Apple Shares Could See Record Highs In The Next Three Years

April 18, 2023

Trending News ☀️

Apple Inc ($NASDAQ:AAPL). is the world’s most valuable public company and its stock has seen an incredible 30 percent increase year-to-date. Analysts are predicting that Apple shares could reach record highs in the next three years, potentially reaching unprecedented heights by 2023. The company has grown from its humble beginnings as a garage-based operation to become a tech giant and global leader in consumer electronics, software, and services. It is known for popular products such as the iPhone, iPad, Mac, iPod, and Apple Watch. Apple also offers a variety of digital content and services, including the App Store, iCloud, Apple Music, and Apple TV+. Apple’s success is attributed to its strong customer base and loyal following. This fan base has been built over the years through the company’s innovative product designs and intuitive user experiences.

In addition, Apple has a reputation for providing superior customer service, which keeps users coming back time and time again. As such, investors may want to consider investing in the tech giant now to benefit from the potential growth in the near future.

Price History

Monday saw Apple Inc shares open at $165.1 and close at $165.2, hinting at potential further gains in the coming years. Apple’s recent investments in streaming services and the launch of Apple Card are also seen as potential catalysts for further growth. The future of Apple Inc looks like it’s full of potential, with many predicting that it could be a record-breaking three years for the tech giant. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apple Inc. More…

| Total Revenues | Net Income | Net Margin |

| 387.54k | 95.17k | 24.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apple Inc. More…

| Operations | Investing | Financing |

| 109.19k | -7.69k | -118.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apple Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.75k | 290.02k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Apple Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 19.9% | 30.1% |

