Prologis Stock Fair Value Calculation – Prologis CEO Hamid Moghadam Shares His Insight on Industrial Real Estate Investment Trusts

June 7, 2023

☀️Trending News

Prologis ($NYSE:PLD) is a global leader in the industrial real estate investment trust (REIT) industry. Recently, CNBC Television released a video featuring Prologis CEO Hamid Moghadam discussing the current status of industrial REITs. In the video, Moghadam highlights the growth of industrial REITs and the opportunities that investors can take advantage of. He also talks about Prologis’ strategy in investing in industrial real estate, which includes focusing on major metropolitan areas and utilizing data and analytics to identify the most attractive locations for industrial development.

Additionally, Moghadam explains how Prologis has been able to maintain its position as a leader in industrial REITs by adapting its business model to meet changing market conditions and embracing the ever-evolving technology landscape. Overall, CEO Hamid Moghadam provides a valuable perspective on the current state of industrial REITs and how Prologis is responding to the market. With its vast experience in the industry, Prologis has been able to remain a leader in industrial real estate, and provides investors with a safe and reliable way to invest in the sector.

Share Price

Prologis is an American-based industrial REIT that specializes in logistics and distribution facilities. The stock opened at $124.0 and closed at $124.9, up 1.9% from its prior closing price of 122.6. This increase in stock price is a testament to the success of the company and its prospects for further growth. Moghadam’s comments focused on the importance of REITs in providing investors with long-term returns, as well as the changes in the industry that have taken place in recent years.

He also noted how Prologis has been able to adapt to these changes and capitalize on new opportunities for growth. His insight is sure to be well-received by investors and industry professionals alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Prologis. More…

| Total Revenues | Net Income | Net Margin |

| 6.52k | 2.67k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Prologis. More…

| Operations | Investing | Financing |

| 4.4k | -5.83k | 45.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Prologis. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 88.52k | 31.06k | 57.15 |

Key Ratios Snapshot

Some of the financial key ratios for Prologis are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 37.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Prologis Stock Fair Value Calculation

