VMWARE Appoints Dykstra as CFO After Rowe Joins Workday

May 26, 2023

Trending News 🌥️

VMWARE ($NYSE:VMW), a cloud computing and virtualization software provider, has announced the appointment of board member Zane Dykstra as its Chief Financial Officer. This comes after the recent departure of former CFO Robynne Rowe, who is joining Workday, a cloud-based human capital management software provider. VMWARE is one of the leading providers of cloud computing and virtualization software, with a proven track record in creating cost-effective, easy-to-use solutions for businesses. With a portfolio of products including vSphere, vSAN and vCloud Director, the company offers customers a wide range of cloud-based solutions to suit their individual needs. The company also provides an array of customer support programs and services to ensure customers have the best experience possible. Furthermore, VMWARE is a publicly traded stock listed on the NASDAQ Global Select Market.

In his new role as CFO, Dykstra will be responsible for overseeing all financial operations within the company. He brings extensive experience in finance and accounting, having worked with various companies such as Adobe, Dell, and Hewlett-Packard. His knowledge and expertise will be invaluable to VMWARE as they continue on their mission to provide industry-leading solutions to their customers. The appointment of Dykstra as CFO is the latest development in the company’s commitment to providing their customers with advanced solutions and unparalleled customer service. As VMWARE continues to expand its presence in the cloud computing sector, this appointment further reinforces their dedication to innovation and excellence.

Price History

On Thursday, VMWARE announced that former CFO Zane Rowe was leaving the company to join Workday, and appointed former CFO of Intuit, Sandy Dykstra, as its new CFO. This news had a positive effect on VMWARE’s stock prices, as the stock opened at $125.1 and closed at $127.9, up 3.1% from the previous closing price of $124.0. VMWARE is looking forward to having Dykstra in the position of CFO and is confident that her experience in managing financial operations for technology companies such as Oracle, Autodesk and Intuit will be beneficial in helping guide VMWARE’s financial strategies. Rowe had served as VMWARE’s CFO for seven years and helped the company become one of the top cloud computing companies in the world.

As a result of this news, analysts are optimistic about VMWARE’s financial prospects going forward under Dykstra’s leadership. The stock had risen significantly from its opening price of $125.1 to its closing price of $127.9, signaling investor confidence in VMWARE’s future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vmware. VMWARE_Appoints_Dykstra_as_CFO_After_Rowe_Joins_Workday”>More…

| Total Revenues | Net Income | Net Margin |

| 13.35k | 1.31k | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vmware. VMWARE_Appoints_Dykstra_as_CFO_After_Rowe_Joins_Workday”>More…

| Operations | Investing | Financing |

| 4.3k | -367 | -2.47k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vmware. VMWARE_Appoints_Dykstra_as_CFO_After_Rowe_Joins_Workday”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.24k | 29.7k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Vmware are shown below. VMWARE_Appoints_Dykstra_as_CFO_After_Rowe_Joins_Workday”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | 10.1% | 15.7% |

