reported strong earnings results for the third quarter of FY2024 and investors responded positively to the news. Although there is still work to be done in order for the company to return to its previous levels of profitability, the third quarter results indicate that progress is being made and that MACY’S is on track for a successful future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Macy’s. More…

| Total Revenues | Net Income | Net Margin |

| 24.02k | 684 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Macy’s. More…

| Operations | Investing | Financing |

| 1.28k | -1.02k | -231 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Macy’s. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.11k | 13.97k | 15.39 |

Key Ratios Snapshot

Some of the financial key ratios for Macy’s are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 14.2% | 4.2% |

| FCF Margin | ROE | ROA |

| 0.9% | 15.1% | 3.5% |

Analysis

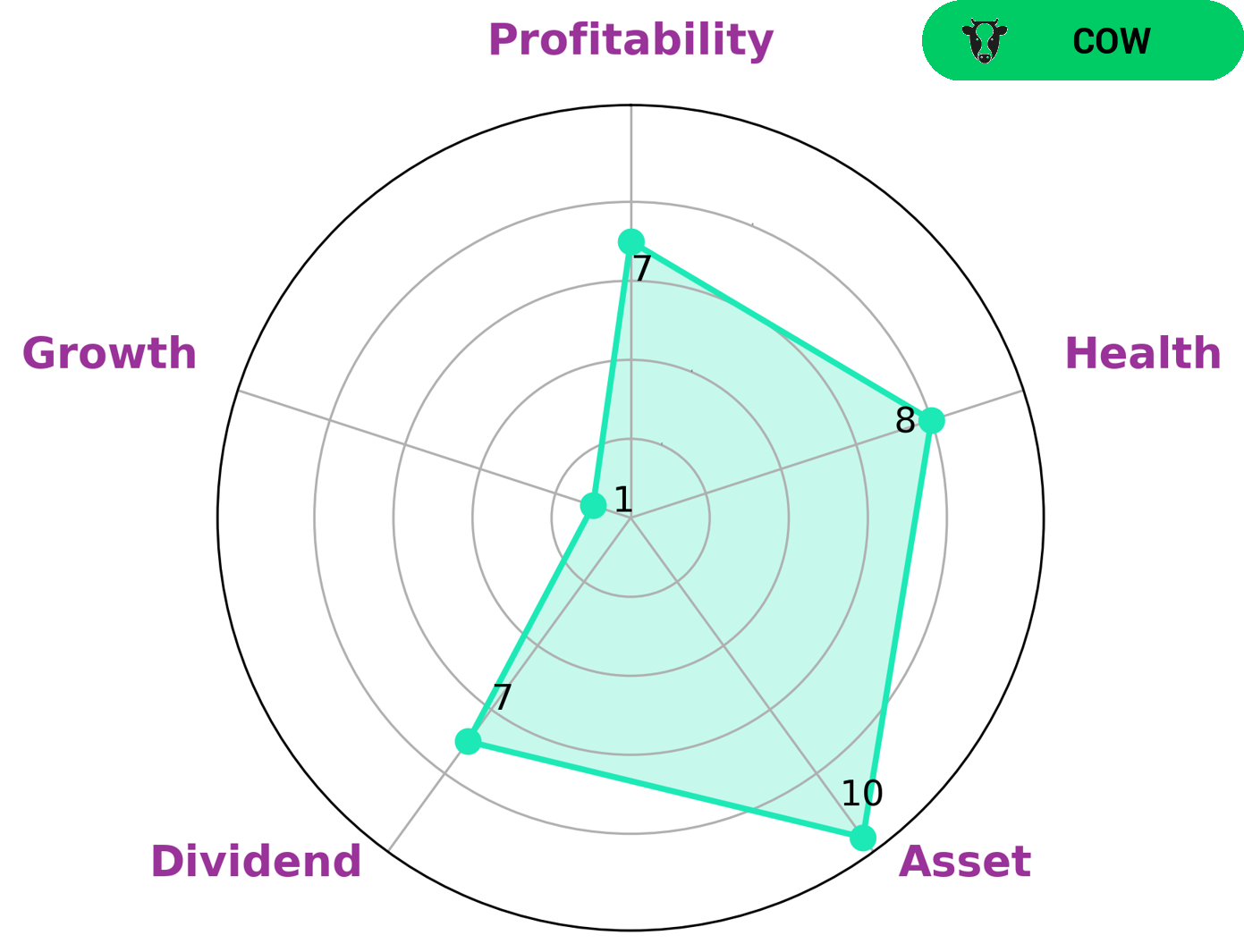

As a company that is classified as ‘cow’ in the GoodWhale Star Chart, Macy’s has demonstrated a track record of paying out consistent and sustainable dividends. This makes it attractive to investors who are looking for a reliable, steady source of income that they can count on. GoodWhale’s score of 8/10 for Macy’s wellbeing indicates that it is capable of safely riding out any crisis without the risk of bankruptcy. This is due to its strong cashflows and low debt levels. In addition, Macy’s also scores high in asset, profitability and medium in dividend, while its weak scores in growth indicate that it is not expected to grow significantly in the near future. Overall, Macy’s is an attractive stock option for investors who are looking for a reliable source of income and are less focused on growth potential. It provides a low-risk, stable return that can help build a portfolio for long-term wealth creation. More…

Peers

Macy’s Inc, World Co Ltd, Kohl’s Corp, and PT Ramayana Lestari Sentosa Tbk are all retail companies.

– World Co Ltd ($TSE:3612)

As of 2022, World Co Ltd has a market cap of 46.04B and a Return on Equity of 4.14%. The company is engaged in the business of providing online services. It offers a range of services, including online search, advertising, maps, software applications, and cloud computing.

– Kohl’s Corp ($NYSE:KSS)

Kohl’s Corp is an American department store retail chain. The company has a market capitalization of $3.56 billion as of 2022 and a return on equity of 16.46%. Kohl’s operates 1,158 stores in 49 states. The company offers a wide variety of merchandise, including apparel, shoes, cosmetics, and home goods. Kohl’s is known for its discount pricing and extensive promotions.

– PT Ramayana Lestari Sentosa Tbk ($IDX:RALS)

Ramayana Lestari Sentosa Tbk is an Indonesian conglomerate with interests in retail, malls, and real estate. The company has a market cap of 3.67 trillion as of 2022 and a return on equity of 6.89%. The company was founded in 1973 and is headquartered in Jakarta, Indonesia.

Summary

Macy’s recently reported their third quarter earnings for FY2024, with total revenue of USD 5038.0 million and net income of USD 43.0 million. Total revenue was down 7.3 % from the same quarter in the previous year, while net income decreased by 60.2%. Despite the drop in profits, investors responded positively, and the stock price increased on the day of the announcement. Going forward, investors should keep an eye on Macy’s financial performance and any potential changes to their strategies that could affect their overall profitability.

Additionally, investors should consider macroeconomic factors that could affect their investment in Macy’s.

Recent Posts