F6H dividend yield calculator – Far East Horizon Ltd Declares 0.49 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 2nd, 2023, Far East Horizon ($BER:F6H) Ltd declared a cash dividend of 0.49 CNY per share. This dividend announcement marks the fourth consecutive year of the same annual dividend per share of 0.36 CNY, yielding an average of 61.31%. This makes FAR EAST HORIZON a very lucrative option for investors who are looking for a high dividend stock. The ex-dividend date, after which shareholders will not be eligible to receive the dividend, is June 12th, 2023. FAR EAST HORIZON has a strong history of consistent returns for its shareholders. The company has managed to maintain this dividend rate for the last three years, despite the current economic crisis and market volatility.

This indicates that the company is in a strong financial position and can continue to provide regular returns to its shareholders in the future. FAR EAST HORIZON is a well-established company in the Far East region known for its reliable and consistent dividends. It is a great option for investors who are looking for a high-yield dividend stock with a long history of paying steady returns. Investors should carefully consider the ex-dividend date before making their decision as to whether or not to invest in FAR EAST HORIZON. With its impressive track record of providing steady returns to its shareholders, FAR EAST HORIZON is worth considering as part of any long-term investment portfolio.

Price History

The news saw their stock open at €0.8 and close at the same price. The dividend was well-received by investors, with a steady increase in the stock’s value throughout the day. The dividend is part of the company’s strategy to return part of its profits to its shareholders. Dividends have become an increasingly popular way for companies to reward their shareholders, and Far East Horizon Ltd is no exception.

The dividend further solidifies Far East Horizon Ltd’s commitment to its shareholders and their investment. It is also a strong indication that the company’s future performance will continue to be positive. This news has been met with enthusiasm by investors, who have been reassured that their investments are in good hands. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for F6H. More…

| Total Revenues | Net Income | Net Margin |

| 35.99k | 6.13k | 16.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for F6H. More…

| Operations | Investing | Financing |

| -7.69k | -1.77k | 9.61k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for F6H. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.99k | 294.55k | 11.2 |

Key Ratios Snapshot

Some of the financial key ratios for F6H are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.2% | 2.5% | 28.7% |

| FCF Margin | ROE | ROA |

| -32.4% | 13.8% | 1.9% |

Analysis

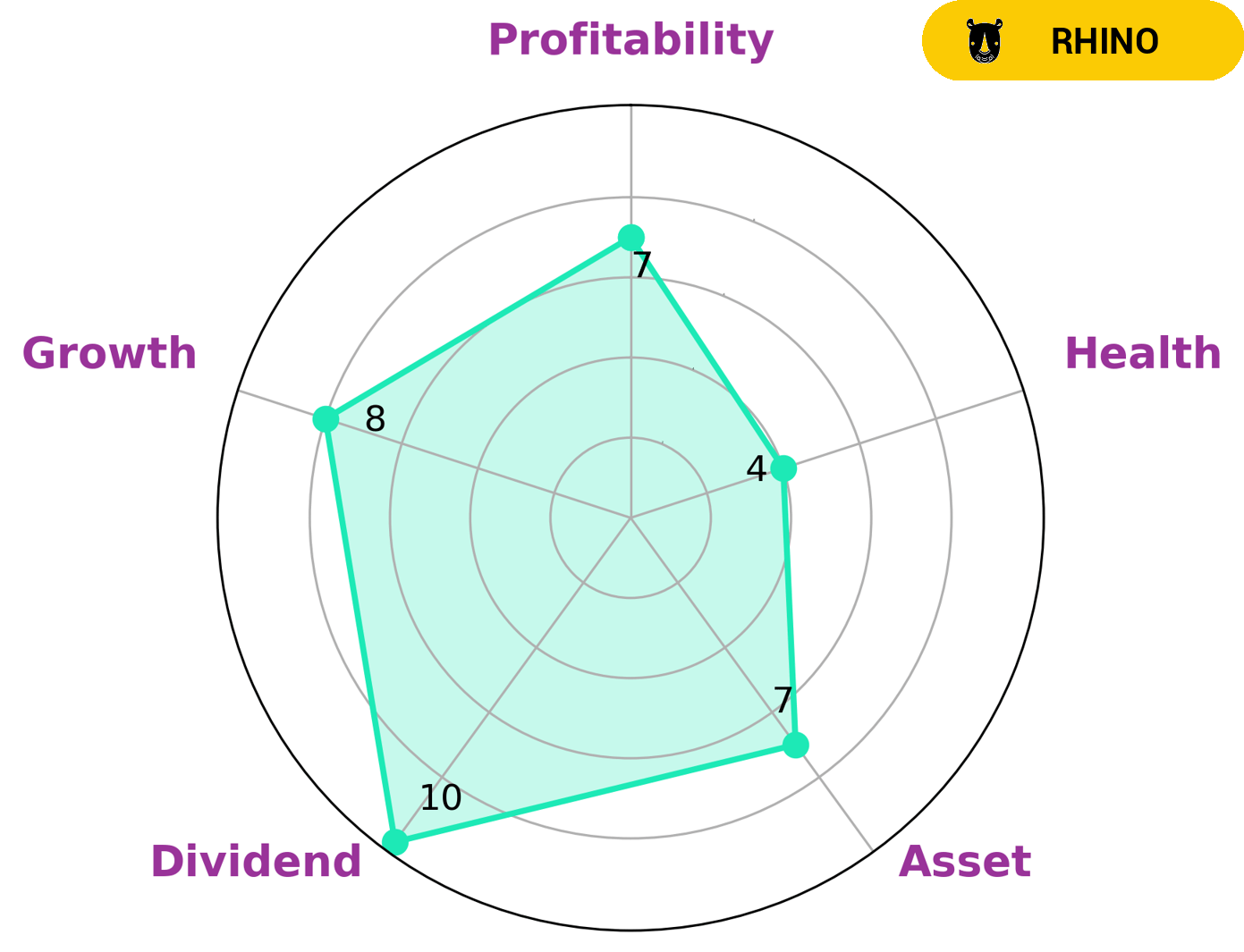

After analyzing FAR EAST HORIZON’s financials, GoodWhale has given it an intermediate health score of 4/10 with regards to its cashflows and debt. This score suggests that FAR EAST HORIZON is likely to be able to pay off existing debt and fund future operations, although it may face difficulty in doing so. FAR EAST HORIZON is classified as a ‘rhino’ company, meaning it has achieved a moderate level of revenue or earnings growth. This makes FAR EAST HORIZON potentially attractive to investors who are seeking slower but steadier growth. FAR EAST HORIZON is also strong in asset, dividend, growth, and profitability. Thus, FAR EAST HORIZON may be an interesting prospect for long-term investors who are looking for a safe and steady investment. More…

Summary

FAR EAST HORIZON is a good investment choice for those looking for high yield returns. Its consistent dividend payout of 0.36 CNY per share during the last three years yields an impressive average of 61.31%, making it one of the highest paying stocks in the market. Investors should also consider the company’s performance in terms of revenue, profit margins, and return on equity when choosing to invest in FAR EAST HORIZON.

Additionally, looking at the trends of share prices and financial metrics over time can help investors determine the stock’s performance and potential. Moreover, keeping up to date on news and developments related to the company as well as any changes to regulations or industry trends is important in order to make an informed decision about investing in FAR EAST HORIZON.

Recent Posts