Equifax Inc Intrinsic Value Calculation – Equifax Reports Q1 2021 Revenue Above Expectations Despite Lower-Than-Predicted EPS

April 20, 2023

Trending News 🌥️

Though their GAAP EPS of $0.91 was $0.09 lower than expected, their revenue of $1.3B was $20M higher than was predicted. In addition to their credit reporting services, they offer an array of products and services including credit monitoring, identity theft protection and fraud prevention. They are also a leader in the development of innovative technology that helps their customers better manage financial risk. The company is headquartered in Atlanta, Georgia and is listed on the New York Stock Exchange.

Despite the lower-than-expected EPS figure, Equifax Inc ($NYSE:EFX). is continuing to focus on growing their business by investing in data and analytics, expanding their product portfolio, and delivering superior customer service. With a strong balance sheet and successful investments in technology, the company is well-positioned for continued success in the coming quarters.

Stock Price

On Wednesday, the stock opened at $193.4 and closed at $194.9, up slightly from the previous closing price of 194.8. Despite the strong revenue numbers, Equifax’s earnings per share (EPS) was slightly lower than expected. The company’s offerings reach a wide range of industries, from healthcare to financial services. These investments will help the company remain competitive and capitalize on the digital transformation taking place in many industries. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Equifax Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.12k | 696.2 | 13.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Equifax Inc. More…

| Operations | Investing | Financing |

| 757.1 | -959.5 | 273.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Equifax Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.55k | 7.57k | 30.71 |

Key Ratios Snapshot

Some of the financial key ratios for Equifax Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 36.4% | 21.7% |

| FCF Margin | ROE | ROA |

| 2.6% | 18.0% | 6.0% |

Analysis – Equifax Inc Intrinsic Value Calculation

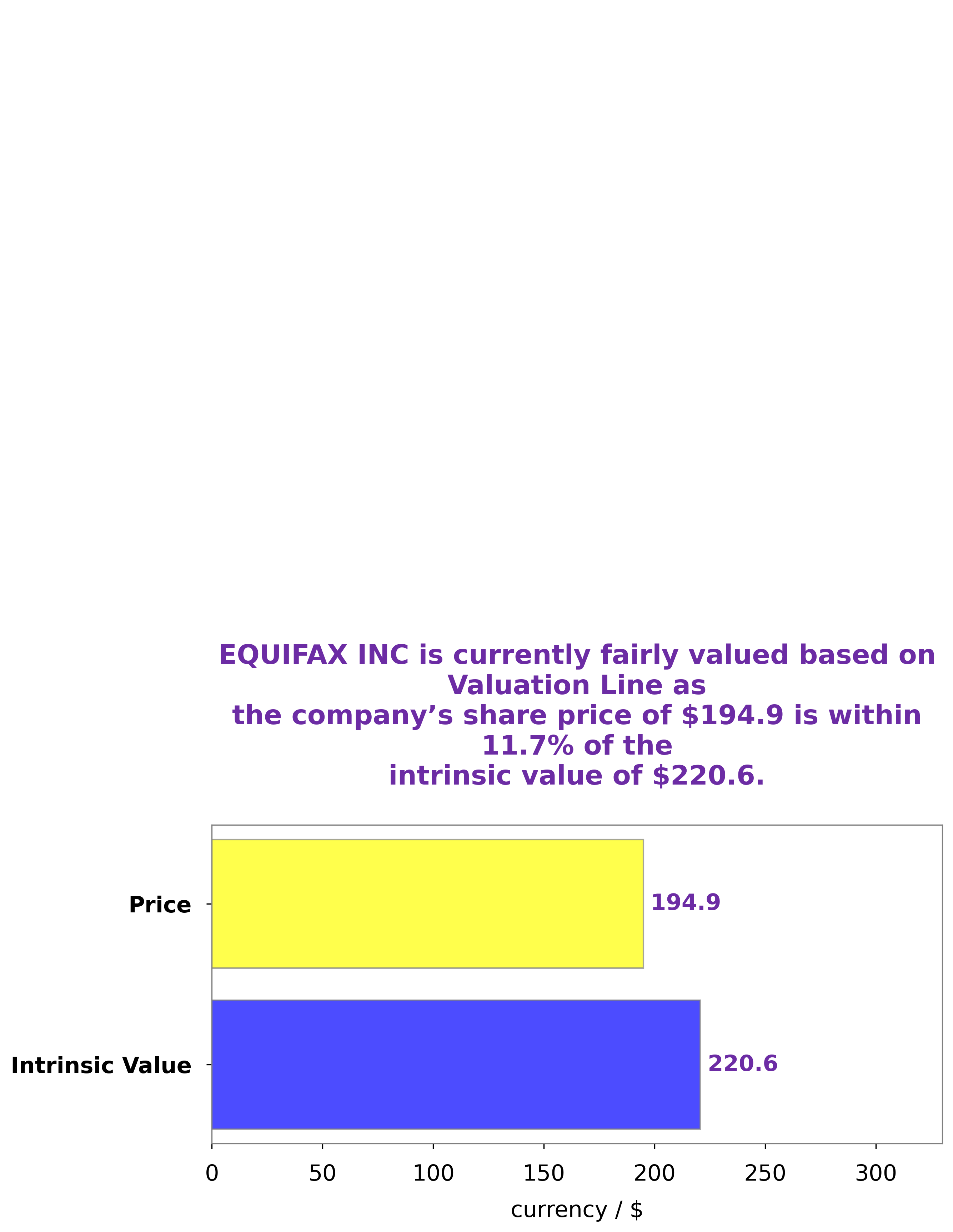

We at GoodWhale have conducted an analysis of EQUIFAX INC‘s fundamentals, and our proprietary Valuation Line has put the fair value of their share at around $220.6. Currently, the stock is being traded for $194.9, which is a fair price but 11.7% undervalued. Therefore, we believe that EQUIFAX INC is a good stock to invest in right now. More…

Peers

Equifax Inc. is a credit reporting agency. Its main competitors are TransUnion, Mills Music Trust, and Experian PLC. All three companies compete for credit report customers and business from creditors.

– TransUnion ($NYSE:TRU)

TransUnion is a credit reporting company. It compiles credit information on consumers and businesses, which is used by lenders to make credit decisions. The company also provides other services such as fraud detection, identity theft protection, and credit counseling. TransUnion has a market cap of 10.77B as of 2022, and a Return on Equity of 8.48%.

– Mills Music Trust ($OTCPK:MMTRS)

Mills Music Trust is a publicly traded music royalty company. The company owns the rights to a large catalog of music, which it licenses to businesses and individuals for use in their products and services. Mills Music Trust has a market cap of 10.14M as of 2022. The company generates revenue by licensing its music to businesses and individuals for use in their products and services.

– Experian PLC ($LSE:EXPN)

As of 2022, Experian PLC has a market cap of 24.89B and a Return on Equity of 34.45%. The company is a global information services company that provides data and analytical tools to its clients. Experian helps businesses to manage credit risk, prevent fraud, target marketing offers and automate decision making.

Summary

The revenue growth was driven by its International and North American Information Solutions segments. Equifax’s total operating expenses also declined, indicating cost-saving measures have been effective. Despite the dip in EPS, Equifax has seen impressive improvement in its fundamentals and financial health over the past year. This includes a significant drop in net debt, and improved cash flow from operations.

The company’s investments in technology and innovation have further enabled Equifax to maintain its leading position in the industry. Overall, investors should be confident in Equifax’s long-term prospects and performance.

Recent Posts