Pinterest’s New CEO Bill Ready Prioritizes User Engagement and Monetization: See Why I Rate PINS Stock as a Buy

June 12, 2023

☀️Trending News

Pinterest ($NYSE:PINS), the online scrapbooking and photo-sharing platform, has recently named Bill Ready as its new Chief Executive Officer. Ready is well-known for his expertise in user engagement and monetization and his new mandate for Pinterest has been to prioritize both areas of the business. Already, Pinterest’s stock has surged on the news of Ready’s appointment and I believe PINS stock is a great buy for investors right now. User engagement is key when it comes to monetizing a company and Ready has seemingly doubled-down on that approach. He will be leveraging Pinterest’s strong user base to generate revenue through various methods, such as advertising, e-commerce, and subscription services.

By focusing on keeping users engaged, this could lead to higher customer loyalty and retention rates, which would ultimately mean more revenue for the company. For investors who are interested in joining the Pinterest story, PINS stock is looking like a very attractive buy right now. With Ready’s new focus on user engagement and monetization, I believe Pinterest is on the right track to becoming a major player in the digital economy. To learn more about why I rate PINS stock as a Buy, click here for a detailed analysis.

Stock Price

On Tuesday, PINTEREST announced the appointment of its new CEO Bill Ready, sending PINS stock up by 2.2%. This was an encouraging sign for investors, as Mr. Ready is highly experienced in user engagement and effective monetization strategies. He has already made several positive changes, including a revamp of the mobile app and website, and is working to create more appealing content that will draw in advertisers. His focus on user engagement and monetization bodes well for the future of PINTEREST, and I believe that it is well-positioned for continued growth. Pinterests_New_CEO_Bill_Ready_Prioritizes_User_Engagement_and_Monetization_See_Why_I_Rate_PINS_Stock_as_a_Buy”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pinterest. More…

| Total Revenues | Net Income | Net Margin |

| 2.83k | -299.35 | -10.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pinterest. More…

| Operations | Investing | Financing |

| 439.27 | -163.49 | -308.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pinterest. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.57k | 506.68 | 4.47 |

Key Ratios Snapshot

Some of the financial key ratios for Pinterest are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.6% | – | -11.0% |

