Visa Reports Record Quarter: EPS Up 10% and Revenue Surpasses Expectations

April 26, 2023

Trending News 🌥️

Visa Inc ($NYSE:V). has reported strong financial results for the third quarter of this fiscal year, surpassing expectations on both revenue and earnings per share (EPS). The company enables individuals and businesses to use digital currency to make secure payments and transact with ease. For the third quarter, Visa reported non-GAAP EPS of $2.09, which was $0.10 higher than expected.

In addition, the company’s revenue amount came in at $8B, a figure which was $210M higher than the predicted number. This marks a 10% increase in EPS compared to the same quarter a year ago. The company’s strong performance was driven by growth in payments volume over the quarter, as well as increased use of the Visa network for cross-border transactions and cashless payments. Moreover, Visa benefited from the ongoing shift toward digital payments, as more people opted for contactless payment methods due to the pandemic. The company is well-positioned for continued growth in the future, and investors appear encouraged by the impressive results.

Stock Price

This news caused a slight dip in the company’s stock price, as it opened at $233.0 and closed at $229.6, down by 1.4% from the last closing price of $232.8. Additionally, the company reported strong growth across all major regions, with Asia Pacific experiencing the most growth by far. In response to these impressive results, Visa Inc. CEO Alfred F. Kelly Jr. stated that “our first quarter results demonstrate that Visa’s global payments network is resilient, and gains in transaction volume trends and cross-border activity bode well for our long-term growth prospects.” Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Visa Inc. More…

| Total Revenues | Net Income | Net Margin |

| 30.19k | 15.18k | 54.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Visa Inc. More…

| Operations | Investing | Financing |

| 18.79k | -4.25k | -14.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Visa Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 85.39k | 48.46k | 17.57 |

Key Ratios Snapshot

Some of the financial key ratios for Visa Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.7% | 8.8% | 62.1% |

