B. Riley Financial, Leads Financing to Support Harrow Health Acquisition in 2023.

March 30, 2023

Trending News ☀️

B. Riley Financial ($NASDAQ:RILY), Inc. has provided financing to support Harrow Health’s acquisition of U.S. Health products and technologies in 2023. The financing package is structured to provide Harrow Health with the necessary resources to complete their acquisition. This lending agreement brings B. Riley Financial’s expertise and experience to the table, providing the financial resources Harrow Health needs to facilitate the acquisition. The acquisition of U.S. Health products and technologies will help Harrow Health expand its product offering and customer base, while providing new opportunities for growth. The additional resources provided by B. Riley Financial, Inc. will help Harrow Health complete the acquisition in a timely fashion, allowing them to maximize their potential and benefit from the resulting synergies of the combined companies.

B. Riley Financial, Inc. is a leading financial services company and is committed to providing its clients with innovative, customized financing solutions that can meet their specific needs. This agreement is a testament to their expertise and dedication to providing financiers with the best possible service and support. As Harrow Health moves forward with the acquisition, B. Riley Financial, Inc. will be there to help ensure that all aspects of the deal are completed successfully.

Market Price

This news has been well-received in the financial industry, as the sentiment towards the news has been largely positive. On Wednesday, the stock of B. RILEY FINANCIAL opened at $27.8 and closed at $28.9, representing a 5.6% increase from its previous closing price of 27.4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RILY. More…

| Total Revenues | Net Income | Net Margin |

| 915.47 | -167.84 | -17.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RILY. More…

| Operations | Investing | Financing |

| 144.73 | -956.53 | 1.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RILY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.11k | 5.43k | 15.65 |

Key Ratios Snapshot

Some of the financial key ratios for RILY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.0% | 135.1% | -8.7% |

