MoneyGram Sale Delayed Until Late in Q2, Shares Dip

May 2, 2023

Trending News ☀️

MONEYGRAM ($NASDAQ:MGI): MoneyGram International, a leading money transfer and payment service provider, has announced that their planned sale to private equity firm Madison Dearborn is delayed until late in the second quarter, causing their share price to dip. They offer a range of services and solutions including money transfers, bill payments, online payments and more. Investors were disappointed when it was revealed that the sale to Madison Dearborn would not go through until late in the second quarter of this year. Investors are concerned about how long it will take to complete the sale and what impact the delay might have on MoneyGram’s future.

MoneyGram has taken steps to reassure investors that their plans for the sale remain on track. They have stated that there have been no changes to the previously announced terms and conditions of the deal and that both parties remain committed to completing the sale as quickly as possible. Despite this, investors are still wary and are closely monitoring the situation as it unfolds.

Stock Price

On Monday, MONEYGRAM INTERNATIONAL shares experienced a drop of 7.3% from the previous day’s closing price of 10.2, with the stock opening at 9.9 and closing at 9.4. MONEYGRAM International stated that they are reviewing the terms and conditions of the agreement as required by international regulators. The cause of the delay is unknown, but it has investors worried as to whether or not the deal will eventually go through. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Moneygram International. More…

| Total Revenues | Net Income | Net Margin |

| 1.34k | 34.1 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Moneygram International. More…

| Operations | Investing | Financing |

| 108.7 | -7.3 | -386.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Moneygram International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.14k | 4.28k | -1.47 |

Key Ratios Snapshot

Some of the financial key ratios for Moneygram International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.1% | 18.9% | 6.8% |

