TransUnion UK Welcomes Neil Bentley as New General Counsel

February 10, 2023

Trending News ☀️

TRANSUNION ($NYSE:TRU): TransUnion UK is delighted to announce the appointment of Neil Bentley as its new General Counsel. Neil is a highly experienced lawyer, having served as a partner in the corporate law department of an international law firm for more than a decade. He has a wealth of experience in business transactions, commercial contracts and corporate governance. It helps to empower customers with the knowledge and data needed to make informed financial decisions, manage risk and protect their identities. By providing solutions to its customers, TransUnion helps to drive economic growth and help create a better future. Neil’s appointment at TransUnion will bring his wealth of experience to the company, helping ensure it continues to maintain the highest standards of corporate governance, compliance and commercial transactions.

His expertise will be invaluable as the company continues to expand its operations across the UK and Europe. Neil is looking forward to being part of the team at TransUnion and working closely with the Board of Directors and senior management team to ensure the company continues to provide the best outcomes for its customers. He is confident that his experience and knowledge will help TransUnion to achieve its goals. With his expertise and guidance, TransUnion is confident that it will be able to continue to provide customers with the best solutions for their financial needs.

Market Price

Mr. Bentley is a seasoned professional, with several years of legal experience in the UK and international markets. He is highly respected in the legal industry and his impressive resume includes noteworthy stints at some of the top firms in Britain. Along with the announcement of his appointment, TRANSUNION‘s stock opened at $71.3 and closed at $70.6, down by 1.4% from last closing price of 71.6. Despite this, TRANSUNION is confident that Mr. Bentley’s years of experience, strategic vision and legal expertise can add significant value to the company’s operations and lead to greater returns in the near future. Mr. Bentley brings a wealth of knowledge and skills to the table. Having worked in both private and public sectors, he has handled complex legal issues on a global scale and is well-versed in the nuances of international law.

He has also represented clients in multiple countries including the US, UK, Germany, France, Spain and Italy. In addition to his impressive résumé, Mr. Bentley is also an outstanding communicator who excels at managing relationships and motivating others. He understands the complexities of the legal field and is adept at developing efficient solutions to intricate cases. The board of directors at TRANSUNION UK have expressed their excitement over Mr. Bentley’s appointment, emphasizing that he is an important asset to the company who will help them remain competitive in a constantly evolving market. With his leadership, TRANSUNION expects to further expand their presence in the UK, Europe and beyond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transunion. More…

| Total Revenues | Net Income | Net Margin |

| 3.6k | 1.24k | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transunion. More…

| Operations | Investing | Financing |

| 223.5 | -2.74k | 2.43k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transunion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.8k | 7.65k | 21.04 |

Key Ratios Snapshot

Some of the financial key ratios for Transunion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 1.0% | 15.7% |

