TransUnion Reports Q4 2023 Non-GAAP EPS of $0.78, Falling $0.04 Short of Expectations.

February 15, 2023

Trending News 🌧️

TRANSUNION ($NYSE:TRU): TransUnion is a leading global provider of data and analytics solutions. They use technology to provide businesses and consumers with access to financial, personal, and credit information. Despite the growth in revenue, TransUnion fell short of expectations in Q4 due to higher operating costs and expenses.

Looking ahead, TransUnion expects to continue to grow its revenue and income in 2023, with the potential for significant upside potential as the company looks to further expand its services. The company plans to invest in technology and customer service initiatives that will help it to further increase customer satisfaction and generate new business opportunities.

Stock Price

The media sentiment in the wake of this news has been mostly negative, as investors had been expecting better results. The stock opened at $70.0 and closed at $68.2, which is a decrease of 1.9% from its last closing price of $69.5. This further adds to the negative sentiment surrounding the company, as investors had hoped for better results from the quarter. Analysts have pointed out that TRANSUNION’s revenue from the quarter was lower than expected, and this is likely what lead to the miss in the Non-GAAP EPS. While it is always disappointing to miss expectations, TRANSUNION must look forward and focus on what it can do to improve its performance in future quarters. The company should also be aware of the potential for regulatory action if its performance does not improve quickly. In addition, investors may become more wary of investing in the company if they are unhappy with the results of upcoming quarters.

However, it is still too early to tell what the long-term consequences of this miss will be, and TransUnion must focus on improving operations and increasing revenue in order to stay competitive in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transunion. More…

| Total Revenues | Net Income | Net Margin |

| 3.6k | 1.24k | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transunion. More…

| Operations | Investing | Financing |

| 223.5 | -2.74k | 2.43k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transunion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.8k | 7.65k | 21.04 |

Key Ratios Snapshot

Some of the financial key ratios for Transunion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 1.0% | 15.7% |

