Equifax Stock Outperforms Despite Day’s Losses, Closing at $200.74 in 2023

March 9, 2023

Trending News ☀️

Despite Wednesday’s mixed stock market session, where the Dow Jones declined overall, Equifax Inc ($NYSE:EFX). still managed to outperform its competitors. The company’s stock price dropped 0.88% to $200.74, yet it still managed to close at a higher rate than the day before. Equifax Inc. is an American consumer credit reporting agency that collects data and provides information on creditworthiness and other financial metrics. The publicly traded company has been a leader in the industry since its inception and is considered one of the “big three” credit bureaus. The success of Equifax Inc.’s shares can be attributed to its strong fundamentals and diverse product portfolio. The company has seen strong growth in its digital offerings and data analytic services, with these areas providing a reliable source of revenue.

Additionally, Equifax has taken steps to improve its security and data protection policies, which have helped to boost investor confidence. All of these measures have contributed to the company’s strong stock performance, even during a weak market environment.

Share Price

Equifax Inc. stock has been performing well despite the day’s losses, closing at $200.74 in 2023. Media sentiment has been mostly positive, with Thursday marking another successful day for the company. Equifax Inc. opened at $198.5 and closed at $202.0, a 0.6% increase from the previous closing price of $200.7.

This marks the sixth consecutive day of gains for the company, with its stock continuing to steadily climb. Investors are seeing the potential in Equifax, leading to increased confidence in the company and its performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Equifax Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.12k | 696.2 | 13.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Equifax Inc. More…

| Operations | Investing | Financing |

| 757.1 | -959.5 | 273.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Equifax Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.55k | 7.57k | 32.3 |

Key Ratios Snapshot

Some of the financial key ratios for Equifax Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 36.4% | 21.7% |

