2023 Ratings Changes for Huron Consulting Group Analyzed by Industry Experts.

March 20, 2023

Trending News 🌥️

The Huron Consulting ($NASDAQ:HURN) Group has been the subject of much scrutiny recently, with analysts making frequent ratings changes to their stock. Industry experts have been analyzing the changes, in order to gain a better understanding of the impact they have on the company’s stock and overall performance. The latest ratings changes have analysts looking towards Huron Consulting Group’s 2023 outlook with optimism, as the company is expected to continue its strong performance in the coming years. Huron’s strategic outlook is currently based on its broad portfolio of services, which span multiple sectors and industries, as well as its commitment to addressing ever-changing customer needs. As the company’s core services remain in demand, analysts expect that Huron’s success will continue for the foreseeable future. This positive assessment of the company is largely due to its impressive recent financial results, which have pointed to an improving outlook. Analysts are also paying close attention to any potential risks that could affect Huron Consulting Group’s future performance. One potential area of concern is the company’s reliance on a small number of large clients for much of its revenue.

However, this risk is mitigated by Huron’s broad portfolio of services and its commitment to meeting customer needs. Overall, industry experts are cautiously optimistic about the future of Huron Consulting Group and its 2023 outlook. Analysts will be keeping a close eye on any ratings changes made in the coming weeks and months, in order to get an even better understanding of the company’s performance.

Price History

The news for Huron Consulting Group (HURON) has mostly been positive this year. On Thursday, HURON stock opened at $74.2 and closed at $75.5, a 0.9% increase from the previous day’s closing price of 74.9. This was an indicator of industry expert’s positive outlook on the company’s future performance. They are closely monitoring the company’s ability to stay on top of the ever-changing market conditions and their ability to adjust to the changing needs of their customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Huron Consulting. More…

| Total Revenues | Net Income | Net Margin |

| 1.16k | 75.55 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Huron Consulting. More…

| Operations | Investing | Financing |

| 85.4 | -20.13 | -74.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Huron Consulting. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.2k | 647 | 27.89 |

Key Ratios Snapshot

Some of the financial key ratios for Huron Consulting are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | 19.4% | 9.5% |

