Kohl’s Experiences Unprecedented Options Trading Volume

November 21, 2023

🌥️Trending News

Kohl’s Corporation ($NYSE:KSS) is a popular retail chain that has been providing customers with quality products at an affordable price for decades. Recently, the company has been experiencing an unprecedented amount of options trading volume. Options trading is when an investor buys a contract that gives them the right to buy or sell a certain amount of stock at a predetermined price before a certain date. The unusually high amount of options trading at Kohl’s suggests that many investors are expecting the value of the company to increase in the near future. This increased trading volume could signal a shift in the market’s sentiment.

Investors may be betting that Kohl’s will experience higher-than-expected growth in the coming quarters and are taking advantage of this opportunity by buying into the company’s stock. Regardless of why investors are putting money into Kohl’s, the surge in options trading is an encouraging sign for the company and its shareholders. As long as the stock keeps appreciating, investors should continue to reap the benefits of their investments.

Stock Price

The stock opened at $25.1 and closed at $24.9, down by 2.7% from its previous closing price of 25.6. This sudden surge in trading activity suggests that investors are anticipating a turnaround in the company’s performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kohl’s Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 17.76k | -104 | -0.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kohl’s Corporation. More…

| Operations | Investing | Financing |

| 1.06k | -574 | -500 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kohl’s Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.79k | 11.06k | 33.64 |

Key Ratios Snapshot

Some of the financial key ratios for Kohl’s Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.9% | -41.2% | 0.9% |

