Cwm LLC Acquires 435 Shares of Academy Sports and Outdoors,

January 30, 2023

Trending News ☀️

Academy ($NASDAQ:ASO) Sports and Outdoors, Inc. is a leading sporting goods and outdoor lifestyle retailer in the United States. Recently, Cwm LLC acquired a total of 435 shares of Academy Sports and Outdoors, Inc. This acquisition marks the first major investment of Cwm LLC in the company. It will provide the company with additional capital and resources that will help it to grow and expand its operations.

In addition, it will give Cwm LLC more control over the direction of the company’s future. It will provide Academy Sports and Outdoors, Inc. with additional capital to grow and expand its operations, while allowing Cwm LLC to have more control over the direction of the company’s future. This acquisition is sure to benefit both parties involved in the long run.

Stock Price

Cwm LLC recently acquired 435 shares of Academy Sports and Outdoors, Inc. This news has been met with mostly positive reactions, and on Monday, the stock opened at $54.5 and closed at $54.9, a 1.4% increase from the previous closing price of 54.2. The acquisition of shares signals a vote of confidence from Cwm LLC in the ability of Academy Sports and Outdoors to deliver consistent returns over time. This is an important development for the company, as it could indicate that more investors may follow suit and invest in the company as well. Academy Sports and Outdoors is a leading retailer of sporting goods, outdoor equipment and apparel in the United States. It has a wide range of products that cater to the needs of all types of athletes, including professional and amateur players alike.

The company’s focus on customer experience and product quality has made it one of the top retailers in its industry. Its ability to attract such a prominent investor shows that the company is well-positioned for success in the future. This will likely result in further investments from other investors who have faith in the company’s potential growth. Overall, this is a great sign for Academy Sports and Outdoors and its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ASO. More…

| Total Revenues | Net Income | Net Margin |

| 6.46k | 612.12 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ASO. More…

| Operations | Investing | Financing |

| 467.37 | -97.12 | -453.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ASO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.78k | 3.22k | 20 |

Key Ratios Snapshot

Some of the financial key ratios for ASO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.3% | 91.7% | 13.1% |

