Apple Pay Later: Uncovering the Surprising Benefits of Apple’s Payment Option

April 2, 2023

Trending News ☀️

Apple Inc ($NASDAQ:AAPL) is an American multinational technology company that is best known for producing products such as the iPhone, iPad, Apple Watch, and Mac computer.

In addition, Apple has recently developed its own payment option called Apple Pay Later. This payment system allows users to make purchases using their Apple accounts and have the transactions completed in a very secure and convenient manner. One of the surprising benefits of using Apple Pay Later is that it offers users a way to avail themselves of better deals and discounts when making purchases. Many retailers and businesses offer discounts to customers who use Apple Pay Later, as this helps to simplify the purchasing process for both parties involved. Furthermore, Apple Pay Later is also integrated with reward programs available from many stores, allowing customers to easily collect points and redeem them for items. Another great benefit of using Apple Pay Later is that it is extremely secure. This payment system is backed by Apple’s advanced security protocols and utilizes Touch ID technology to authenticate transactions. As a result, users can be sure that their information is safe and secure when using Apple Pay Later.

Additionally, the payment system is also compatible with major credit cards, providing customers with more flexibility when making purchases online. In conclusion, Apple Pay Later offers users numerous benefits when making purchases. From discounts and reward programs to increased security, this payment system can make shopping easier and more enjoyable. With Apple Pay Later, customers have access to better deals, more convenience, and additional peace of mind when conducting transactions online.

Stock Price

Apple Pay Later is Apple Inc‘s payment option which allows customers to purchase items without the need of cash or credit cards. On Friday, Apple Inc’s stock opened at $162.4 and closed at $164.9, up by 1.6% from the previous closing price of $162.4. This growth in stock price is indicative of the increasing popularity of Apple Pay Later as an alternative payment option for customers. Specifically, Apple Pay Later offers several benefits to its customers. Firstly, it provides a secure and convenient form of payment since users only need to scan their device in order to process their payments.

Furthermore, it helps to streamline the checkout process since customers do not need to enter their credit card details or wait for cash payments to be made. Lastly, Apple Pay Later also gives customers the ability to track their purchases and keep track of their spending. It is no surprise that it is becoming increasingly popular among customers and is contributing to the growth of Apple Inc’s stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apple Inc. More…

| Total Revenues | Net Income | Net Margin |

| 387.54k | 95.17k | 24.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apple Inc. More…

| Operations | Investing | Financing |

| 109.19k | -7.69k | -118.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apple Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.75k | 290.02k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Apple Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 19.9% | 30.1% |