| FCF Margin | ROE | ROA |

| 5.3% | 12.4% | 5.7% |

Analysis

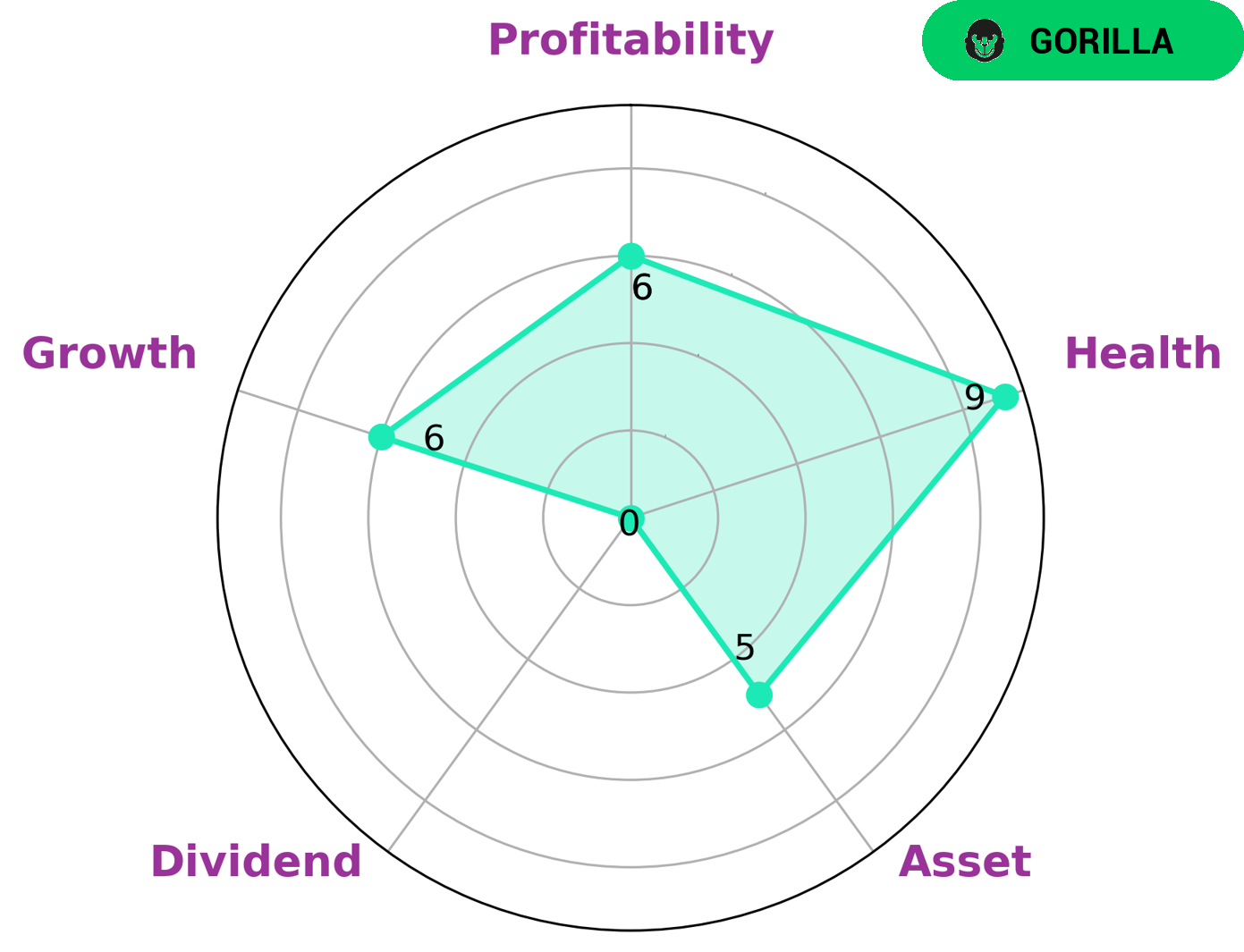

GoodWhale conducted an analysis of HURON CONSULTING‘s financials and found that it is strong in asset, growth, profitability and weak in dividend, as shown in the Star Chart. Additionally, HURON CONSULTING has a high health score of 9/10 with regard to its cashflows and debt, indicating it is capable to pay off debt and fund future operations. HURON CONSULTING is classified as ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. As such, investors who are interested in such companies with strong competitive advantages and stable and high revenue or earning growth may be interested in HURON CONSULTING. More…

Peers

As the global economy continues to experience uncertainty, the consulting industry has become increasingly competitive. Huron Consulting Group, Inc. is one of the leading providers of consulting services, with a focus on helping organizations improve performance, reduce costs, and manage risk. The company competes against other large consulting firms, such as American Education Center, Inc., FTI Consulting, Inc., and Circulation Co., Ltd. While each company has its own strengths and weaknesses, Huron has a proven track record of delivering results for its clients.

– American Education Center Inc ($OTCPK:AMCT)

American Education Center Inc has a market cap of 6.32M as of 2022. The company’s return on equity is 96.84%. The company provides educational services. It offers educational programs and services to students from the United States and around the world. The company’s programs and services include academic counseling, admissions counseling, cultural exchange programs, English language training, and student support services.

– FTI Consulting Inc ($NYSE:FCN)

FTI Consulting is a global business advisory firm. The company provides advice on a wide range of business issues including mergers and acquisitions, enterprise risk management, financial restructuring and litigation. FTI Consulting has a market cap of 5.53B as of 2022 and a Return on Equity of 11.2%. The company has a strong reputation for providing high quality advice and services to its clients.

– Circulation Co Ltd ($TSE:7379)

Circulation Co Ltd is a Japanese company that operates in the healthcare sector. It is engaged in the development, manufacture, and sale of medical devices and equipment. The company has a market capitalization of 13.55 billion as of 2022 and a return on equity of 14.03%. Circulation Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

Summary

HURON Consulting Group is a leading provider of consulting services in the areas of dispute resolution, corporate restructuring, and operational performance. Industry experts have recently analyzed its 2023 ratings and the news is largely positive. Analysis has shown that HURON’s services have been in demand throughout the year, which has allowed the company to generate strong profits and grow its customer base. Investors have noted that the company’s financial position remains stable, with steady cash flow and healthy balance sheets.

HURON Consulting Group has also made numerous acquisitions, which have helped to further bolster their position in the sector. The outlook for the future remains bright, with analysts predicting a continued growth in demand for its services.

Recent Posts