TransUnion Reports Impressive Quarterly Earnings, Surpassing Expectations

April 26, 2023

Trending News ☀️

TRANSUNION ($NYSE:TRU): TransUnion is a publicly-traded company that provides information and risk management solutions to businesses, employers, and consumers across the globe. The company is focused on helping its customers make better decisions in financial services, insurance, healthcare, and other industries by providing comprehensive data and insights. TransUnion’s services are used to help its customers assess, monitor, and manage risk more effectively.

The company’s strong third quarter results are a testament to its continued success in delivering value to its customers. TransUnion is well positioned for the future, as the increasing demand for data and analytics services makes the company an attractive choice for businesses looking to streamline their operations and minimize risk.

Share Price

TransUnion reported impressive quarterly earnings on Tuesday, surpassing expectations. The stock opened at $66.4 and closed at $63.1, down by 1.2% from the last closing price of 63.8. Despite the slight decrease in share price, the strong quarterly performance highlighted the strength of the company’s core business operations. The company’s overall financial performance and operational excellence remain impressive. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transunion. More…

| Total Revenues | Net Income | Net Margin |

| 3.73k | 273.8 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transunion. More…

| Operations | Investing | Financing |

| 363.4 | -736.5 | -474.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transunion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.56k | 7.23k | 21.89 |

Key Ratios Snapshot

Some of the financial key ratios for Transunion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.0% | 1.0% | 17.1% |

| FCF Margin | ROE | ROA |

| 1.5% | 9.5% | 3.5% |

Analysis

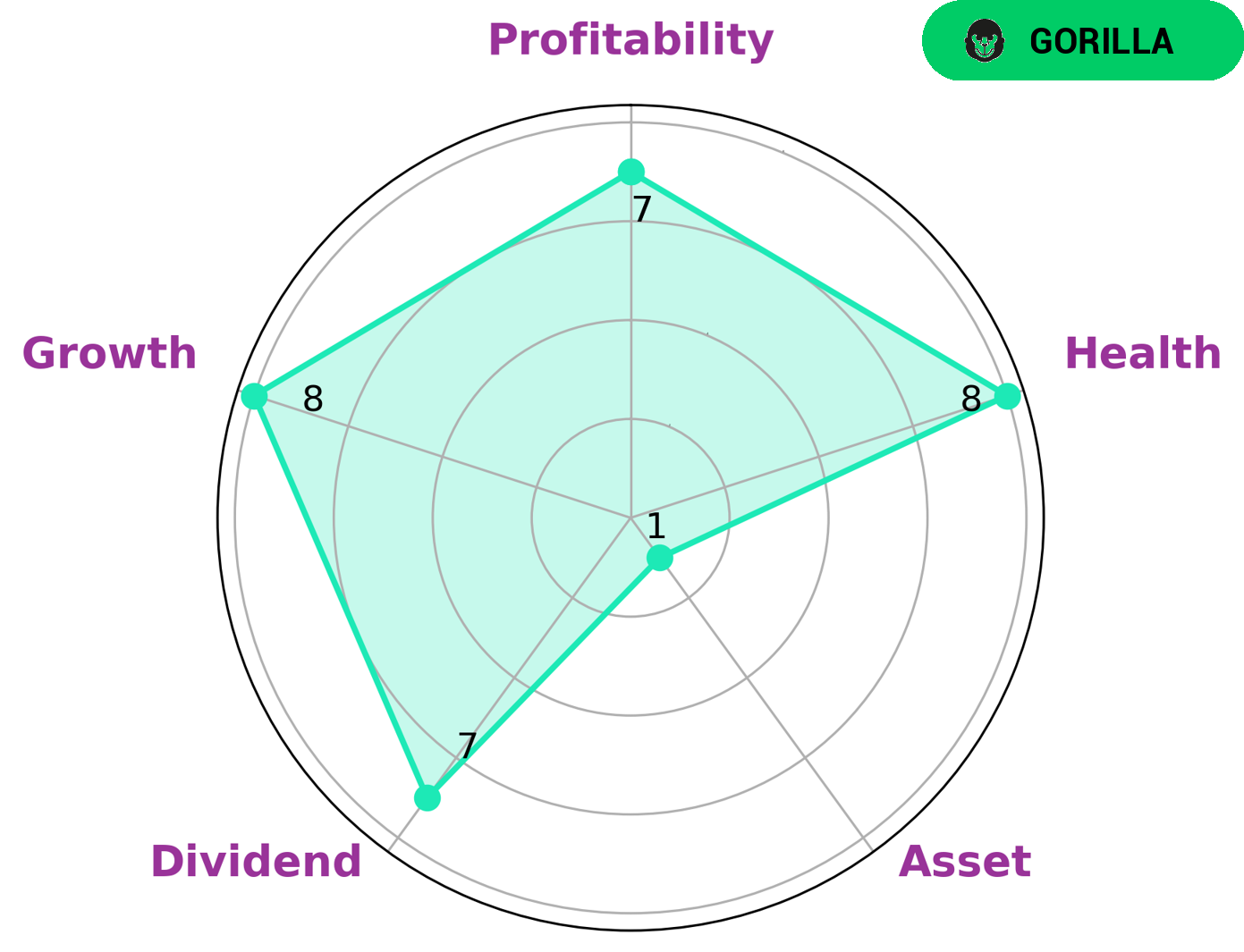

GoodWhale conducted an analysis of TRANSUNION’s wellbeing according to Star Chart. We classified the company as ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who may be interested in such a company would be those that are looking for steady performance in the market with minimal risk. Furthermore, TRANSUNION scored an impressive 8/10 on its health score with regard to cashflows and debt; this indicates its capability to safely ride out any crisis without the risk of bankruptcy. Although TRANSUNION is strong in dividend, growth, profitability, it is weak in asset management. In spite of this, TRANSUNION still proves to be a suitable investment choice for investors seeking safety and stability with their investments. TransUnion_Reports_Impressive_Quarterly_Earnings_Surpassing_Expectations”>More…

Peers

The company was founded in 1968 and is headquartered in Chicago, Illinois.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.81B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to clients in a variety of industries. Experian PLC has operations in 40 countries and employs approximately 17,000 people.

– Equifax Inc ($NYSE:EFX)

As of 2022, Equifax Inc has a market cap of 18.4B and a Return on Equity of 18.44%. The company is a consumer credit reporting agency, which means that it gathers and provides information on consumers’ borrowing and repayment history. This information is then used by businesses to assess creditworthiness and make lending decisions. Equifax is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

– CRA International Inc ($NASDAQ:CRAI)

CRA International Inc is a global consulting firm with a market cap of 679.36M as of 2022. The company has a Return on Equity of 17.68%. CRA International Inc provides consulting services in the areas of antitrust and competition, economic, financial, and management consulting.

Summary

TransUnion recently reported its second quarter earnings, beating analysts’ expectations. The company reported Non-GAAP earnings per share of $0.80, which was $0.06 higher than the consensus estimate. Revenue was also higher than expected, totaling $940.3M and beating estimates by $26.44M.

The stock has responded positively to these results, suggesting investors are pleased with the outperformance. Looking forward, it is likely that investors will continue to monitor TransUnion’s performance as the company looks to capitalize on its strong financial performance.

Recent Posts