| FCF Margin | ROE | ROA |

| 14.7% | -6.1% | -5.4% |

Analysis

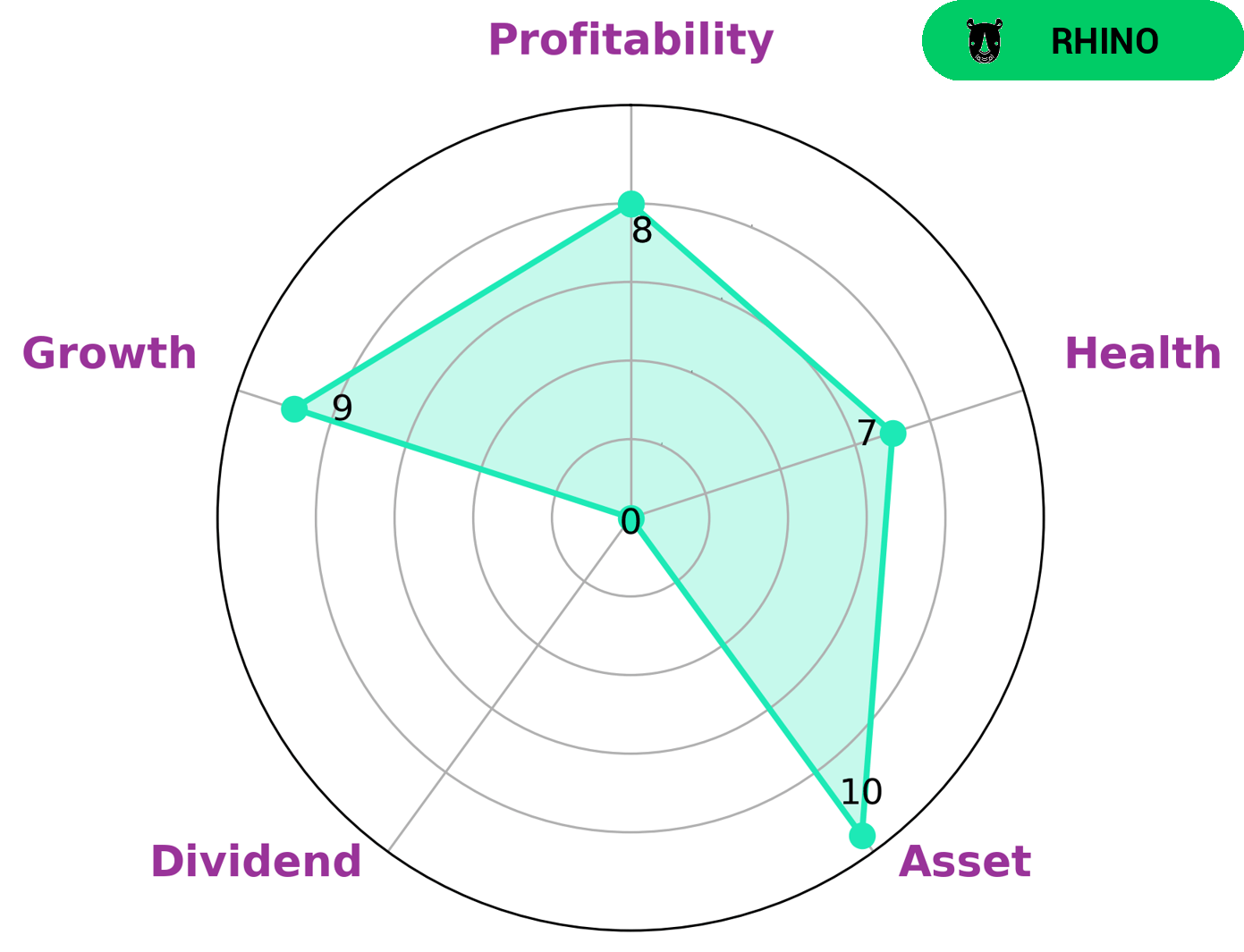

GoodWhale conducted an analysis of PINTEREST’s financials, and the results are quite positive. According to our Star Chart, PINTEREST has a high health score of 7/10 with regard to its cashflows and debt. This means that PINTEREST is capable of paying off debt and funding future operations. We classify PINTEREST as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given its strengths in asset, growth, and profitability, and relative weakness in dividend, we believe that PINTEREST may be attractive to investors who are looking for long-term capital growth rather than immediate returns. Investors who are interested in investing in companies with strong underlying fundamentals, such as PINTEREST, may find this type of company attractive. Pinterests_New_CEO_Bill_Ready_Prioritizes_User_Engagement_and_Monetization_See_Why_I_Rate_PINS_Stock_as_a_Buy”>More…

Peers

The social media landscape is constantly changing and evolving, which can make it hard to keep up with the competition. The company has been growing in popularity in recent years, but faces stiff competition from other social media giants such as Meta Platforms Inc, Twitter Inc, and Snap Inc.

– Meta Platforms Inc ($NYSE:TWTR)

Twitter, Inc. is an American microblogging and social networking service on which users post and interact with messages known as “tweets”. Registered users can post, like, and retweet tweets, but unregistered users can only read them. The company was founded in March 2006 by Jack Dorsey, Noah Glass, Biz Stone, and Evan Williams and has more than 24,000 employees.

– Twitter Inc ($NYSE:SNAP)

Snap Inc has a market cap of 15.45B as of 2022. The company has a Return on Equity of -20.9%. Snap Inc is a camera company. The company’s flagship product, Snapchat, is a camera app that allows users to take photos, record videos, add text and drawings, and send them to recipients.

Summary

Investors should have a positive outlook on Pinterest‘s future due to the company’s new focus on user engagement and monetization. Under the helm of CEO Bill Ready, Pinterest has implemented strategies to drive engagement and create revenue streams from its platform. The stock is currently rated as a Buy due to its potential for growth and strong balance sheet. With its large user base and ability to capitalize on emerging trends, investors should consider Pinterest as an opportunity to capitalize on the potential upside.

Recent Posts