Mitsui Kingzoku Faces Potential Illegal Groundwater Use Charges in 2023

March 15, 2023

Trending News 🌧️

Mitsui ($TSE:8031) Kingzoku, one of India’s leading garment manufacturers, is facing potential charges in 2023 for the illegal use of groundwater. This comes after the National Green Tribunal (NGT) requested a report on a petition that alleges Mitsui Kingzoku has been using groundwater without obtaining the necessary permissions to do so. This has led to a shortage of water in the local area, and the petitioners are calling for the company to be held accountable. The NGT has stated that if it finds evidence of illegal usage, then Mitsui Kingzoku will be charged and held responsible for the demand of groundwater. The petitioners have also requested compensation for the affected people in the area.

Mitsui Kingzoku has denied any wrongdoing and stated that all their activities are carried out in accordance with applicable laws and regulations. The company has also stated that they are working towards a sustainable solution to ensure that the water resources are not depleted any further. While the NGT is still evaluating the petition, Mitsui Kingzoku will be closely monitored in 2023 to determine if any illegal usage is taking place. If so, the company could face charges and be held responsible for the shortage of water in the local area.

Price History

As of the time of writing, media coverage has been largely negative. However, on Thursday, MITSUI stocks opened at JP¥4259.0 and closed at JP¥4291.0, up by 1.4% from last closing price of 4231.0. This indicates that investors are confident that the company is still strong and will be able to weather the storm. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mitsui. More…

| Total Revenues | Net Income | Net Margin |

| 14.2M | 1.12M | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mitsui. More…

| Operations | Investing | Financing |

| 1.05M | -117.2k | -594.44k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mitsui. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.57M | 9.24M | 3.84k |

Key Ratios Snapshot

Some of the financial key ratios for Mitsui are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.8% | 38.3% | 10.4% |