| FCF Margin | ROE | ROA |

| 25.2% | 135.9% | 21.0% |

Analysis

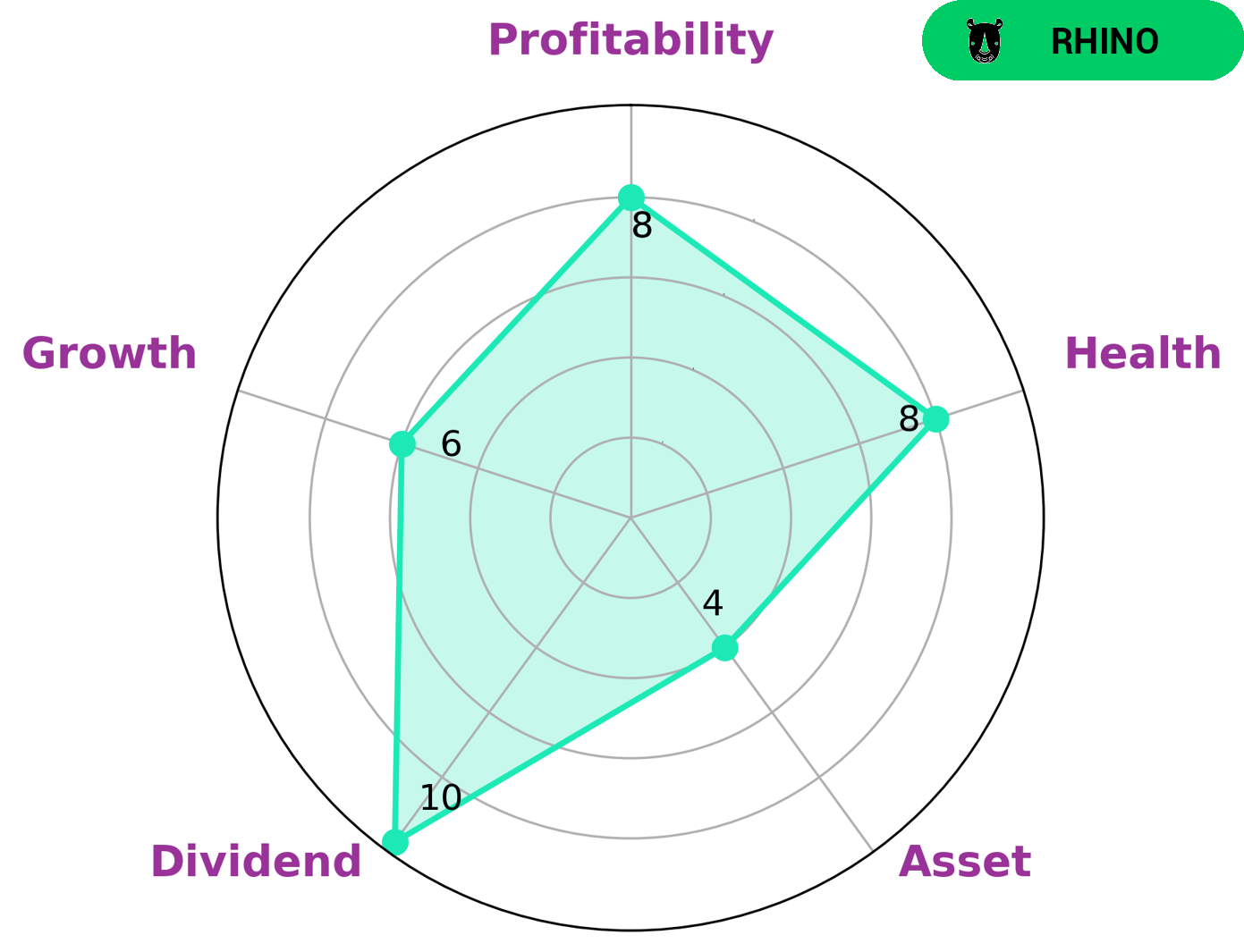

GoodWhale conducted an analysis of APPLE INC‘s financials and found that the company is classified as a ‘rhino’, indicating that it has achieved moderate revenue or earnings growth. We believe that investors who are looking for a stable investment would be interested in APPLE INC, as the company has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. Furthermore, APPLE INC is strong in dividend and profitability, and medium in asset and growth. All of these factors taken together make it an attractive option for investors seeking a long-term return on their investments. More…

Peers

The competition between Apple Inc and its competitors, Cisco Systems Inc, Microsoft Corp, and Sony Group Corp, has been intense over the years. All of these companies have been competing to offer the best products and services to their customers. Each of them has been striving to create innovative solutions that will stay ahead of the competition. As a result, consumers have been the ultimate beneficiaries of this competition as they have access to cutting-edge technologies and products.

– Cisco Systems Inc ($NASDAQ:CSCO)

Cisco Systems Inc is a multinational technology company that designs, manufactures and sells networking equipment. As of 2023, the company has a market capitalization of 199.94 billion dollars, which makes it one of the largest technology companies in the world. Furthermore, its Return on Equity (ROE) stands at 23.05%, which is an indication of its impressive financial performance. Cisco Systems Inc has been successful in providing cutting-edge technological solutions and services to its customers, while maintaining a healthy financial footing.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is a multinational technology company that develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Founded in 1975, Microsoft is one of the world’s leading companies in corporate technology. With a market cap of 1.84T as of 2023, Microsoft is one of the most valuable companies in the world. Microsoft’s Return on Equity (ROE) of 29.64% is also one of the highest rates in the corporate sector. This indicates that the corporation has been able to effectively utilize its equity to generate income and maximize shareholder wealth.

– Sony Group Corp ($TSE:6758)

Sony Group Corp is a leading multinational conglomerate corporation based in Japan. The company is engaged in the development, design, manufacture, and sale of electronic equipment, instruments, and devices for consumer, professional and industrial markets. As of 2023, Sony Group Corp has a market cap of 14.3T, making it one of the largest companies in the world. Additionally, the company has a Return on Equity (ROE) of 10.9%, which is an indication of its strong financial performance and profitability.

Summary

Apple Inc is a multinational technology company that designs and manufactures consumer electronics, software, and online services. The company has a large market capitalization and a strong balance sheet, which makes it an attractive investment. Apple’s revenue has grown steadily over the past decade, and its stock price has seen substantial appreciation.

Apple is also a leader in innovation and its investments in research and development have yielded products such as the iPhone, iPad, Apple Watch, and Apple TV. With a focus on customer satisfaction and a commitment to growing its existing businesses, Apple is likely to remain a popular investment for years to come.

Recent Posts