| FCF Margin | ROE | ROA |

| 3.5% | -10.3% | -0.8% |

Analysis

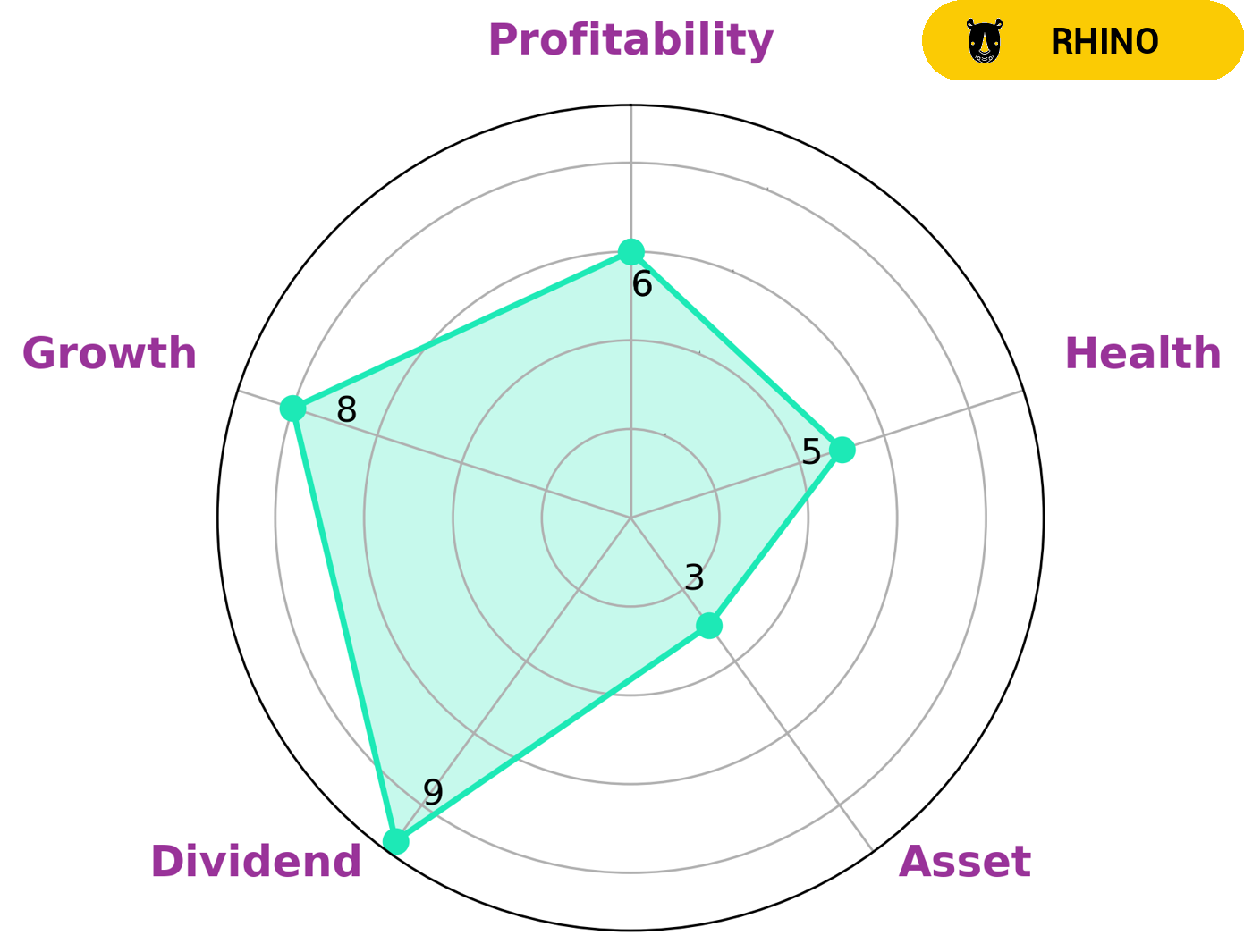

As GoodWhale, we examined the fundamentals of B. RILEY FINANCIAL and conducted our analysis. Based on our Star Chart, B. RILEY FINANCIAL is classified as ‘rhino’, which suggests that it has achieved moderate revenue or earnings growth. Given its relative strength in dividend and growth, medium profitability and weak assets, we believe that long-term investors, including those interested in dividend stocks, may be interested in B. RILEY FINANCIAL. Considering its cashflows and debt level, we feel that B. RILEY FINANCIAL is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company operates through the following segments: Capital Markets, Auction and Liquidation, Valuation and Appraisal, and Principal Investing. It offers its services to middle market public and private companies, institutional investors, and high net worth individuals. The company was founded on November 10, 2009 and is headquartered in Los Angeles, CA.

– Interups Inc ($OTCPK:ITUP)

Interups Inc is a publicly traded company with a market capitalization of 4.14 million as of 2022. The company has a return on equity of 80.66%. Interups Inc is engaged in the business of providing interrupts to computer systems. The company’s products are used in a variety of applications, including gaming, security, and networking.

– Houlihan Lokey Inc ($NYSE:HLI)

Houlihan Lokey is a global investment bank with a market capitalization of $5.66 billion as of 2022. The company’s return on equity is 25.46%. Houlihan Lokey provides advice on mergers and acquisitions, capital markets, financial restructuring, valuation, and other strategic matters. The company has approximately 1,200 employees in 18 offices around the world.

– Shanghai Chinafortune Co Ltd ($SHSE:600621)

Shanghai Chinafortune Co Ltd is a Chinese company with a market cap of 11.63B as of 2022. The company operates in the real estate industry and has a Return on Equity of 5.7%. Shanghai Chinafortune Co Ltd is one of the leading developers of real estate projects in China. The company has developed a number of large-scale real estate projects in Shanghai and other major cities in China.

Summary

B. Riley Financial, Inc. recently announced that it would provide financing to support the acquisition of Harrow Health in 2023. The news has been met with a generally positive sentiment and resulted in an immediate increase in the company’s stock price. Investors should consider the news when making decisions about B. Riley Financial. The acquisition could lead to increased revenue, improved efficiencies and other advantages for the company.

Furthermore, the financial position of the company should be taken into account when assessing the impact of this transaction. Ultimately, investors should conduct their own due diligence to determine whether investing in B. Riley Financial is the right choice for them based on their individual objectives and risk tolerance.

Recent Posts