| FCF Margin | ROE | ROA |

| 28.8% | 112.0% | 4.2% |

Analysis

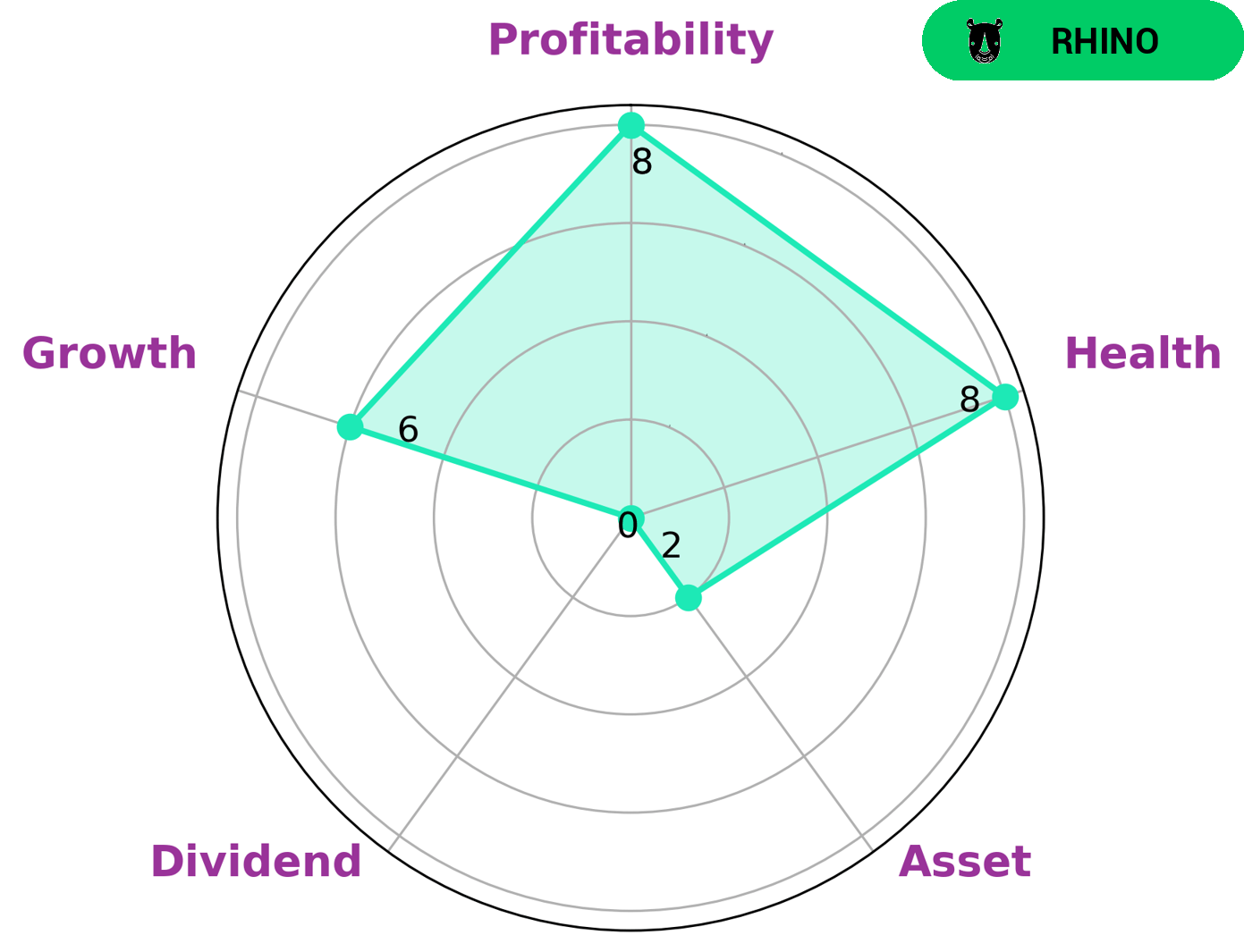

As GoodWhale, we have been analyzing VMWARE‘s wellbeing. Our Star Chart classification puts them in the ‘Rhino’ group, which suggests that they have achieved moderate revenue or earnings growth. This type of company could be of interest to more conservative investors who are looking for stability and return on their investments. Looking at VMWARE’s individual health scores, we see that it is strong in profitability, medium in growth and weak in asset and dividend. Overall, VMWARE has a high health score of 8/10, which suggests that it is capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

VMware Inc is a leading provider of virtualization and cloud infrastructure solutions. Its competitors include GSS Infotech Ltd, Venzee Technologies Inc, ProStar Holdings Inc.

– GSS Infotech Ltd ($BSE:532951)

GSS Infotech Ltd. is a global provider of software and IT services. The company offers a range of services, including application development, enterprise resource planning, and infrastructure management. It also provides software solutions for the banking, financial services, and insurance industries. GSS Infotech has a market cap of 4.49 billion as of 2021 and a return on equity of 12.46%. The company was founded in 1997 and is headquartered in Hyderabad, India.

– Venzee Technologies Inc ($TSXV:VENZ)

Assuming you are writing as of 2022:

Venzee Technologies Inc has a market cap of 2.47M as of 2022. The company’s return on equity is 1422.25%. Venzee Technologies is a software company that provides a platform to streamline the exchange of product data between retailers and brands.

– ProStar Holdings Inc ($TSXV:MAPS)

ProStar Holdings Inc is a provider of geospatial data and related services for the energy industry. The company’s market cap is $22.79 million and its ROE is -67.74%. ProStar’s geospatial data and services are used by oil and gas companies, government agencies, and other organizations involved in the exploration, production, and transportation of energy.

Summary

Investors should keep a close eye on VMware Inc., as the company recently appointed long-time board member Zane Dykstra to the Chief Financial Officer (CFO) position. This move comes after previous CFO, Mark Rowe, left to join another company, Workday. The stock price of VMware responded positively to the news of the new CFO’s appointment, signaling that investors are optimistic about the future of the company. With a new CFO in place and experience on the board already, investors can expect VMware to continue to be a reliable and profitable investment in the future.

Recent Posts