Apple Inc Stock Intrinsic Value – Apple Thrives in China Despite Trade Tensions, Sees ‘Resilient’ iPhone Demand

April 5, 2023

Trending News ☀️

Apple Inc ($NASDAQ:AAPL). is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. It is one of the world’s most valuable companies, recognized for its iconic products such as the iPhone, iPad, and Mac computers. Despite increasing trade tensions between the United States and China, Apple has seen resilient demand for its iPhones in the Chinese market and has recently increased its share in the market.

According to recent reports, Apple has managed to maintain its spot as the third-largest smartphone vendor in China despite the trade war. This suggests that despite the trade tensions between China and the US, Apple’s products are still popular among Chinese consumers and Apple is managing to stay competitive in the Chinese market.

Market Price

On Monday, Apple Inc. stock opened at $164.3 and closed at $166.2, up by 0.8% from the previous closing price of 164.9, indicating a thriving company amidst ongoing trade tensions between China and the United States. Despite the ongoing trade tensions between the two countries, Apple Inc. has continued to perform well in China, where it is one of the biggest smartphone providers. The company reported strong demand for their iPhone models in China during their most recent quarterly earnings call, which they described as “resilient”. This indicates that their products are still highly sought after by customers, despite ongoing trade tensions and slowing economic growth in the country. Apple Inc. has also introduced new features to their products such as facial recognition and Apple Pay, which have been well received in China.

In addition, Apple Inc. has been expanding its presence in China by opening new stores and partnering with local companies such as Didi Chuxing. Their strategy has been to focus on localizing their products and services for the China market, which has helped them maintain their market share and continue to thrive despite trade tensions between the two countries. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apple Inc. More…

| Total Revenues | Net Income | Net Margin |

| 387.54k | 95.17k | 24.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apple Inc. More…

| Operations | Investing | Financing |

| 109.19k | -7.69k | -118.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apple Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 346.75k | 290.02k | 3.59 |

Key Ratios Snapshot

Some of the financial key ratios for Apple Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 19.9% | 30.1% |