| FCF Margin | ROE | ROA |

| 25.2% | 135.9% | 21.0% |

Analysis

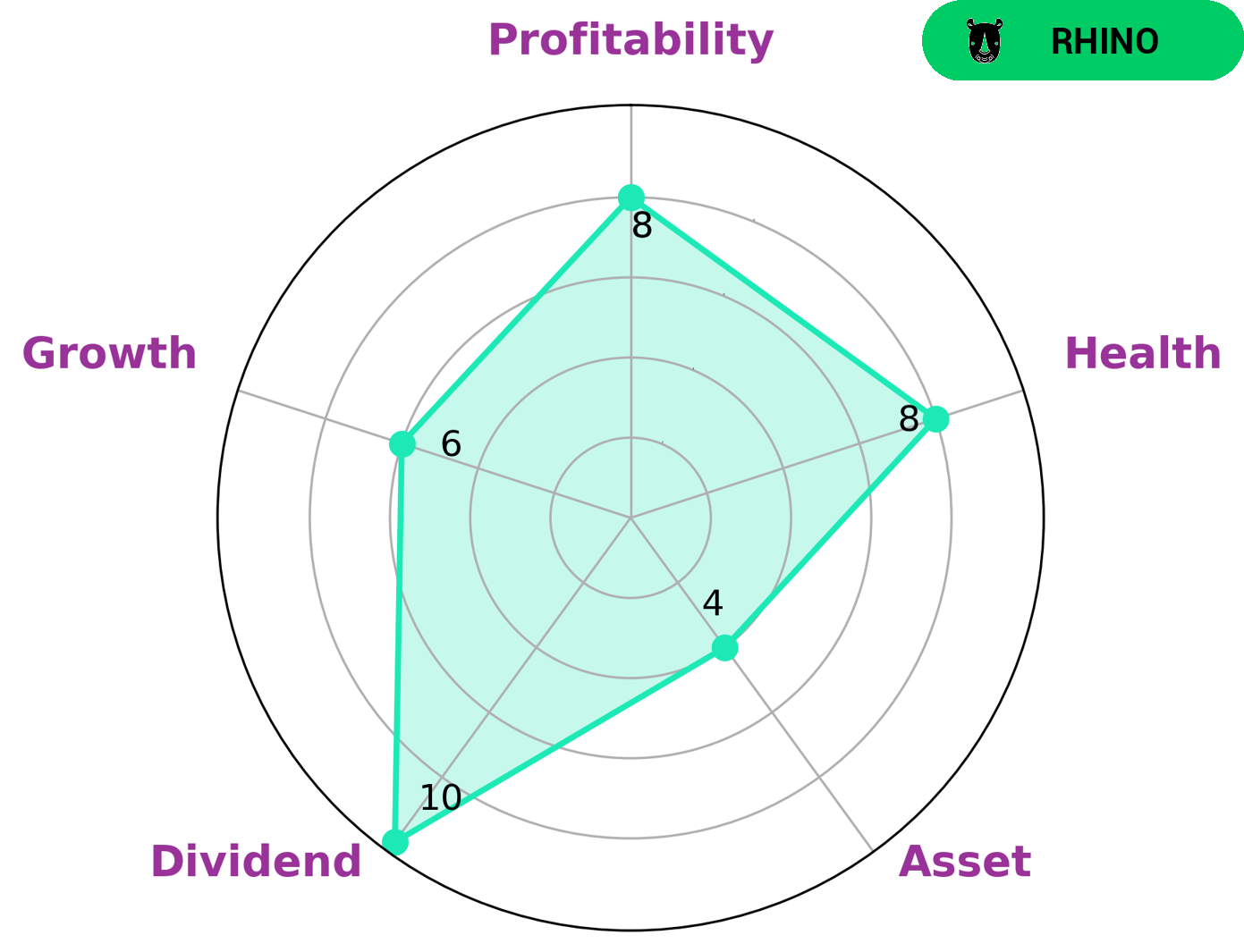

GoodWhale has analyzed the fundamentals of APPLE INC and has given it a high health score of 8/10, indicating its strong cashflows and debt capabilities that enable it to sustain future operations in times of crisis. We have classified APPLE INC as a ‘rhino’, indicating that it has achieved moderate revenue or earnings growth. Investors interested in APPLE INC will be primarily drawn to its strong dividend and profitability, while it is also capable of offering medium asset and growth. As a result, investors who are looking for a low-risk, steady investment may find APPLE INC to be an attractive choice. More…

Peers

The competition between Apple Inc and its competitors, Cisco Systems Inc, Microsoft Corp, and Sony Group Corp, has been intense over the years. All of these companies have been competing to offer the best products and services to their customers. Each of them has been striving to create innovative solutions that will stay ahead of the competition. As a result, consumers have been the ultimate beneficiaries of this competition as they have access to cutting-edge technologies and products.

– Cisco Systems Inc ($NASDAQ:CSCO)

Cisco Systems Inc is a multinational technology company that designs, manufactures and sells networking equipment. As of 2023, the company has a market capitalization of 199.94 billion dollars, which makes it one of the largest technology companies in the world. Furthermore, its Return on Equity (ROE) stands at 23.05%, which is an indication of its impressive financial performance. Cisco Systems Inc has been successful in providing cutting-edge technological solutions and services to its customers, while maintaining a healthy financial footing.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is a multinational technology company that develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Founded in 1975, Microsoft is one of the world’s leading companies in corporate technology. With a market cap of 1.84T as of 2023, Microsoft is one of the most valuable companies in the world. Microsoft’s Return on Equity (ROE) of 29.64% is also one of the highest rates in the corporate sector. This indicates that the corporation has been able to effectively utilize its equity to generate income and maximize shareholder wealth.

– Sony Group Corp ($TSE:6758)

Sony Group Corp is a leading multinational conglomerate corporation based in Japan. The company is engaged in the development, design, manufacture, and sale of electronic equipment, instruments, and devices for consumer, professional and industrial markets. As of 2023, Sony Group Corp has a market cap of 14.3T, making it one of the largest companies in the world. Additionally, the company has a Return on Equity (ROE) of 10.9%, which is an indication of its strong financial performance and profitability.

Summary

Analysts have suggested that the company’s increasing revenue from its services segment, as well as the successful launch of several new products, are driving the positive share performance. Strong investor sentiment has also been bolstered by Apple’s commitment to fair and responsible business practices, as well as their commitment to environmentally friendly operations. Despite this optimism, investors should remain cognizant of the risks associated with investing in Apple, including potential macroeconomic headwinds and stiff competition from other technology giants.

Recent Posts