| FCF Margin | ROE | ROA |

| 5.8% | 15.2% | 5.9% |

Analysis

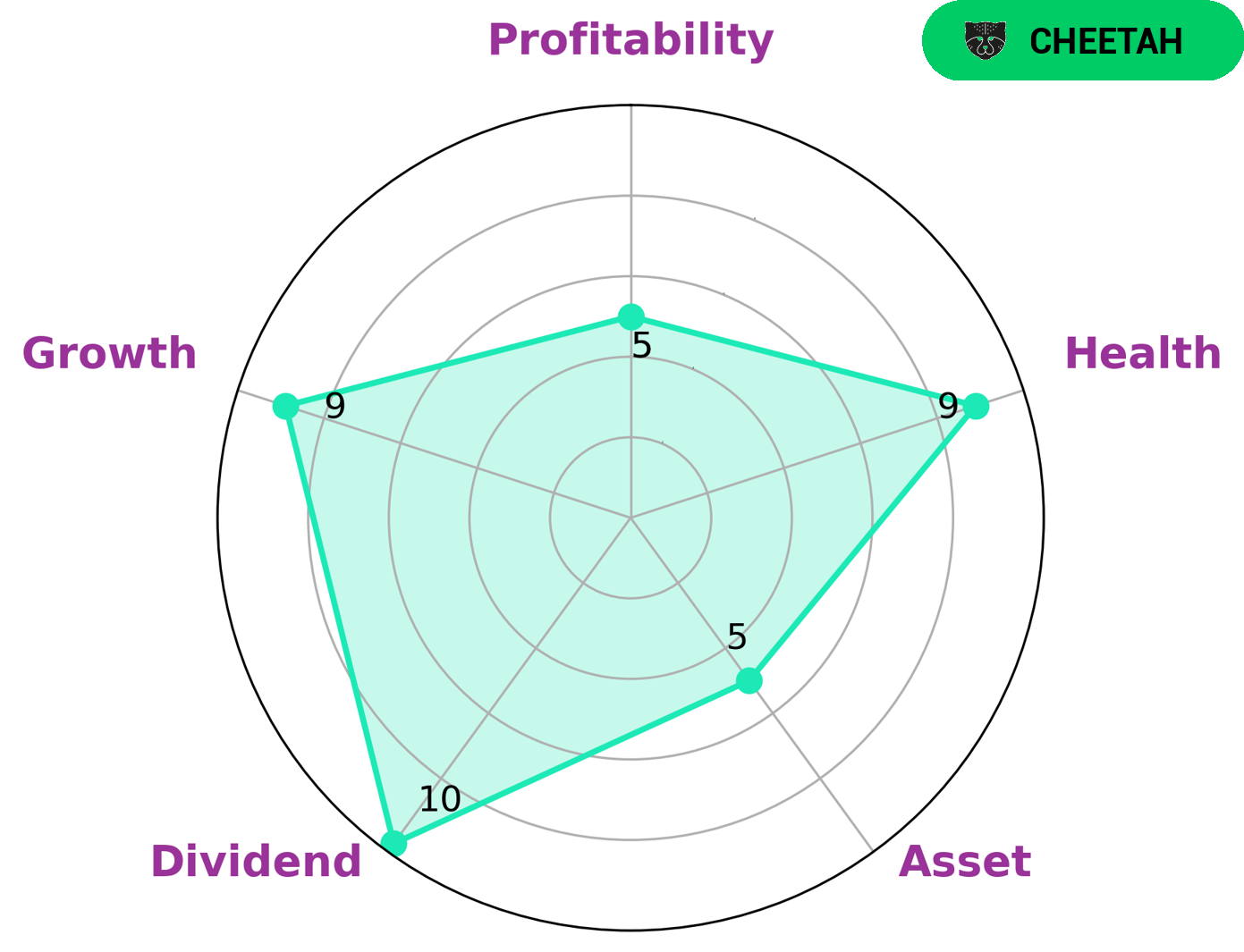

GoodWhale has conducted an analysis of MITSUI‘s wellbeing. According to our Star Chart, MITSUI is strong in dividend and growth, and medium in asset and profitability. We have also determined that MITSUI has a high health score of 9/10 with regard to its cash flows and debt, and is thus capable of sustaining future operations in times of crisis. Based on our analysis, MITSUI is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who may be interested in such a company include those with a higher appetite for risk and those who are seeking higher potential returns. Additionally, those who are patient investors who are willing to wait for returns or those looking for capital gains may also be interested in this type of company. More…

Peers

Mitsui & Co Ltd is one of the largest global trading and investment companies in the world. It competes with other global conglomerates including Foreign Trade Development And Investment, Sumitomo Corp, and Intrakat Societe Anonyme Of Technical And Energy Projects. These companies are all engaged in a wide range of activities such as exploration, production, and marketing of commodities, investments in capital markets, and development of new technologies. Despite the competition, Mitsui & Co Ltd has remained a dominant player in the global market by providing innovative solutions and services to its clients.

– Foreign Trade Development And Investment ($HOSE:FDC)

Sumitomo Corporation is a global trading and investment company that operates in many areas of the world. The company has a market capitalization of 2.72 trillion as of 2023, which is the highest among its peers. Additionally, Sumitomo Corporation has an impressive Return on Equity (ROE) of 13.13%, indicating that the company is able to generate a return for its shareholders. Sumitomo Corporation is involved in a diverse range of sectors, from metals, to machinery, and chemicals, among many others. The company is able to leverage its extensive network of relationships across multiple countries and industries to generate value for its shareholders.

– Sumitomo Corp ($TSE:8053)

Intrakat Societe Anonyme Of Technical And Energy Projects is a Greek company that specializes in technical and energy projects. The company has a market cap of 122.71M as of 2023, which is an indication of the company’s market value and the size of its operations. Its Return on Equity (ROE) of -17.91% indicates that the company is not generating enough profit relative to the amount of equity invested in the business. This signals that the company may not be making the most efficient use of its resources or capital, and investors may want to consider other options.

Summary

Mitsui Kingzoku, a Tokyo-based company, is facing potential illegal groundwater use charges in 2023. At the time of writing, media coverage has been mostly negative. Investors should be aware of the potential risks involved in investing in this company, such as the potential fines and legal costs that could be associated with any charges.

Additionally, investors should consider potential reputational damage that could arise from this issue and its impact on the company’s long-term prospects. Investors should provide their own research and analysis to determine the best course of action.

Recent Posts