| FCF Margin | ROE | ROA |

| 2.5% | 2.7% | 0.7% |

Analysis

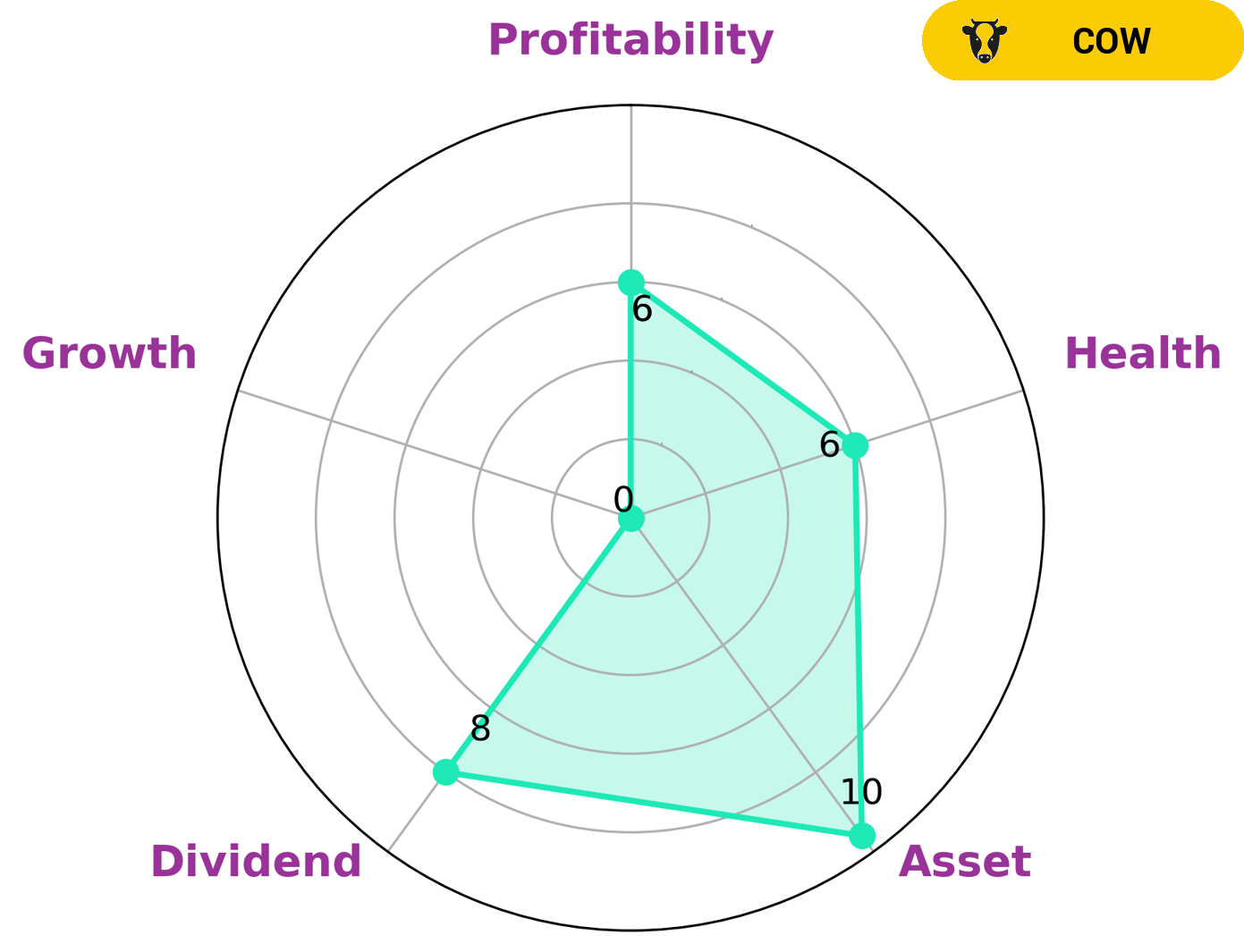

GoodWhale offers investors the ability to analyze KOHL’S CORPORATION‘s fundamentals. From our Star Chart, we can see that KOHL’S CORPORATION is classified as a ‘cow’, meaning it has the track record of paying out consistent and sustainable dividends. This makes it an attractive choice for dividend investors, who are looking to receive regular income from their investments. When looking at KOHL’S CORPORATION’s financial health, GoodWhale has rated it 6/10. This score suggests that the company is in an intermediate state of health with regards to its cashflows and debt, and may be able to safely ride out any crisis without the risk of bankruptcy. Further inspection into KOHL’S CORPORATION’s fundamentals reveals that it is strong in dividend, medium in asset, profitability and weak in growth. The company may not be highly desirable for investors who are looking for rapid returns, but its solid dividend yields and intermediate financial health should make it a sensible choice for those who are looking to build a diversified portfolio over the long-term. More…

Peers

The company operates stores under the Kohl’s, Kohl’s Cares, and Kohl’s Cash names. As of February 3, 2018, Kohl’s operated 1,158 department stores in 49 states. The company also operated a website, Kohls.com, and a mobile app.

– Macy’s Inc ($NYSE:M)

Macy’s, Inc. is an American holding company founded by Xavier Warren in 1830. The company operates about 850 department stores in 45 states, the District of Columbia, Puerto Rico, and Guam, as well as macys.com, bloomingdales.com, and bluemercury.com. Macy’s, Inc. is headquartered in Cincinnati, Ohio.

Macy’s market cap is 5.27B as of 2022 and has a ROE of 40.81%. The company operates about 850 department stores in 45 states, the District of Columbia, Puerto Rico, and Guam, as well as macys.com, bloomingdales.com, and bluemercury.com. Macy’s, Inc. is headquartered in Cincinnati, Ohio.

– Nordstrom Inc ($NYSE:JWN)

Nordstrom Inc is a leading retailer with a market cap of 3.2B as of 2022. The company has a strong return on equity of 70.09%. Nordstrom is known for its wide range of products and services, including clothing, shoes, cosmetics, and home furnishings. The company operates more than 350 stores in the United States and Canada. Nordstrom also operates an online store and provides customer service through its website and call center.

– World Co Ltd ($TSE:3612)

Alibaba Group Holding Limited is a Chinese multinational conglomerate holding company specializing in e-commerce, retail, Internet, and technology. Founded in 1999 by Jack Ma, Alibaba Group’s mission is to make it easy to do business anywhere. The company operates in four primary business segments: core commerce, cloud computing, digital media and entertainment, and innovation initiatives. Alibaba Group’s businesses encompass online and mobile marketplaces in retail and wholesale, payment processing, e-commerce infrastructure, and data-centric cloud computing. The company also owns and operates a number of other businesses, including Taobao Marketplace, Tmall, AliExpress, Alibaba Cloud Computing, Ant Financial, and Lazada. Alibaba Group has a market cap of $47.06 billion as of 2022 and a return on equity of 4.14%.

Summary

Kohl’s Corporation is a retail company that specializes in selling clothing, footwear, bedding, furniture, jewelry, beauty products, and housewares. Recently, there has been an unusually high volume of trading in options on Kohl’s stock. This indicates increased interest from investors in the company. Analysts suggest that investors are buying options in anticipation of further growth and positive performance. When assessing the stock, investors consider factors such as the company’s financials, dividend yield, competitive landscape, and overall industry trends.

The company also has a strong balance sheet and has seen consistent earnings growth over the past five years. On the other hand, Kohl’s faces stiff competition from online retailers, which could potentially hurt near-term performance. Overall, investors should carefully consider the pros and cons before investing in Kohl’s stock.

Recent Posts