| FCF Margin | ROE | ROA |

| -1.2% | 8.7% | 3.0% |

Analysis

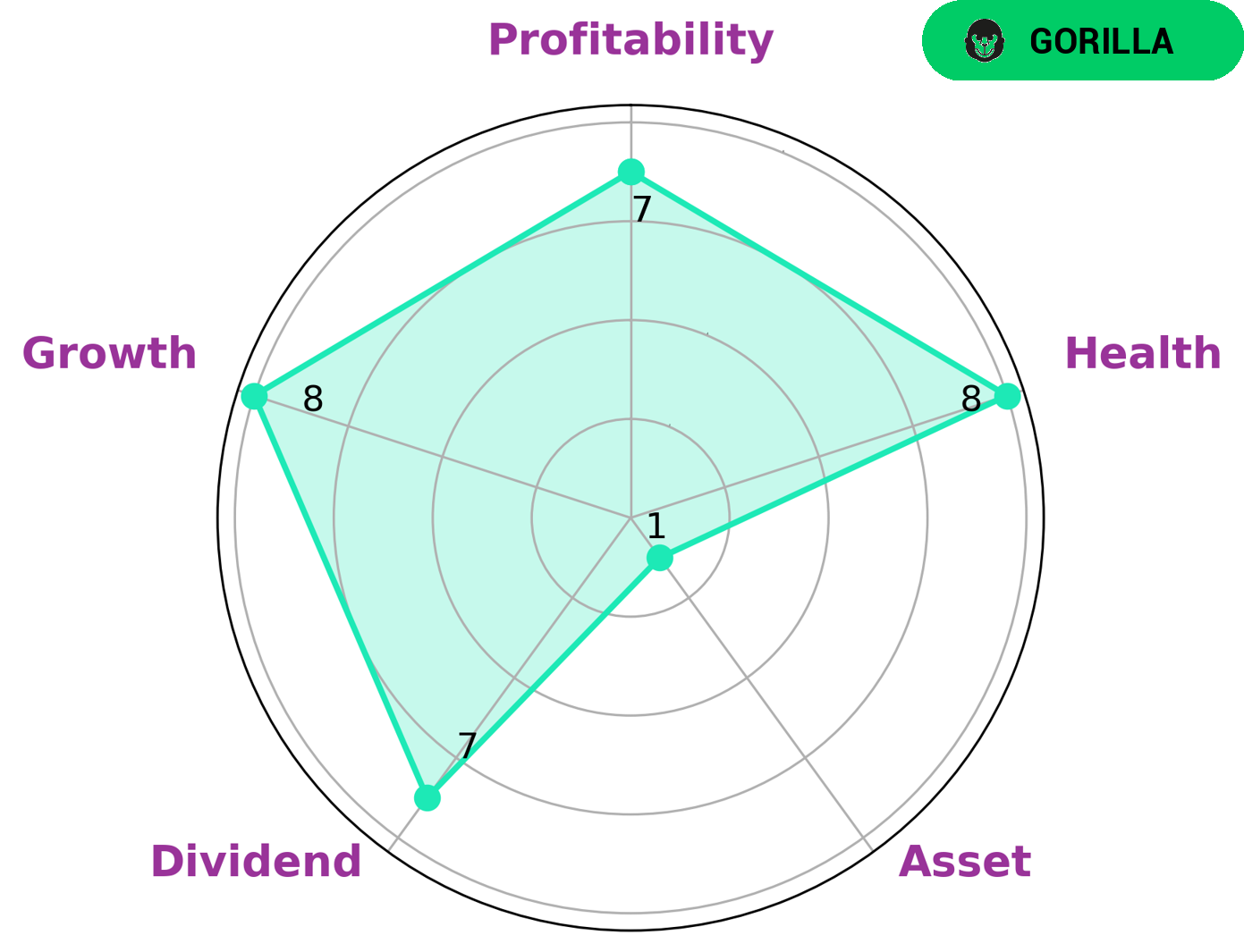

GoodWhale’s analysis of TRANSUNION‘s financials reveals that the company has a high health score of 8/10 with regard to its cashflows and debt, making it a strong candidate for investors. The Star Chart provides a detailed overview of the company’s current operations, showing that it can easily pay off debt and fund future operations. In addition, TRANSUNION is classified as a ‘gorilla’, a type of company that has achieved consistent high revenue or earnings growth due to its strong competitive advantage. Given its strong financial standing, several types of investors may find TRANSUNION attractive. Dividend investors, for example, will appreciate the steady income that TRANSUNION provides, while growth investors may be attracted to its strong potential for future growth. On the other hand, asset investors will not find as much value in TRANSUNION due to its relatively weaker performance in this area. Profitability investors, however, will surely be drawn to the company’s impressive return on investments. In conclusion, TRANSUNION is an ideal candidate for investors interested in dividend, growth, profitability and weak assets. With its robust financials and competitive advantages, the company is well positioned to deliver steady returns while also providing potential for future growth. More…

Peers

The company was founded in 1968 and is headquartered in Chicago, Illinois.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.81B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to clients in a variety of industries. Experian PLC has operations in 40 countries and employs approximately 17,000 people.

– Equifax Inc ($NYSE:EFX)

As of 2022, Equifax Inc has a market cap of 18.4B and a Return on Equity of 18.44%. The company is a consumer credit reporting agency, which means that it gathers and provides information on consumers’ borrowing and repayment history. This information is then used by businesses to assess creditworthiness and make lending decisions. Equifax is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

– CRA International Inc ($NASDAQ:CRAI)

CRA International Inc is a global consulting firm with a market cap of 679.36M as of 2022. The company has a Return on Equity of 17.68%. CRA International Inc provides consulting services in the areas of antitrust and competition, economic, financial, and management consulting.

Summary

Media sentiment has been mostly negative in response to the results, indicating that investors may be feeling less confident in the company. However, TransUnion remains a strong brand in credit reporting and identity management and has potential for long-term growth. Analysts suggest that investors take a long-term approach to this stock, given that the company has a wide range of services and a loyal customer base. While the results were not as expected, it is important to look at the overall performance of the company to make an informed investment decision.

Recent Posts