| FCF Margin | ROE | ROA |

| 58.8% | 32.3% | 13.7% |

Analysis

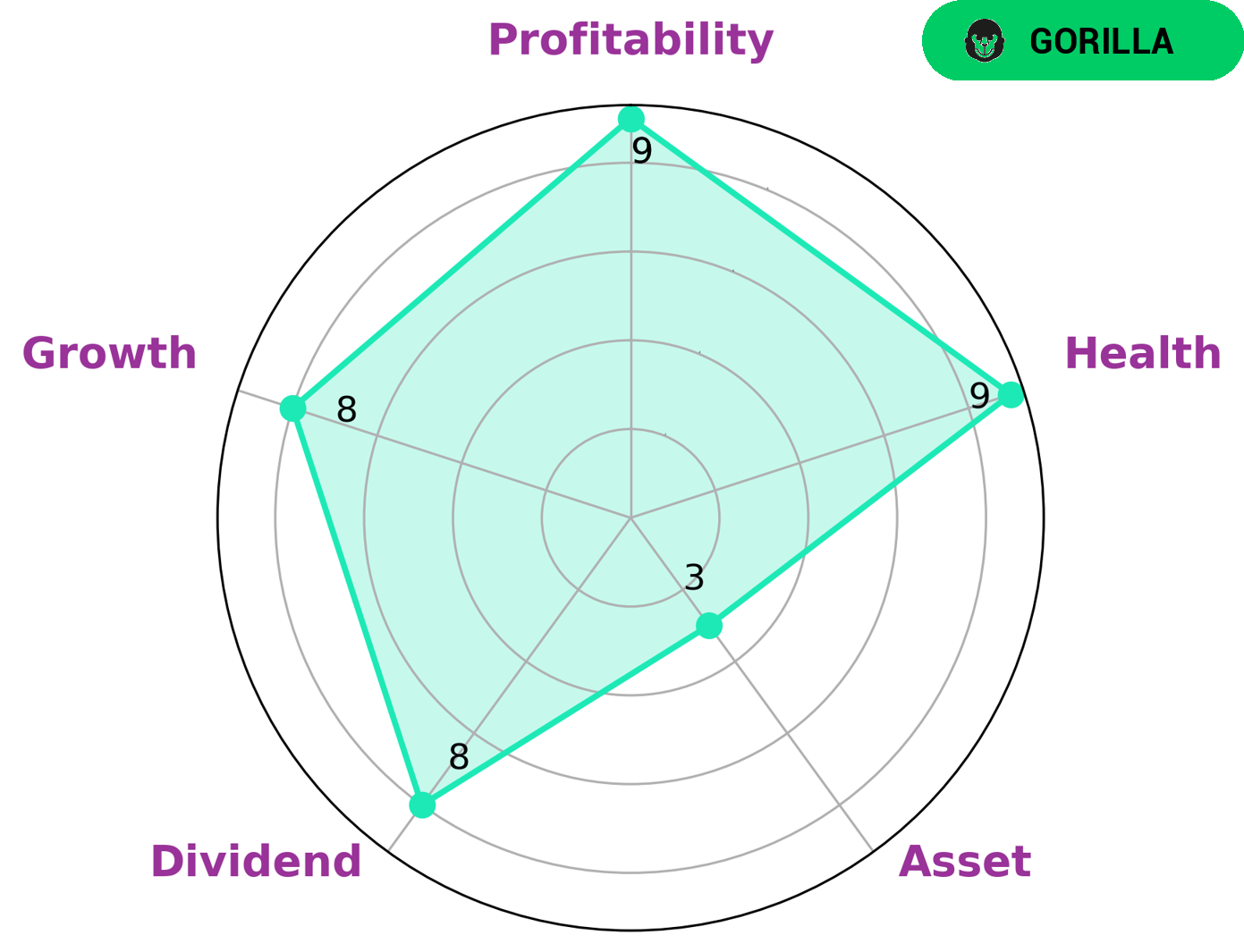

As GoodWhale analyzed the financials of VISA INC, we found that VISA INC has a high health score of 9/10 considering its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Our Star Chart shows that VISA INC is strong in dividend, growth, profitability, and weak in asset. Furthermore, VISA INC is classified as ‘gorilla’, a type of company we conclude that achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the financials of VISA INC, investors who value strong competitive advantages and companies that demonstrate stability in terms of revenue and earning growth will be interested in investing in this company. These investors are likely to be value investors looking for long-term investments, rather than short-term gains. Additionally, dividend investors may also be interested given VISA INC’s strong dividend payout, as well as those seeking low-risk investments due to the company’s ability to pay off its debt. More…

Peers

In the world of electronic payments, there are four major players: Visa Inc, Mastercard Inc, PayPal Holdings Inc, and American Express Co. All four of these companies are in constant competition with one another to gain market share. While Visa and Mastercard are the traditional giants in the industry, PayPal and American Express have been making inroads in recent years.

– Mastercard Inc ($NYSE:MA)

Mastercard Inc is a technology company that connects consumers, financial institutions, merchants, governments and businesses around the world, enabling them to use secure and convenient electronic transactions. As of 2022, Mastercard Inc has a market cap of 287.75B and a ROE of 110.3%. The company operates in two segments: Global Payment Solutions and Data & Services.

– PayPal Holdings Inc ($NASDAQ:PYPL)

Founded in 1998, PayPal Holdings, Inc. is a technology platform company that enables digital and mobile payments on behalf of consumers and merchants. PayPal has over 300 million active customers and handles over $232 billion in total payment volume on an annual basis. The company operates as a payment processor for online vendors, auction sites, and other commercial users, for which it charges a fee. In addition, PayPal offers a credit product called “Bill Me Later,” which allows customers to finance their online purchases.

– American Express Co ($NYSE:AXP)

American Express Co is a multinational financial services corporation with a market cap of 107.94B as of 2022. The company is headquartered in Three World Financial Center in New York City. American Express Co is best known for its credit card, charge card, and traveler’s cheque businesses.

Summary

Visa Inc. reported a strong fourth quarter earnings beat. The company’s Non-GAAP earnings per share of $2.09 exceeded analysts’ expectations by $0.10 and revenue of $8B surpassed estimates by $210M. This beat was driven by an increase in payments volume and processed transactions, which helped boost the company’s total net revenue. The strength of the U.S. dollar, however, was a drag on earnings in the quarter.

Going forward, Visa expects to benefit from strategic investments made in the past several years and to further capitalize on opportunities in the digital payments space. Analysts are optimistic in the company’s growth prospects and believe that Visa is well-positioned to capitalize on this growth.

Recent Posts