Transunion and Rently Join Forces to Enhance Tenant Screening for Family Rental Properties

April 6, 2023

Trending News ☀️

Transunion ($NYSE:TRU), a leading global risk and credit information solutions provider, has recently announced a new partnership with Rently, a digital leasing platform. The collaboration will provide family rental properties with enhanced tenant screening abilities. Through the use of Rently’s digital leasing technology, Transunion’s data and analytic capabilities will offer family rental properties an easy-to-use process to quickly and accurately screen prospective tenants. Transunion is an American consumer credit reporting agency that collects and aggregates information on over one billion consumers and businesses worldwide.

By leveraging its extensive data, Transunion offers its customers valuable insights that can help them make better business decisions. With Transunion’s data and analytic capabilities combined with Rently’s digital leasing technology, rental properties will now have access to comprehensive tenant insights that can help them make informed decision in a timely manner. This will help reduce the time and cost associated with traditional tenant screening as well as provide landlords with insights that are not available through other means.

Share Price

This new collaboration allows TransUnion to offer rental property owners, managers, and investors access to more efficient and comprehensive tenant screening solutions. The news of this alliance sent TransUnion stock up 0.5%, as the stock opened at $60.8 and closed at $60.6, compared to its prior closing price of 60.3. This collaboration is expected to further strengthen TransUnion’s position within the rental industry and provide added value to real estate investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transunion. More…

| Total Revenues | Net Income | Net Margin |

| 3.71k | 269.5 | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transunion. More…

| Operations | Investing | Financing |

| 297.2 | -723.9 | -820.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transunion. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.67k | 7.4k | 21.04 |

Key Ratios Snapshot

Some of the financial key ratios for Transunion are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | 1.2% | 16.7% |

| FCF Margin | ROE | ROA |

| -0.0% | 9.4% | 3.3% |

Analysis

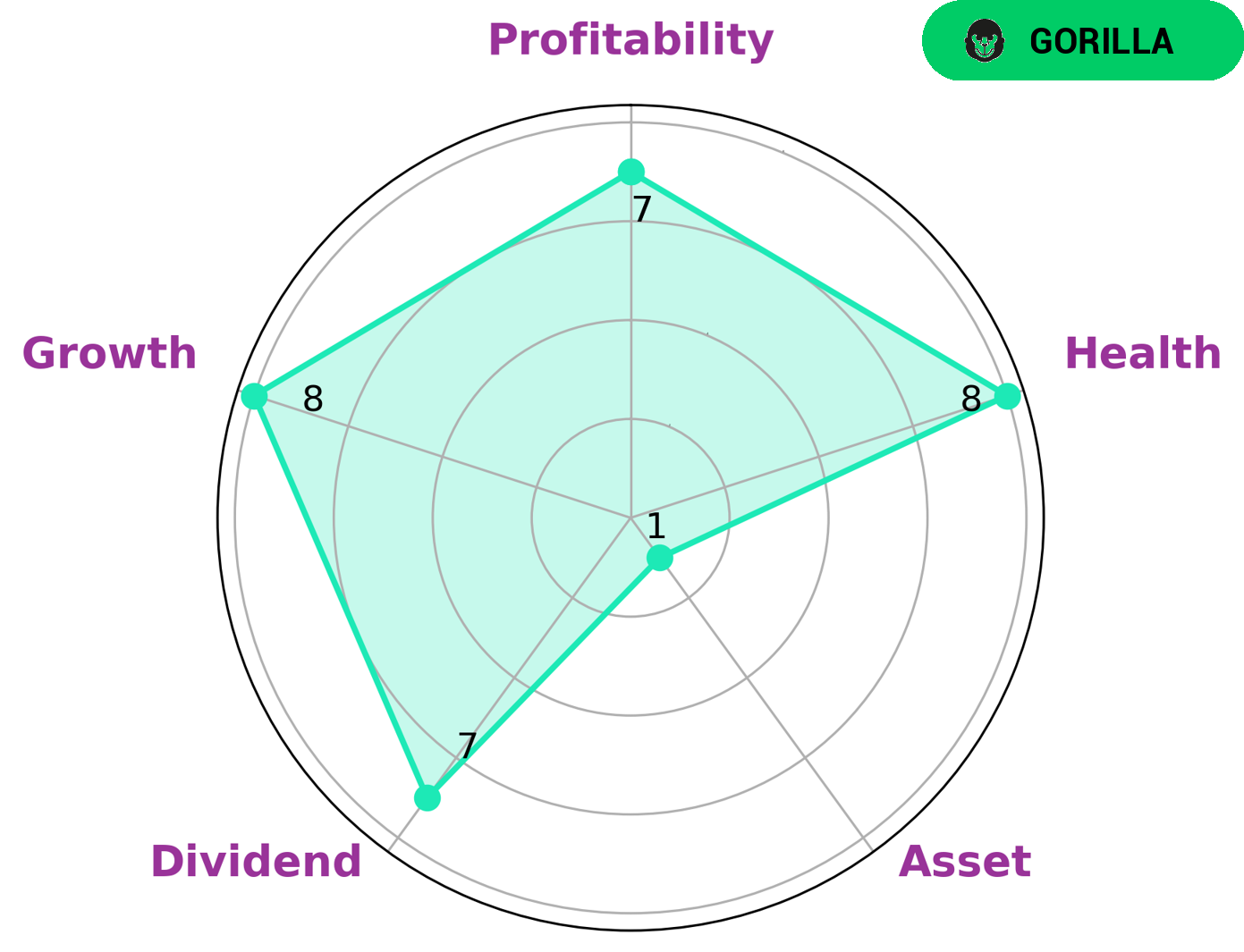

GoodWhale conducted an analysis of TRANSUNION‘s wellbeing and based on the Star Chart, we concluded that TRANSUNION is strong in dividend, growth, and profitability. However, the company is weak in terms of its asset. Further, TRANSUNION is classified as ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Given its strong performance in terms of growth, dividend, and profitability, we believe that value-oriented investors may be interested in this company. Additionally, TRANSUNION has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. This makes it an attractive investment opportunity for risk-averse investors. More…

Peers

The company was founded in 1968 and is headquartered in Chicago, Illinois.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.81B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to clients in a variety of industries. Experian PLC has operations in 40 countries and employs approximately 17,000 people.

– Equifax Inc ($NYSE:EFX)

As of 2022, Equifax Inc has a market cap of 18.4B and a Return on Equity of 18.44%. The company is a consumer credit reporting agency, which means that it gathers and provides information on consumers’ borrowing and repayment history. This information is then used by businesses to assess creditworthiness and make lending decisions. Equifax is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

– CRA International Inc ($NASDAQ:CRAI)

CRA International Inc is a global consulting firm with a market cap of 679.36M as of 2022. The company has a Return on Equity of 17.68%. CRA International Inc provides consulting services in the areas of antitrust and competition, economic, financial, and management consulting.

Summary

Transunion provides a comprehensive analysis of financial investments for businesses and individuals. With its comprehensive credit reports, Transunion delivers a comprehensive overview of an individual’s or business’s credit history, enabling customers to make informed decisions about their investments. Transunion’s research and analysis services cover various investment products such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other derivatives.

Based on data from its proprietary credit bureau, Transunion’s analysis helps users understand the risks involved in investing and to form an actionable plan. It also provides real-time updates on the current financial market conditions, helping customers stay informed and up to date on the latest trends in their investments.

Recent Posts