| FCF Margin | ROE | ROA |

| 25.2% | 135.9% | 21.0% |

Analysis – Apple Inc Stock Intrinsic Value

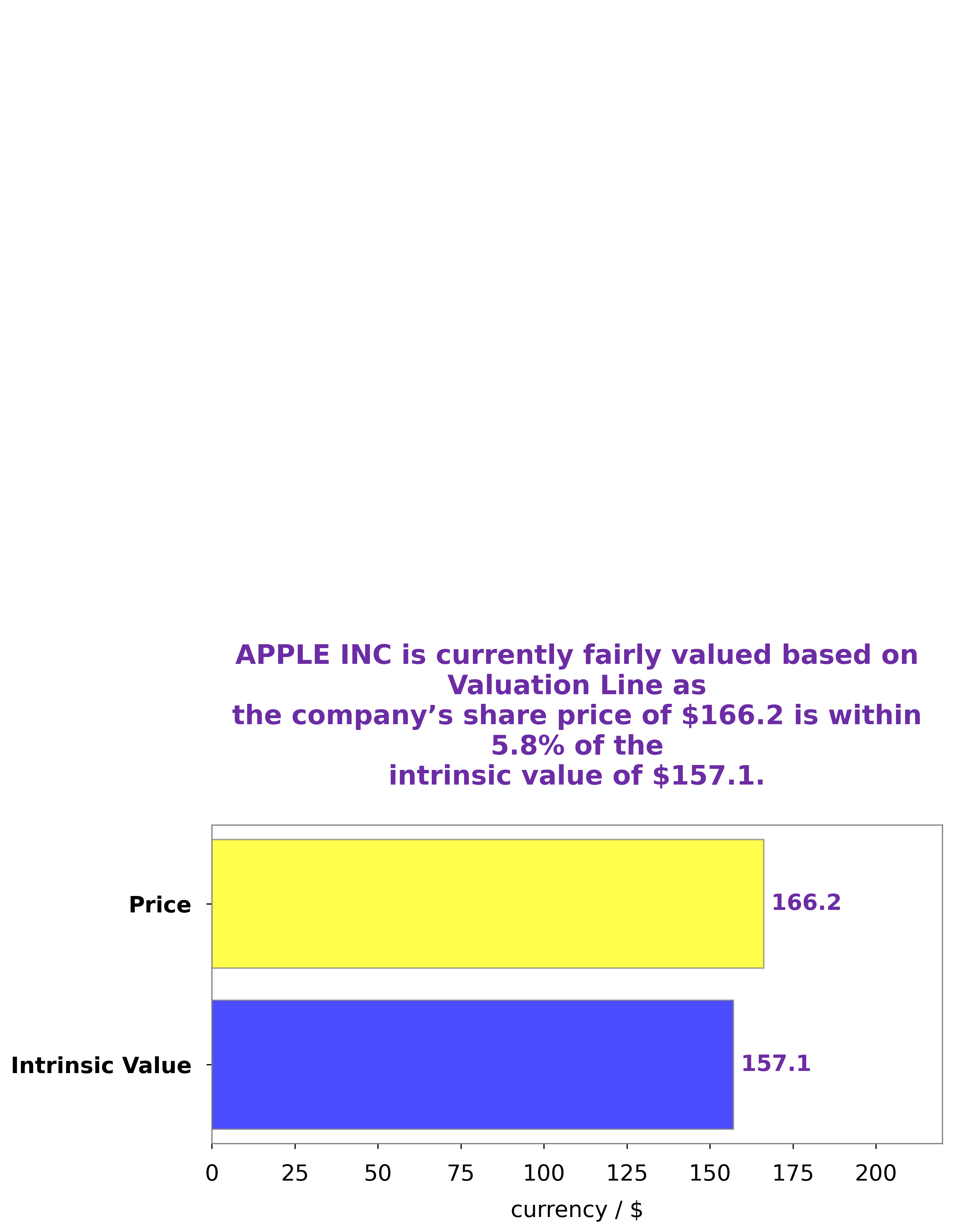

At GoodWhale, we conducted an analysis of APPLE INC‘s fundamentals and concluded that the intrinsic value of its share is around $157.1, calculated by our proprietary Valuation Line. We believe that the current market price of APPLE INC stock, which is trading at $166.2, is a fair price; however, it is slightly overvalued by 5.8%. More…

Peers

The competition between Apple Inc and its competitors, Cisco Systems Inc, Microsoft Corp, and Sony Group Corp, has been intense over the years. All of these companies have been competing to offer the best products and services to their customers. Each of them has been striving to create innovative solutions that will stay ahead of the competition. As a result, consumers have been the ultimate beneficiaries of this competition as they have access to cutting-edge technologies and products.

– Cisco Systems Inc ($NASDAQ:CSCO)

Cisco Systems Inc is a multinational technology company that designs, manufactures and sells networking equipment. As of 2023, the company has a market capitalization of 199.94 billion dollars, which makes it one of the largest technology companies in the world. Furthermore, its Return on Equity (ROE) stands at 23.05%, which is an indication of its impressive financial performance. Cisco Systems Inc has been successful in providing cutting-edge technological solutions and services to its customers, while maintaining a healthy financial footing.

– Microsoft Corp ($NASDAQ:MSFT)

Microsoft Corporation is a multinational technology company that develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Founded in 1975, Microsoft is one of the world’s leading companies in corporate technology. With a market cap of 1.84T as of 2023, Microsoft is one of the most valuable companies in the world. Microsoft’s Return on Equity (ROE) of 29.64% is also one of the highest rates in the corporate sector. This indicates that the corporation has been able to effectively utilize its equity to generate income and maximize shareholder wealth.

– Sony Group Corp ($TSE:6758)

Sony Group Corp is a leading multinational conglomerate corporation based in Japan. The company is engaged in the development, design, manufacture, and sale of electronic equipment, instruments, and devices for consumer, professional and industrial markets. As of 2023, Sony Group Corp has a market cap of 14.3T, making it one of the largest companies in the world. Additionally, the company has a Return on Equity (ROE) of 10.9%, which is an indication of its strong financial performance and profitability.

Summary

Apple Inc. has seen resilient demand for its products, especially the iPhone, during the pandemic. This has been boosted by increased market share in China, despite the US-China tensions. This has resulted in Apple’s stock being one of the strongest performers on the Dow Jones Industrial Average, boosting its market value to over $2 trillion. Analysts have been impressed with the company’s strong financial performance and resilience during a difficult time for the global economy.

Apple has also continued to invest in innovation, growing its services and product lines, which should provide an additional boost to its future performance. Although volatility in the markets could affect its stock price in the short term, long-term investors should be optimistic about the company’s prospects.

Recent Posts