| FCF Margin | ROE | ROA |

| -1.2% | 8.7% | 3.0% |

Analysis

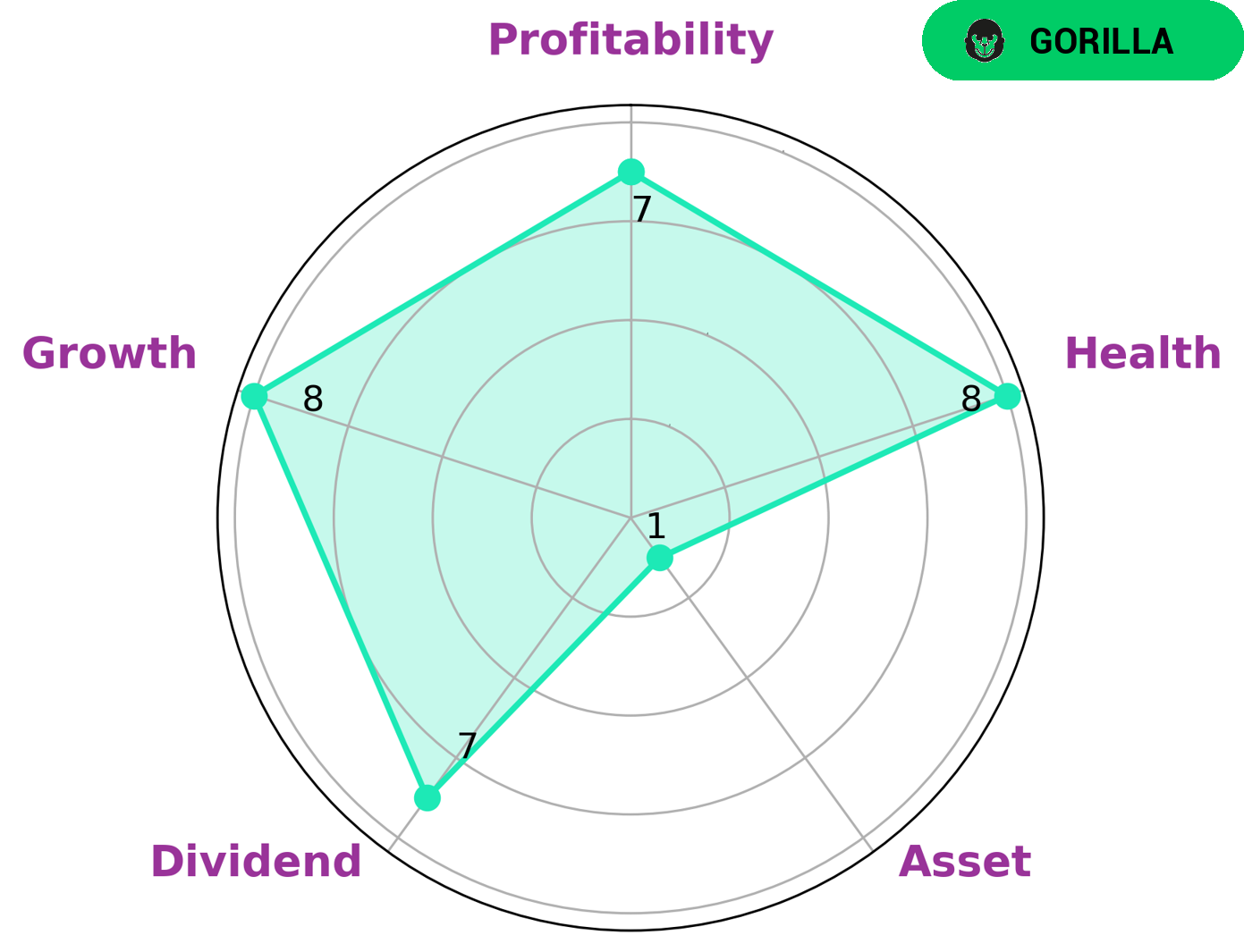

GoodWhale’s analysis of TRANSUNION has revealed that the company is classified as a ‘gorilla’ due to its strong competitive advantage which resulted in stable and high revenue or earning growth. In terms of investor appeal, TRANSUNION has a strong dividend, good growth and profitability, but is weaker in terms of asset utilization. TRANSUNION’s health score is 8/10, indicating that the company is well-positioned to sustain future operations even in times of crisis due to its strong cashflows and debt management. Given these factors, TRANSUNION is an attractive investment opportunity for growth investors, as it possesses long-term upside potential given its strong competitive advantage. Dividend investors can also benefit from the company’s consistent dividend payouts. However, value investors may find the company less attractive due to its relatively weaker asset utilization. In conclusion, TRANSUNION’s strong competitive advantage and its ability to maintain healthy cashflows and debt positions make it an attractive investment opportunity for those looking for a combination of growth potential and dividend income. More…

Peers

The company was founded in 1968 and is headquartered in Chicago, Illinois.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.81B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to clients in a variety of industries. Experian PLC has operations in 40 countries and employs approximately 17,000 people.

– Equifax Inc ($NYSE:EFX)

As of 2022, Equifax Inc has a market cap of 18.4B and a Return on Equity of 18.44%. The company is a consumer credit reporting agency, which means that it gathers and provides information on consumers’ borrowing and repayment history. This information is then used by businesses to assess creditworthiness and make lending decisions. Equifax is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

– CRA International Inc ($NASDAQ:CRAI)

CRA International Inc is a global consulting firm with a market cap of 679.36M as of 2022. The company has a Return on Equity of 17.68%. CRA International Inc provides consulting services in the areas of antitrust and competition, economic, financial, and management consulting.

Summary

TransUnion is a leading global risk and information solutions company, providing data-driven solutions to financial institutions and businesses, helping them make better decisions while managing risk. Its recently appointed General Counsel, Neil Bentley, has extensive experience in financial services and corporate law. As part of its commitment to investors, TransUnion provides comprehensive analysis of economic trends and credit cycles, helping evaluate risk and return. It also offers a variety of data products for investors to make informed decisions about their investments.

The company also implements stringent security and privacy policies to ensure data safety. TransUnion is committed to enhancing shareholder value through financial and strategic decisions.

Recent Posts