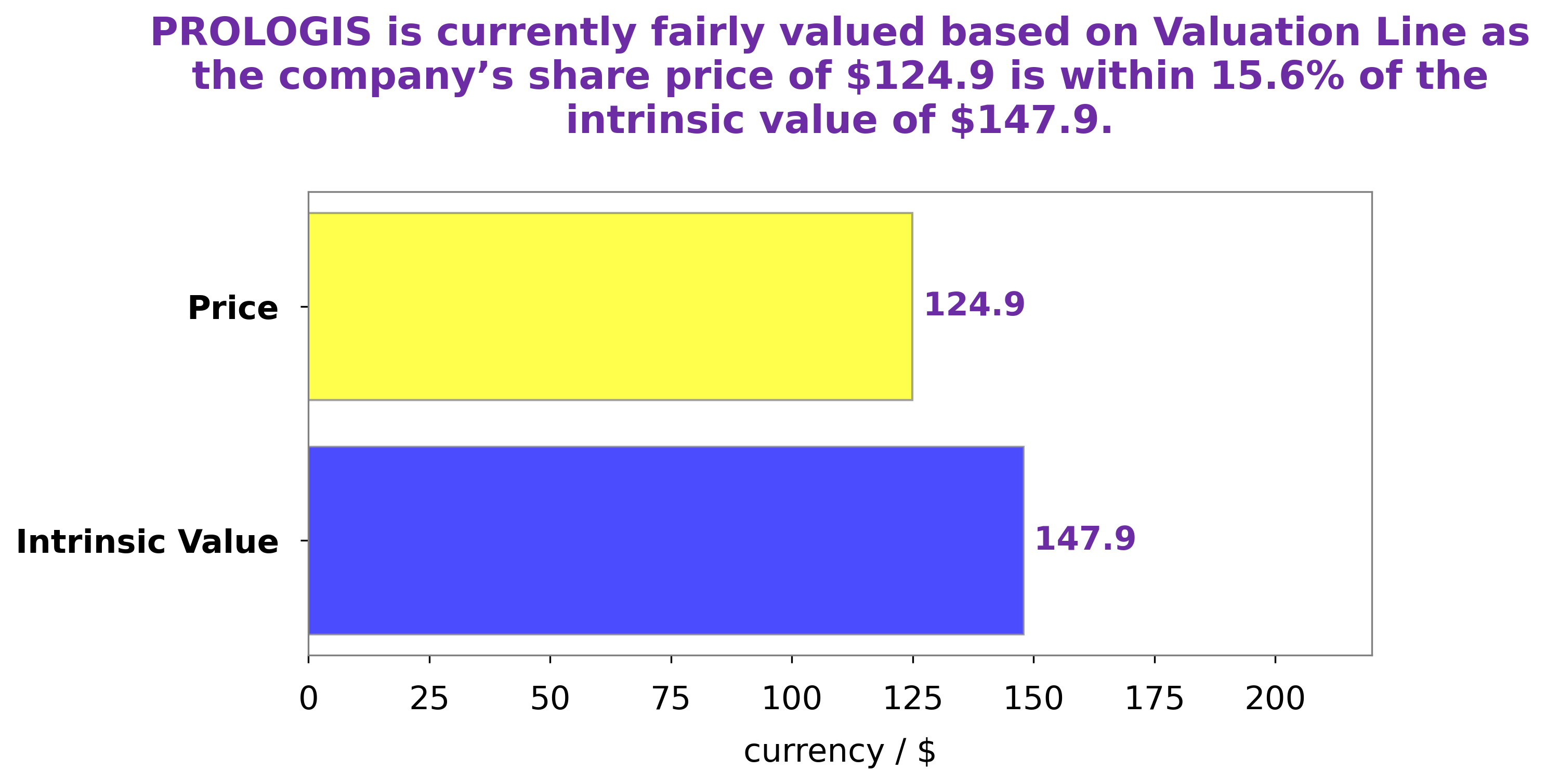

GoodWhale has conducted an extensive analysis of PROLOGIS‘s wellbeing and has concluded that the fair value of PROLOGIS shares is around $147.9. This calculation was made using our proprietary Valuation Line, which is a robust method for assessing the fair value of a company’s stock. At the current trading price of $124.9, PROLOGIS stock appears to be undervalued by 15.5%. This discrepancy between the fair value and the current trading price presents an opportunity for investors to purchase PROLOGIS stock at a discounted rate. We believe that this analysis shows the potential for PROLOGIS stock to not only increase in value, but also to outperform the market in the long term. We recommend that investors take action to take advantage of this opportunity as soon as possible. More…

Peers

Prologis Inc is one of the world’s leading logistics real estate companies with a global portfolio of approximately 946 million square feet. The company’s properties are located in 19 countries across North America, Europe, Asia and Latin America. Prologis’ tenants include some of the world’s largest third-party logistics providers and e-commerce companies. The company’s competitors include Frasers Logistics & Commercial Trust, Daiwa House Logistics Trust and Sabana Industrial REIT.

– Frasers Logistics & Commercial Trust ($SGX:BUOU)

Frasers Logistics & Commercial Trust has a market cap of 4.1B as of 2022. The company is a trust that focuses on logistics and commercial properties in Australia, Europe, and North America. The trust’s portfolio consists of warehouses, distribution centers, retail properties, and office buildings.

– Daiwa House Logistics Trust ($SGX:DHLU)

Daiwa House Logistics Trust is a Japanese real estate investment trust (REIT) that was established in 2010. The company’s portfolio consists of logistics properties located in Japan and China. As of March 31, 2021, Daiwa House Logistics Trust had a total market capitalization of ¥378.54 billion.

– Sabana Industrial REIT ($SGX:M1GU)

Sabana Industrial REIT has a market cap of 443.93M as of 2022. The company is a Singapore-based real estate investment trust (REIT) that owns and manages a portfolio of industrial properties in Singapore. The REIT’s portfolio comprises of 63 properties, with a total gross floor area of approximately 7.1 million square feet. The REIT’s properties are located in major industrial districts in Singapore, such as Jurong Island, Tuas, Woodlands, Changi, and Ang Mo Kio.

Summary

Prologis, a leader in the industrial real estate investment trust (REIT) space, has seen great success in recent years as demand for logistics and supply chain assets has increased. Hamid Moghadam, the CEO of Prologis, notes that the industrial REITs have outperformed the broader real estate market, with higher rents and strong occupancy rates. He believes this trend will continue due to the growth of e-commerce and increased demand for space. Moghadam also highlights the importance of capital discipline, as Prologis has focused its investments on high-quality assets with long-term potential.

He believes this strategy has allowed the company to be successful while protecting its balance sheet. Finally, Moghadam states that Prologis is well-positioned to capitalize on the current growth in the industrial real estate sector.

Recent Posts