| FCF Margin | ROE | ROA |

| 2.6% | 18.0% | 6.0% |

Analysis

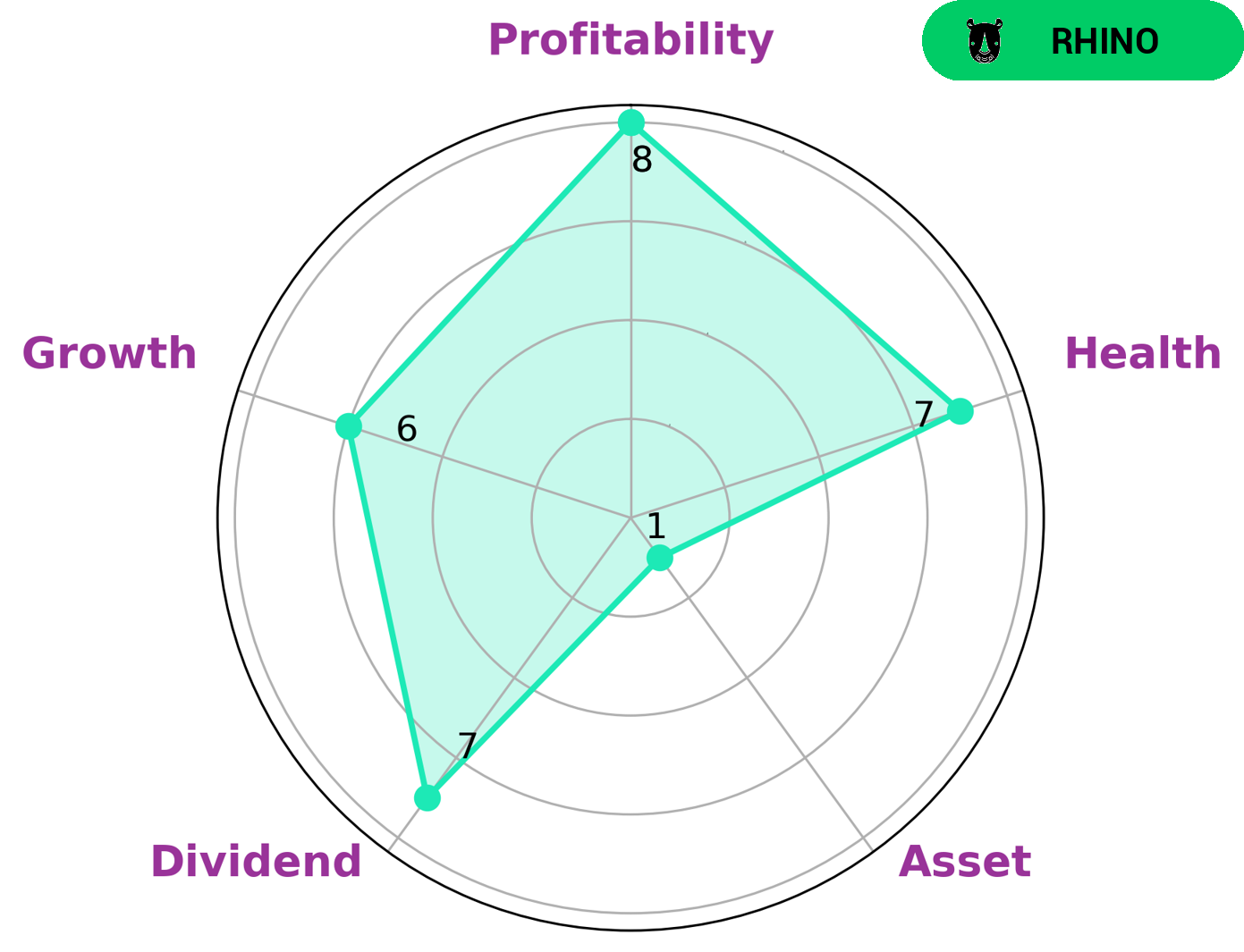

GoodWhale conducted an analysis of the fundamentals of EQUIFAX INC. Our Star Chart indicated a high health score of 7/10, meaning that this company is well-positioned to weather any economic downturn without the risk of bankruptcy. We classified EQUIFAX INC as a “rhino” company, which is one that has achieved moderate revenue or earnings growth. For investors looking to capitalize on the strong dividend and profitability of EQUIFAX INC, while not expecting rapid growth, this could be an attractive option. While EQUIFAX INC was strong in dividend and profitability, it was weaker in terms of growth and assets. As such, investors should consider their personal preferences and risk tolerances when looking at this company as a potential investment. More…

Peers

Equifax Inc. is a credit reporting agency. Its main competitors are TransUnion, Mills Music Trust, and Experian PLC. All three companies compete for credit report customers and business from creditors.

– TransUnion ($NYSE:TRU)

TransUnion is a credit reporting company. It compiles credit information on consumers and businesses, which is used by lenders to make credit decisions. The company also provides other services such as fraud detection, identity theft protection, and credit counseling. TransUnion has a market cap of 10.77B as of 2022, and a Return on Equity of 8.48%.

– Mills Music Trust ($OTCPK:MMTRS)

Mills Music Trust is a publicly traded music royalty company. The company owns the rights to a large catalog of music, which it licenses to businesses and individuals for use in their products and services. Mills Music Trust has a market cap of 10.14M as of 2022. The company generates revenue by licensing its music to businesses and individuals for use in their products and services.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.89B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to its clients. Experian helps businesses to manage credit risk, prevent fraud, target marketing offers and automate decision making.

Summary

Equifax Inc. has been a successful investment despite the overall losses of the day, closing at $200.74 in 2023. The media sentiment surrounding this stock has been mostly positive, with investors citing the company’s strong financials and strong management team as reasons for such success. Analysts have applauded the stock’s consistent dividends, its low debt-to-equity ratio, and its increasing gross profit margin as signs of Equifax’s long-term growth potential.

Those looking to invest in Equifax should also consider the company’s commitment to data security, as well as its innovative products and services that serve customers from individuals to large businesses. Equifax has a bright future, and investors should consider the stock for their portfolios.

Recent Posts