| FCF Margin | ROE | ROA |

| 3.4% | -39.3% | 1.4% |

Analysis

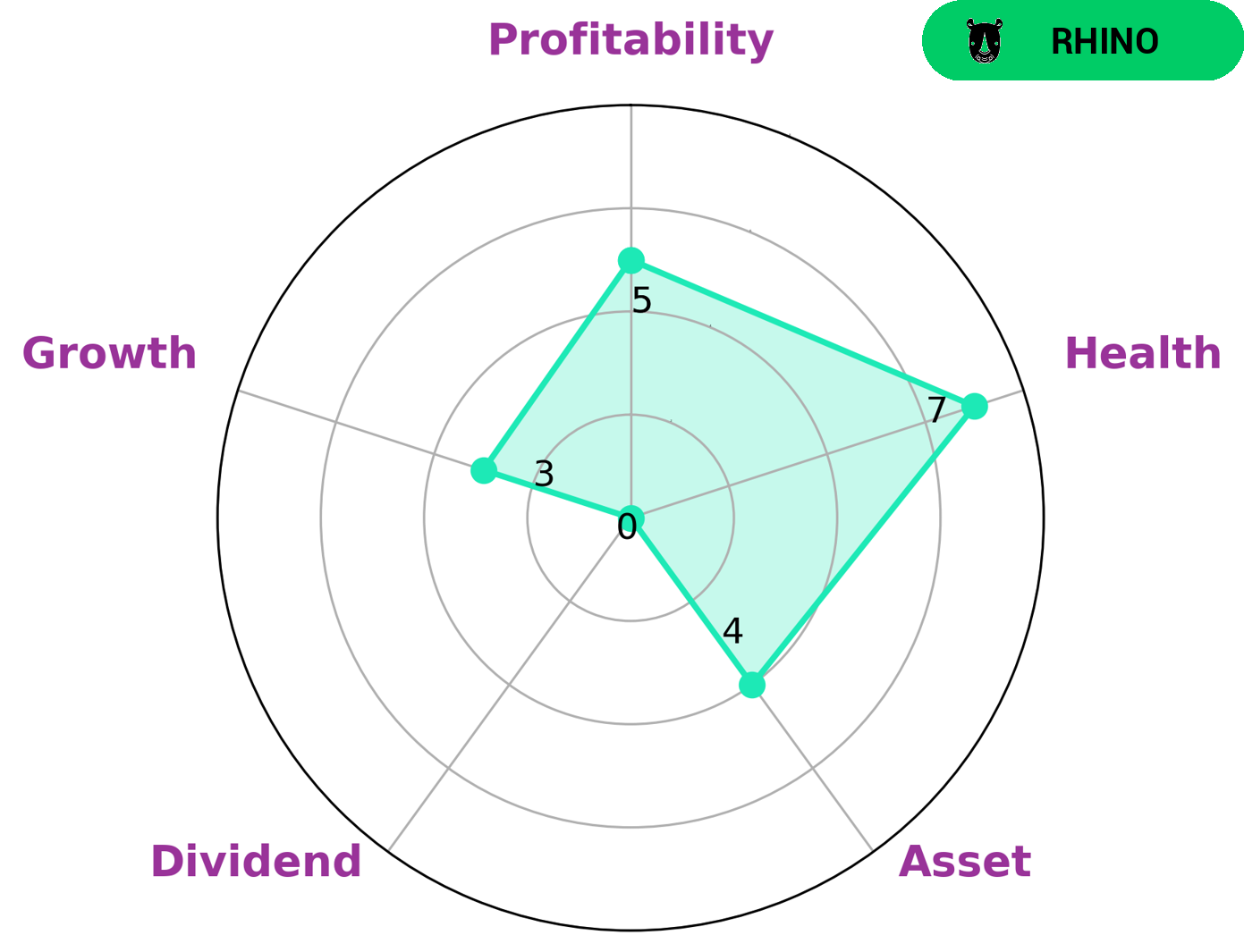

Analyzing GoodWhale’s financials for MONEYGRAM INTERNATIONAL, the Star Chart shows that it is strong in asset, profitability and weak in dividend, growth. Its health score of 7/10 indicates excellent cashflows and debt levels, making it capable to pay off debt and fund future operations. According to GoodWhale’s classification of ‘rhino’, MONEYGRAM INTERNATIONAL has achieved moderate revenue or earnings growth. Investors that may be interested in such a company are those with a moderate risk appetite and looking for a steady return on their investments over time. With its solid financials, MONEYGRAM INTERNATIONAL could be a good option for such investors. More…

Peers

The company offers a variety of money transfer services including online money transfers, money orders, and bill payments. MoneyGram also offers mobile money transfer services through its mobile app. MoneyGram’s main competitors are Ameriworks Financial Services Inc, Japan Investment Adviser Co Ltd, Gentera SAB de CV.

– Ameriworks Financial Services Inc ($OTCPK:AWKS)

Japan Investment Adviser Co Ltd, with a market cap of $39.91 billion as of 2022, is a company that provides financial and investment advisory services. Its return on equity (ROE) is 13.77%. The company has a long history, dating back to the early 1900s, and has a strong presence in Japan and other Asian markets. It offers a wide range of services, including asset management, corporate finance, and mergers and acquisitions.

– Japan Investment Adviser Co Ltd ($TSE:7172)

Gentera SAB de CV is a Mexican holding company that operates through several subsidiaries engaged in microfinance, sustainable energy, and other financial services. The company has a market capitalization of 1.57 billion as of 2022 and a return on equity of 15.38%. Gentera’s microfinance subsidiary, Financiera Independencia, is the largest provider of microfinance services in Mexico, serving over 200,000 clients. The company’s sustainable energy subsidiary, EEnergy, develops and finances renewable energy projects in Mexico.

Summary

MoneyGram International is a global money transfer and payment services provider. Investors have reacted negatively to the delay, causing the stock price to move down the same day the news was released. Despite the current setback, MoneyGram remains committed to creating value and delivering strong operational performance.

The company continues to focus on innovative and cost-effective solutions for customers across its global network, while also exploring new market opportunities. With a strong market position and robust growth strategy in place, MoneyGram remains well-positioned to capitalize on future growth.

Recent Posts