VERISK ANALYTICS Reports Q2 FY 2023 Earnings Results on August 2, 2023

August 15, 2023

🌥️Earnings Overview

On August 2, 2023, VERISK ANALYTICS ($NASDAQ:VRSK) released their financial report for the second quarter of fiscal year 2023, which ended on June 30, 2023. The company reported total revenue of USD 675.0 million, a 9.6% decrease from the same period in the previous year. Meanwhile, net income for the quarter decreased by 0.4% year-on-year, to USD 196.9 million.

Price History

On Wednesday, August 2, 2023, VERISK ANALYTICS reported its second-quarter FY 2023 earnings results. The stock opened at $226.4 and closed at $232.4, representing a 1.4% increase from its prior closing price of 229.2. The company also announced new strategic initiatives that will help the company further expand its presence in the predictive analytics space.

These initiatives include the launch of new products and services, as well as a focus on developing new partnerships and collaborations with other firms in the industry. Overall, VERISK ANALYTICS’ strong earnings results and the introduction of new strategic initiatives demonstrate that the company is well-positioned to continue to generate solid returns and growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verisk Analytics. More…

| Total Revenues | Net Income | Net Margin |

| 2.57k | 503.7 | 19.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verisk Analytics. More…

| Operations | Investing | Financing |

| 1.09k | 2.71k | -3.97k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verisk Analytics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.32k | 4.01k | 2.03 |

Key Ratios Snapshot

Some of the financial key ratios for Verisk Analytics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.6% | -0.3% | 43.9% |

| FCF Margin | ROE | ROA |

| 32.0% | 388.5% | 16.3% |

Analysis

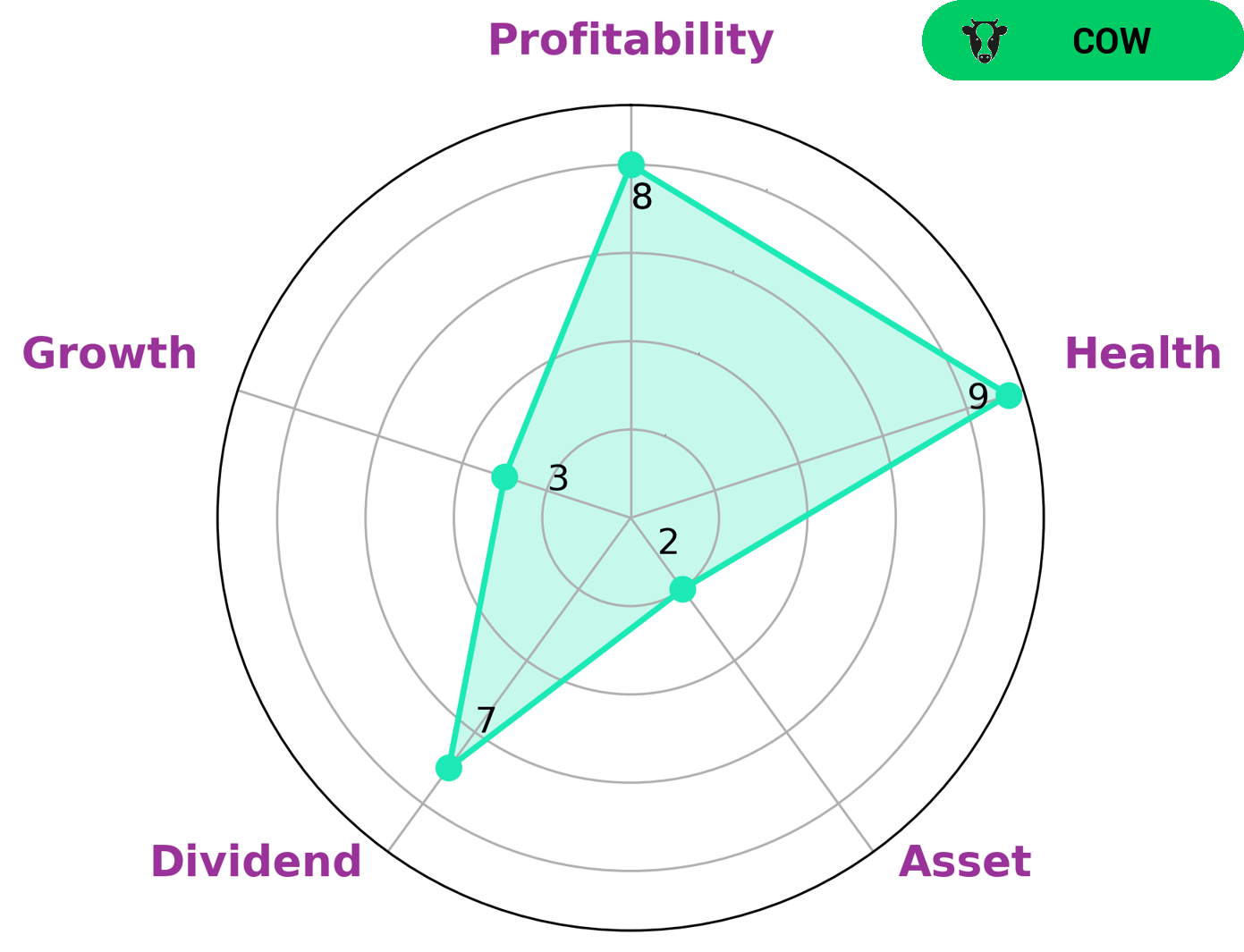

At GoodWhale, we have conducted an analysis of VERISK ANALYTICS‘ wellbeing. Star Chart classified the company as a ‘cow’, a type of company with a track record of paying consistent and sustainable dividends. This makes VERISK ANALYTICS an attractive option for investors looking for a steady passive income. We found that VERISK ANALYTICS is strong in dividend and profitability, but weak in growth and asset. Despite this, it received a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The competition between Verisk Analytics Inc and its competitors is fierce. IHS Markit Ltd, Trinet Group Inc, and Insperity Inc are all fighting for market share in the competitive data analytics industry. Verisk Analytics Inc has a strong product offering and a solid reputation, but its competitors are not far behind. IHS Markit Ltd has a strong product offering as well, and Trinet Group Inc has a good reputation. Insperity Inc is a newer player in the industry, but it has a lot of potential.

– IHS Markit Ltd ($NYSE:TNET)

Trinet Group Inc is a professional employer organization that provides human resources solutions to small and medium-sized businesses. The company has a market cap of $4.04 billion and a return on equity of 41.85%. Trinet Group Inc offers a range of services including payroll, benefits, workers’ compensation, and compliance. The company serves businesses in a variety of industries including healthcare, technology, manufacturing, and retail.

– Trinet Group Inc ($NYSE:NSP)

Inspriety Inc is a human resources and business solutions provider based in the United States. The company has a market capitalization of 4.59 billion as of 2022 and a return on equity of 366.51%. Inspriety provides a range of services including payroll, benefits, and compliance solutions to businesses of all sizes. The company has a strong focus on small and medium-sized businesses, and has a client base of over 100,000 businesses.

Summary

Verisk Analytics reported their second quarter earnings for fiscal 2023 on August 2nd, with total revenue of USD 675.0 million, a 9.6% decrease from the same period the year prior. Net income was reported as USD 196.9 million, a 0.4% decrease year over year. Investors should analyze the company’s financials further before investing in Verisk Analytics, as this data indicates a downward year-over-year trend in revenue and net income. It is important to consider the company’s competitive landscape, potential market trends, and risk factors in making an informed investment decision.

Recent Posts