| FCF Margin | ROE | ROA |

| 5.7% | 34.3% | 11.1% |

VI Analysis

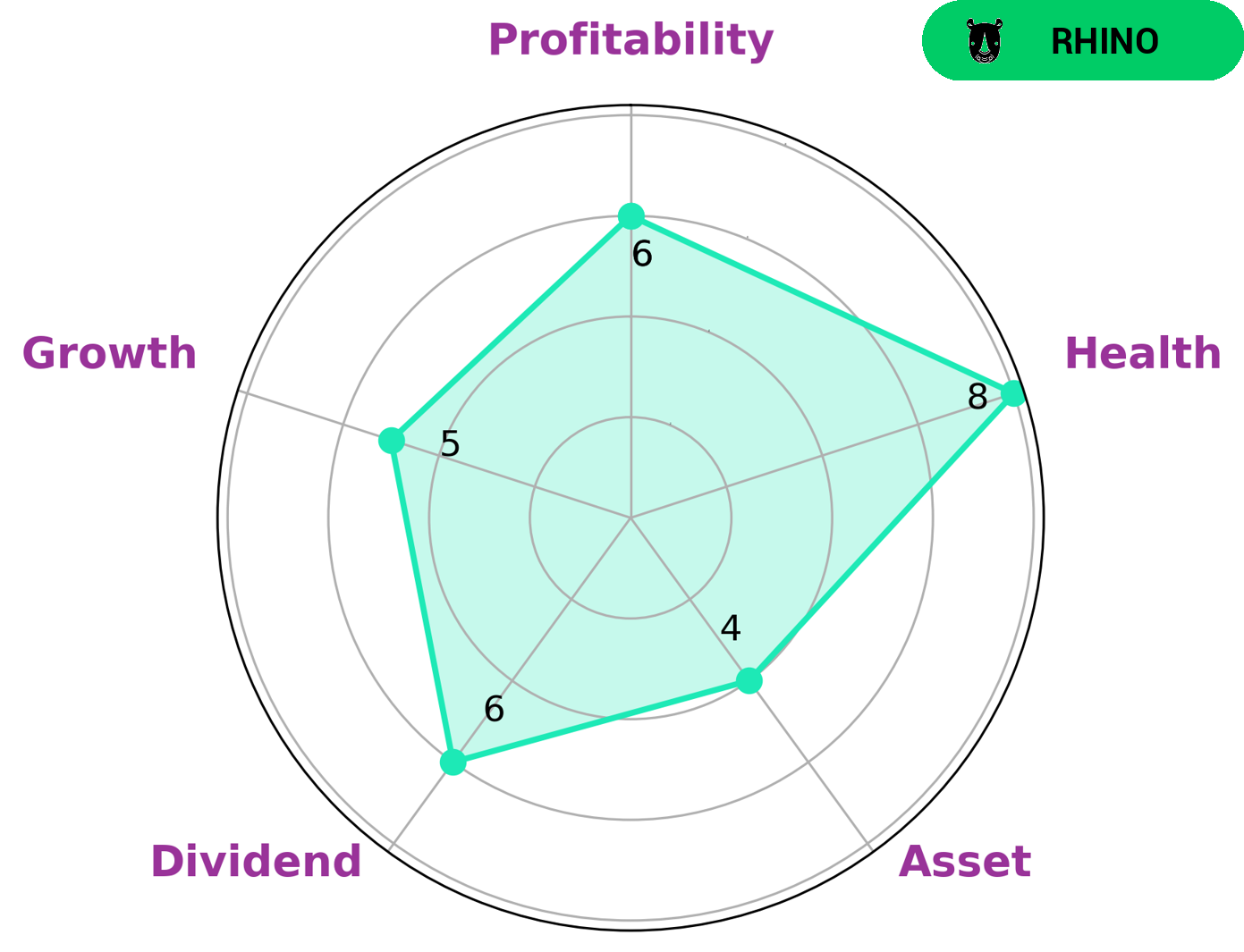

Investors looking for a company with strong fundamentals should consider Academy Sports and Outdoors. According to VI Star Chart, Academy Sports and Outdoors has a high health score of 8/10, indicating that it is capable of sustaining its operations in times of crisis due to its cashflows and debt. It is also classified as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. Academy Sports and Outdoors is strong in cash flow, debt, and liquidity, and medium in asset utilization, dividend coverage, growth, and profitability. With these positive attributes, the company makes a great investment opportunity for long-term investors looking for a reliable return on investment. In addition, Academy Sports and Outdoors has a diverse product range that appeals to a wide variety of customers. This makes them well-positioned to weather any downturns in the market as customers seek out their products. The company’s financial performance has also been relatively steady over the years, providing investors with a sense of security when investing. Overall, Academy Sports and Outdoors offers investors a reliable and diversified investment opportunity. Its strong fundamentals and long-term potential make it an attractive option for those looking to invest in a stable and growing business. More…

VI Peers

The company offers a wide range of products for a variety of sports and outdoor activities, including hunting, fishing, camping, and more. Academy Sports and Outdoors Inc competes with XXL ASA, Danang Books And School Equipment JSC, and Book And Education Equipment Jsc.

– XXL ASA ($BER:2XX)

The company’s market cap is 104.96M as of 2022 and its ROE is -1.76%. The company is a provider of internet services.

Summary

Investment firm Cwm LLC recently acquired 435 shares of Academy Sports and Outdoors, Inc. This move indicates that the company may be a viable investment opportunity. Currently, news coverage of the company is mostly positive. Academy Sports and Outdoors, Inc. is a leading sporting goods retailer in the United States, offering quality products at competitive prices. They offer a wide selection of apparel, footwear, and equipment for a variety of sports and activities, as well as outdoor gear.

The company’s strong presence in the market is backed by their commitment to customer service and their focus on providing value for money. With their solid financials and promising outlook, Academy Sports and Outdoors, Inc. may be a great choice for investors looking for long-term growth.

Recent Posts